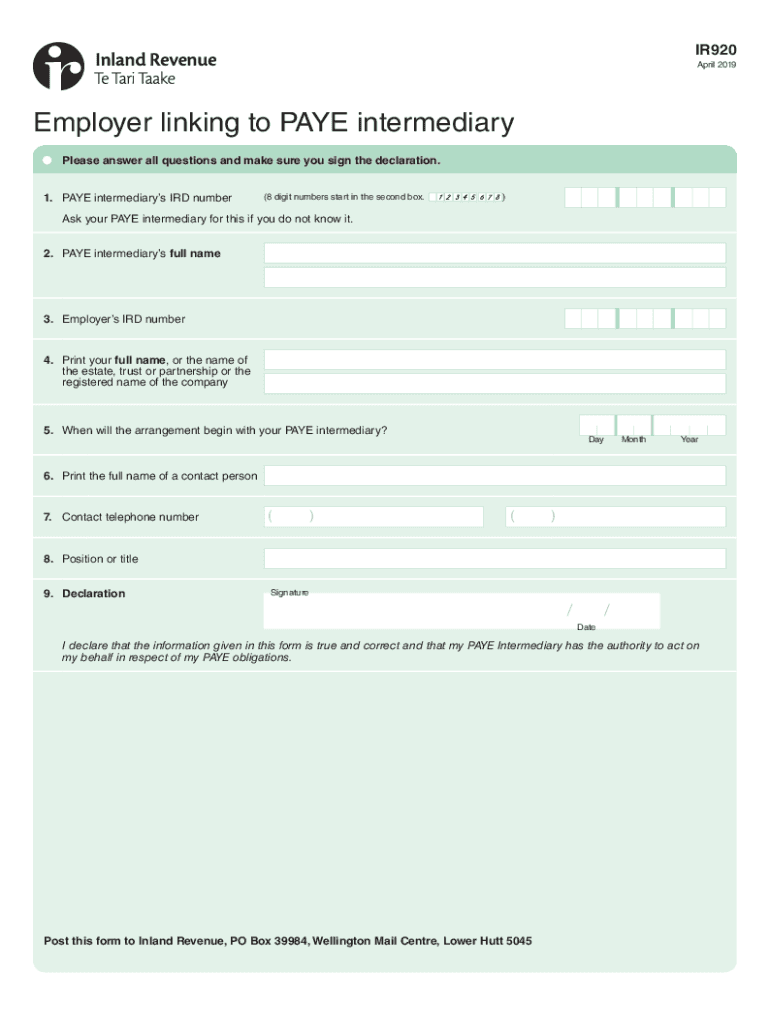

IR920 April 2019Employer Linking to PAY Intermedia Form

What is the IR920 form?

The IR920 form, officially known as the Employer Linking to PAY Intermedia, is a document used for tax compliance in the United States. This form allows employers to link their payroll information to the Internal Revenue Service (IRS) for accurate reporting and tax processing. It is essential for businesses to ensure that their employee payroll data is correctly aligned with IRS requirements, facilitating smooth tax filings and potential audits.

How to use the IR920 form

Using the IR920 form involves several straightforward steps. First, employers must gather all necessary payroll information, including employee earnings, tax withholdings, and any applicable deductions. Next, the form should be filled out accurately, ensuring that all data corresponds with the IRS guidelines. Once completed, employers can submit the IR920 form electronically or via traditional mail, depending on their preference and the IRS's current submission policies.

Steps to complete the IR920 form

Completing the IR920 form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant payroll information for the reporting period.

- Fill out the IR920 form, ensuring all fields are completed accurately.

- Double-check the form for any errors or omissions.

- Choose a submission method: online or by mail.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the IR920 form

The IR920 form is legally required for employers who need to report payroll information to the IRS. Proper use of this form ensures compliance with federal tax laws and helps avoid potential legal issues. Employers must maintain accurate records and submit the form within the specified timeframes to meet regulatory requirements.

Filing Deadlines / Important Dates

Timely filing of the IR920 form is crucial for compliance. Employers should be aware of the specific deadlines set by the IRS for submitting payroll-related forms. Typically, these deadlines align with quarterly and annual tax filing dates. It is advisable for employers to mark these dates on their calendars to ensure timely submission and avoid any penalties for late filing.

Required Documents

To complete the IR920 form, employers will need several key documents. These include:

- Employee payroll records for the reporting period.

- Tax withholding information for each employee.

- Any relevant documentation related to deductions or credits.

Having these documents readily available will streamline the process and help ensure accuracy when filling out the form.

Quick guide on how to complete ir920 april 2019employer linking to pay intermedia

Prepare IR920 April 2019Employer Linking To PAY Intermedia effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage IR920 April 2019Employer Linking To PAY Intermedia on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign IR920 April 2019Employer Linking To PAY Intermedia without any hassle

- Obtain IR920 April 2019Employer Linking To PAY Intermedia and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate creating new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign IR920 April 2019Employer Linking To PAY Intermedia and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir920 april 2019employer linking to pay intermedia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ir920 and how does it work?

The ir920 is a powerful feature within airSlate SignNow that allows users to streamline their document signing process. It enables businesses to send, sign, and manage documents electronically, ensuring a seamless workflow. With the ir920, you can easily track the status of your documents and receive notifications when they are signed.

-

How much does the ir920 feature cost?

The pricing for the ir920 feature is competitive and designed to fit various business needs. airSlate SignNow offers flexible subscription plans that include access to the ir920, ensuring you get the best value for your investment. For detailed pricing information, visit our pricing page or contact our sales team.

-

What are the key benefits of using the ir920?

Using the ir920 feature provides numerous benefits, including increased efficiency and reduced turnaround time for document signing. It also enhances security by ensuring that all signatures are legally binding and tamper-proof. Additionally, the ir920 helps businesses save on paper and printing costs.

-

Can the ir920 integrate with other software?

Yes, the ir920 is designed to integrate seamlessly with various software applications, enhancing your existing workflows. Whether you use CRM systems, project management tools, or cloud storage services, the ir920 can connect with them to streamline your document processes. Check our integrations page for a full list of compatible applications.

-

Is the ir920 suitable for small businesses?

Absolutely! The ir920 is tailored to meet the needs of businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it an ideal choice for small teams looking to improve their document management processes without breaking the bank.

-

How secure is the ir920 for document signing?

The ir920 prioritizes security by employing advanced encryption and authentication methods to protect your documents. All signed documents are stored securely, ensuring that sensitive information remains confidential. With the ir920, you can trust that your document signing process is both safe and compliant with legal standards.

-

What types of documents can I sign using the ir920?

The ir920 allows you to sign a wide variety of documents, including contracts, agreements, and forms. Whether you need to send a simple document or a complex multi-page contract, the ir920 can handle it all. This versatility makes it an essential tool for any business looking to digitize their signing process.

Get more for IR920 April 2019Employer Linking To PAY Intermedia

- Y direct debt mandate cumbernauld ymca ywca cumbernauldy org form

- Miscellaneous city of beaufort cityofbeaufort form

- 502x 2017 form

- Form mw 507 2018

- Rounders england scoresheet form

- Intermediate level training bcertificateb the royal college of bb rcoa ac form

- Kindergarten data sheet for the brigance pk1 screen form

- Pdf how to draw modern florals an introduction to the art of form

Find out other IR920 April 2019Employer Linking To PAY Intermedia

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form