PAYROLL DEDUCTION AUTHORIZATION FORM

What is the Payroll Deduction Authorization Form

The Payroll Deduction Authorization Form is a document that allows employees to authorize their employer to deduct specific amounts from their paychecks for various purposes. These deductions can include contributions to retirement plans, health insurance premiums, union dues, or other benefits. By completing this form, employees provide explicit consent for these deductions, ensuring compliance with federal and state regulations.

How to Use the Payroll Deduction Authorization Form

To effectively use the Payroll Deduction Authorization Form, employees should first obtain the form from their employer or human resources department. After filling out the required information, including the type of deduction and the amount, employees must sign and date the form. Once completed, the form should be submitted to the payroll department for processing. It is essential to keep a copy for personal records.

Steps to Complete the Payroll Deduction Authorization Form

Completing the Payroll Deduction Authorization Form involves several straightforward steps:

- Obtain the form from your employer or HR department.

- Fill in your personal details, including your name, employee ID, and department.

- Specify the type of deduction, such as retirement contributions or insurance premiums.

- Indicate the amount to be deducted from each paycheck.

- Sign and date the form to authorize the deductions.

- Submit the completed form to the payroll department.

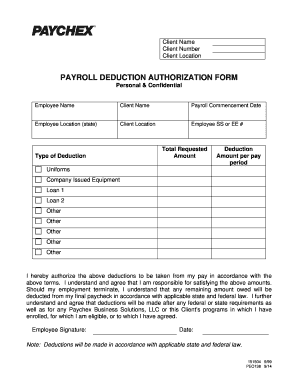

Key Elements of the Payroll Deduction Authorization Form

The Payroll Deduction Authorization Form typically includes several key elements:

- Employee Information: Name, employee ID, and contact details.

- Deduction Type: A list of available deductions, such as health insurance or retirement plans.

- Deduction Amount: The specific amount to be deducted from each paycheck.

- Authorization Signature: The employee's signature confirming consent for the deductions.

- Date: The date on which the form is completed and signed.

Legal Use of the Payroll Deduction Authorization Form

The legal use of the Payroll Deduction Authorization Form is governed by various federal and state laws. Employers must ensure that deductions comply with the Fair Labor Standards Act (FLSA) and other relevant regulations. Additionally, employers are required to maintain accurate records of all deductions made. Employees should be informed of their rights regarding deductions and have the ability to revoke authorization if necessary.

Examples of Using the Payroll Deduction Authorization Form

There are various scenarios in which the Payroll Deduction Authorization Form may be used:

- Employees may authorize deductions for health insurance premiums to cover medical expenses.

- Workers might opt for payroll deductions to contribute to a 401(k) retirement plan.

- Union members may use the form to allow deductions for union dues.

- Employees may authorize charitable contributions to be deducted from their paychecks.

Quick guide on how to complete payroll deduction authorization form 43685588

Effortlessly Prepare PAYROLL DEDUCTION AUTHORIZATION FORM on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without any holdups. Manage PAYROLL DEDUCTION AUTHORIZATION FORM on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to Edit and Electronically Sign PAYROLL DEDUCTION AUTHORIZATION FORM with Ease

- Obtain PAYROLL DEDUCTION AUTHORIZATION FORM and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and electronically sign PAYROLL DEDUCTION AUTHORIZATION FORM to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll deduction authorization form 43685588

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PAYROLL DEDUCTION AUTHORIZATION FORM?

A PAYROLL DEDUCTION AUTHORIZATION FORM is a document that allows employees to authorize their employer to deduct specific amounts from their paychecks for various purposes, such as benefits or savings plans. This form ensures that deductions are made accurately and consistently, providing clarity for both the employer and employee.

-

How can airSlate SignNow help with PAYROLL DEDUCTION AUTHORIZATION FORMs?

airSlate SignNow simplifies the process of creating, sending, and eSigning PAYROLL DEDUCTION AUTHORIZATION FORMs. With our user-friendly platform, businesses can streamline their payroll processes, ensuring that all necessary forms are completed and stored securely.

-

Is there a cost associated with using airSlate SignNow for PAYROLL DEDUCTION AUTHORIZATION FORMs?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our cost-effective solution ensures that you can manage PAYROLL DEDUCTION AUTHORIZATION FORMs without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing PAYROLL DEDUCTION AUTHORIZATION FORMs?

airSlate SignNow provides features such as customizable templates, secure eSigning, and automated workflows for PAYROLL DEDUCTION AUTHORIZATION FORMs. These tools help businesses save time and reduce errors, making the payroll process more efficient.

-

Can I integrate airSlate SignNow with other payroll systems for PAYROLL DEDUCTION AUTHORIZATION FORMs?

Absolutely! airSlate SignNow offers seamless integrations with various payroll systems, allowing you to manage PAYROLL DEDUCTION AUTHORIZATION FORMs alongside your existing software. This integration helps streamline your payroll operations and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for PAYROLL DEDUCTION AUTHORIZATION FORMs?

Using airSlate SignNow for PAYROLL DEDUCTION AUTHORIZATION FORMs provides numerous benefits, including increased accuracy, reduced processing time, and enhanced security. Our platform ensures that all forms are easily accessible and compliant with regulations, giving you peace of mind.

-

How secure is the information on PAYROLL DEDUCTION AUTHORIZATION FORMs with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect the information on PAYROLL DEDUCTION AUTHORIZATION FORMs, ensuring that sensitive employee data remains confidential and secure.

Get more for PAYROLL DEDUCTION AUTHORIZATION FORM

- Dxcc form

- Financial affidavit cobb county cobbcounty form

- Applicant co applicant ss ss dl state dl state d form

- Loid employment application lewiston orchards irrigation district loid form

- Pdf file generated from tmp636tif state of nevada images water nv form

- Fsis inspection form

- Cec nrci mch 01 e revised 0116 energy ca form

- Dsps sbd 10708 form

Find out other PAYROLL DEDUCTION AUTHORIZATION FORM

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template