I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi

What is the I 010 Form 1 Wisconsin Income Tax?

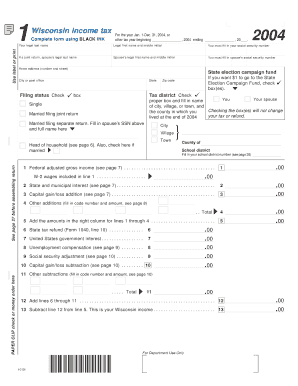

The I 010 Form 1 is a tax form used by residents of Wisconsin to report their income and calculate their state income tax liability. This form is essential for individuals who earn income in Wisconsin and need to comply with state tax regulations. It captures various types of income, deductions, and credits that may apply to the taxpayer's situation, ensuring that individuals pay the correct amount of taxes owed to the state.

Steps to Complete the I 010 Form 1 Wisconsin Income Tax

Completing the I 010 Form 1 involves several key steps:

- Gather necessary documents: Collect all relevant income statements, such as W-2s and 1099s, along with any documentation for deductions and credits.

- Fill in personal information: Enter your name, address, and Social Security number accurately on the form.

- Report income: List all sources of income, including wages, interest, and dividends, in the appropriate sections of the form.

- Claim deductions and credits: Identify and include any eligible deductions or credits that can reduce your taxable income.

- Calculate tax liability: Follow the instructions to compute the total tax owed or the refund due based on the information provided.

- Sign and date the form: Ensure you sign the form to validate it before submission.

How to Obtain the I 010 Form 1 Wisconsin Income Tax

The I 010 Form 1 can be obtained through several convenient methods. Taxpayers can download the form directly from the Wisconsin Department of Revenue website. Additionally, physical copies may be available at local government offices or libraries. It is important to ensure that you are using the most current version of the form to comply with state tax laws.

Form Submission Methods

Taxpayers have multiple options for submitting the I 010 Form 1:

- Online submission: Many residents choose to file electronically through approved e-filing software, which can streamline the process and reduce errors.

- Mail: Completed forms can be mailed to the designated address provided in the form's instructions. Ensure that you send it well before the filing deadline.

- In-person: Some individuals may prefer to submit their forms in person at local tax offices, where they can receive assistance if needed.

Key Elements of the I 010 Form 1 Wisconsin Income Tax

Understanding the key elements of the I 010 Form 1 is crucial for accurate completion:

- Personal Information: This section requires basic details about the taxpayer, including name, address, and Social Security number.

- Income Reporting: Taxpayers must report all income sources, which may include wages, business income, and investment earnings.

- Deductions: The form allows for various deductions, such as those for student loan interest or contributions to retirement accounts.

- Tax Credits: Taxpayers can claim applicable credits that may reduce their overall tax liability, such as the earned income credit.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the I 010 Form 1 to avoid penalties:

- Annual filing deadline: Typically, the form must be submitted by April 15 of the following year, unless it falls on a weekend or holiday.

- Extensions: Taxpayers may request an extension, but this does not extend the time to pay any taxes owed.

Quick guide on how to complete i 010 form 1 wisconsin income tax i 010 form 1 revenue wi

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely save them online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and electronically sign your documents without any delays. Process [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric workflow today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive details using tools specifically offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi

Create this form in 5 minutes!

How to create an eSignature for the i 010 form 1 wisconsin income tax i 010 form 1 revenue wi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi?

The I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi is a tax form used by residents of Wisconsin to report their income and calculate their state tax obligations. It is essential for ensuring compliance with state tax laws and can affect your overall tax liability.

-

How can airSlate SignNow help with the I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi?

airSlate SignNow provides a streamlined platform for electronically signing and sending the I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi. This simplifies the process, making it faster and more efficient to complete and submit your tax documents.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that can assist with the I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi, ensuring you find a solution that fits your budget.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi, automated reminders, and secure storage. These features help ensure that your tax documents are organized and easily accessible.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing you to seamlessly manage your tax documents, including the I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi. This integration enhances your workflow and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for your tax forms, including the I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. You can complete and submit your forms quickly, ensuring timely compliance with tax regulations.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and employs advanced encryption methods to protect your sensitive tax information, including the I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi. You can trust that your data is safe while using our platform.

Get more for I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi

- Prevention and stabilization services for youth and families pssyf form

- Patient information form 395648550

- Direct deposit request form bethpage federal credit union

- Parkland financial assistance renewal form

- Axis bank form 60

- Form 540 14931176

- 2015 form il 1120 st small business corporation replacement tax return tax illinois

- Sales tax collections for online purchases required in 43 form

Find out other I 010 Form 1 Wisconsin Income Tax I 010 Form 1 Revenue Wi

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT