NOTIFICATION of TRANSFER of VEHICLE Motor Tax Online Form

What is the Notification of Transfer of Vehicle Motor Tax Online

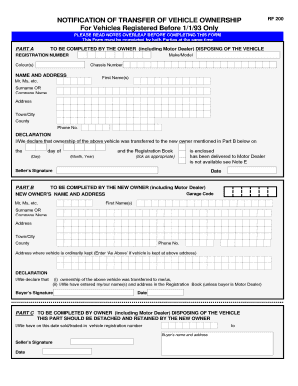

The Notification of Transfer of Vehicle Motor Tax Online is a formal document used to inform the relevant state authorities about the transfer of ownership of a vehicle. This notification is essential for updating the vehicle registration records and ensuring that the new owner is recognized as the legal owner. It typically includes details such as the vehicle identification number (VIN), make and model of the vehicle, and the names and addresses of both the seller and the buyer.

How to Use the Notification of Transfer of Vehicle Motor Tax Online

Using the Notification of Transfer of Vehicle Motor Tax Online involves several straightforward steps. First, access the online platform designated by your state for vehicle registration. Next, locate the section for vehicle ownership transfer. Fill out the required fields accurately, ensuring that all information matches the vehicle's title. After completing the form, submit it electronically. This process typically allows for immediate updates to the vehicle's registration status, streamlining the transfer process.

Steps to Complete the Notification of Transfer of Vehicle Motor Tax Online

Completing the Notification of Transfer of Vehicle Motor Tax Online can be done efficiently by following these steps:

- Gather necessary documents, including the vehicle title and identification for both parties.

- Access the state’s online vehicle registration portal.

- Navigate to the transfer notification section.

- Input the required vehicle and owner details accurately.

- Review the information for accuracy before submission.

- Submit the form electronically and save the confirmation for your records.

Legal Use of the Notification of Transfer of Vehicle Motor Tax Online

The legal use of the Notification of Transfer of Vehicle Motor Tax Online ensures compliance with state regulations regarding vehicle ownership. This notification serves as a legal record of the transfer, protecting both the seller and the buyer. It is crucial for avoiding potential disputes over ownership and for ensuring that tax responsibilities are correctly assigned to the new owner. Failure to submit this notification may result in penalties or complications with future vehicle registrations.

State-Specific Rules for the Notification of Transfer of Vehicle Motor Tax Online

Each state in the U.S. has specific rules and regulations governing the Notification of Transfer of Vehicle Motor Tax Online. These rules can vary significantly, including the required information, submission deadlines, and associated fees. It is important for individuals to familiarize themselves with their state's requirements to ensure compliance. Some states may also have additional forms or documentation that must be submitted alongside the notification.

Required Documents

To complete the Notification of Transfer of Vehicle Motor Tax Online, certain documents are typically required. These may include:

- The original vehicle title, signed by the seller.

- Proof of identification for both the seller and the buyer.

- Any state-specific forms related to vehicle transfer.

- Payment information for any applicable fees.

Penalties for Non-Compliance

Failing to submit the Notification of Transfer of Vehicle Motor Tax Online can lead to various penalties. These may include fines, delayed registration for the new owner, and potential legal issues if disputes arise regarding vehicle ownership. Additionally, the seller may remain liable for any infractions or taxes associated with the vehicle until the transfer is officially recorded. It is advisable to complete this notification promptly to avoid such complications.

Quick guide on how to complete notification of transfer of vehicle motor tax online

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents rapidly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] without difficulty

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Disregard lost or misfiled documents, tedious file searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the notification of transfer of vehicle motor tax online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for submitting a NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online?

To submit a NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online, simply log into your airSlate SignNow account, select the appropriate document template, and fill in the required details. Once completed, you can eSign and submit the notification directly through our platform. This streamlined process ensures that your vehicle transfer is processed quickly and efficiently.

-

Are there any fees associated with the NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online?

Yes, there may be nominal fees associated with the NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online, depending on your local regulations. However, using airSlate SignNow can help you save on costs by providing a cost-effective solution for document management and eSigning. Check with your local motor tax authority for specific fee details.

-

What features does airSlate SignNow offer for the NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online?

airSlate SignNow offers a variety of features for the NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online, including customizable templates, secure eSigning, and real-time tracking of document status. These features enhance the user experience and ensure that your vehicle transfer documentation is handled efficiently and securely.

-

How does airSlate SignNow ensure the security of my NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online and other sensitive documents. Additionally, our platform complies with industry standards to ensure your data remains confidential and secure.

-

Can I integrate airSlate SignNow with other software for managing NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage your NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your document management needs are met in one place.

-

What are the benefits of using airSlate SignNow for NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online?

Using airSlate SignNow for your NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online provides numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform simplifies the entire process, allowing you to focus on what matters most while ensuring compliance with motor tax regulations.

-

Is there customer support available for issues related to NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online?

Yes, airSlate SignNow offers dedicated customer support to assist you with any issues related to your NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online. Our knowledgeable support team is available via chat, email, or phone to help you navigate any challenges and ensure a smooth experience.

Get more for NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online

- Bofferb acceptance bformb rmit university

- University of sydney application form

- Company and tax invoice form

- Please fill out front and back of this form signature eleanor

- Business school referencing guide 11th edition the university of sydney edu form

- Claim form accident and health international underwriting

- Emergency contact health ampamp fitness assessment form forms and induction checklists

- 55b23 58090593 form

Find out other NOTIFICATION OF TRANSFER OF VEHICLE Motor Tax Online

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy