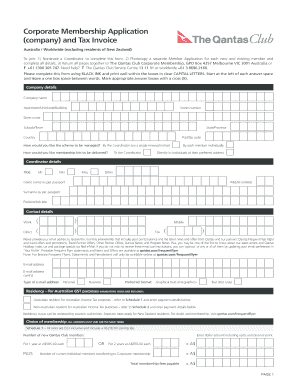

Company and Tax Invoice Form

What is the company and tax invoice?

The company and tax invoice is a formal document that outlines the details of a transaction between a buyer and a seller. It serves as a request for payment and includes essential information such as the seller's name, address, and tax identification number, as well as the buyer's details. This document typically lists the products or services provided, their quantities, prices, and any applicable taxes. It is crucial for businesses to maintain accurate records of these invoices for accounting and tax purposes.

How to obtain the company and tax invoice?

To obtain a company and tax invoice, businesses can create one using accounting software or templates available online. Many platforms offer customizable invoice templates that allow users to enter their specific details. Alternatively, businesses can also hire a professional accountant or use a digital solution that automates the invoicing process. It is important to ensure that the invoice complies with local regulations and includes all necessary information to be considered valid.

Steps to complete the company and tax invoice

Completing a company and tax invoice involves several key steps:

- Gather necessary information, including the seller's and buyer's details.

- List the products or services provided, including descriptions, quantities, and prices.

- Calculate the total amount due, including any applicable taxes.

- Include payment terms, such as due dates and accepted payment methods.

- Review the invoice for accuracy before sending it to the buyer.

Legal use of the company and tax invoice

The legal use of a company and tax invoice is essential for both parties involved in a transaction. For the seller, it serves as proof of sale and is necessary for tax reporting. For the buyer, it acts as a record of the expenses incurred, which can be used for tax deductions. To ensure the invoice is legally binding, it must include all relevant details and comply with local tax laws. Failure to provide a proper invoice may result in penalties or issues during audits.

Key elements of the company and tax invoice

Key elements of a company and tax invoice include:

- Invoice Number: A unique identifier for tracking purposes.

- Date of Issue: The date when the invoice is created.

- Seller's Information: Name, address, and tax identification number.

- Buyer's Information: Name and address of the buyer.

- Description of Goods/Services: Detailed list of what was sold.

- Total Amount Due: The final amount payable, including taxes.

Examples of using the company and tax invoice

Examples of using a company and tax invoice can vary across different industries. For instance, a freelance graphic designer may issue an invoice to a client after completing a project, detailing the services provided and the total cost. A retail store may provide an invoice to customers for their purchases, which serves as a receipt for warranty claims. In both cases, the invoice is crucial for record-keeping and tax compliance.

Quick guide on how to complete company and tax invoice

Effortlessly Prepare company And Tax Invoice on Any Device

The management of online documents has gained popularity among companies and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Manage company And Tax Invoice on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and electronically sign company And Tax Invoice with ease

- Locate company And Tax Invoice and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically available from airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review the details and click the Done button to finalize your edits.

- Choose how you wish to share your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Modify and electronically sign company And Tax Invoice to ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Qantas Club membership?

Qantas Club membership is a premium service provided by Qantas Airlines that offers exclusive access to lounges, priority boarding, and a range of travel benefits. As a member, you can enjoy a more comfortable and convenient travel experience, making it ideal for frequent travelers. This membership enhances your journey, especially when flying with Qantas and its partners.

-

How much does Qantas Club membership cost?

The cost of Qantas Club membership can vary based on the type of membership you choose, whether it's individual, family, or corporate. Generally, members can expect to pay an annual fee, which may also include promotional discounts. Keep an eye on the Qantas website for current pricing and special offers on membership.

-

What are the key benefits of Qantas Club membership?

Qantas Club membership offers numerous benefits, including access to exclusive lounges, complimentary refreshments, and priority check-in services. Members also enjoy access to partner lounges worldwide, enhancing the travel experience on international flights. These benefits make the membership valuable for frequent travelers seeking comfort and convenience.

-

Can I use Qantas Club membership with other airlines?

Yes, Qantas Club membership provides access to partner lounges and services associated with partner airlines. This makes traveling with other airlines easier and allows members to enjoy the comforts and advantages of Qantas lounges even when flying abroad. It's an excellent asset for those who travel frequently with multiple carriers.

-

Is there a family membership option for Qantas Club membership?

Yes, Qantas offers a family membership option that allows up to two adults and their children to access all the benefits of Qantas Club membership. This makes it an affordable and convenient choice for families who travel together. Family members can enjoy the same lounges, priority boarding, and additional perks as the primary member.

-

How can I renew my Qantas Club membership?

To renew your Qantas Club membership, you can log into your Qantas account online or contact customer service for assistance. Renewal notifications are typically sent prior to the membership expiration date, making it easy to stay current. Take advantage of any available discounts or promotions during the renewal process.

-

Are there any restrictions on Qantas Club membership access?

While Qantas Club membership provides extensive access to lounges and benefits, some restrictions may apply, such as capacity limits at certain lounges or specific hours of operation. Additionally, access may vary for different types of membership. It's important to check the terms and conditions associated with your membership for detailed information.

Get more for company And Tax Invoice

- Form tf 800 ampquotrequest to seal or make case records

- Dr 701instructions for motion domestic relations form

- Additional form of order

- Pro se packet guardianship hawaii state judiciary form

- Vacating a judgment and form

- 30 day joint compliance certificate fultoncourtorg form

- Summons forms for non prisoner pro se plaintiffs proceeding

- Florida durable financial power of attorney form

Find out other company And Tax Invoice

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile