Form 502AC

What is the Form 502AC

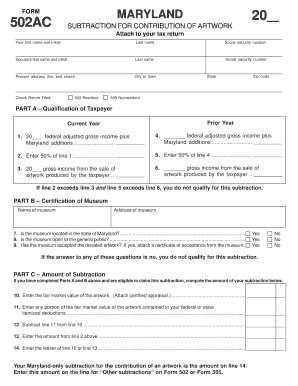

The Form 502AC is a specific tax form used in the United States, primarily for reporting certain tax-related information. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations. The form serves as a declaration of specific income or deductions that may affect an individual’s or entity’s overall tax liability.

How to use the Form 502AC

Using the Form 502AC involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and deduction records. Next, carefully fill out the form, ensuring that each section is completed according to the instructions provided. After completing the form, review it for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Form 502AC

Completing the Form 502AC requires attention to detail. Begin by entering your personal information, such as your name and address. Then, input your income details and any applicable deductions. It is crucial to follow the guidelines provided for each section to avoid errors. Once all information is entered, double-check for any mistakes. Finally, sign and date the form before submission.

Legal use of the Form 502AC

The Form 502AC must be used in accordance with state tax laws. It is legally binding, meaning that any information provided must be truthful and accurate. Misrepresentation or failure to file the form correctly can lead to penalties or legal repercussions. Understanding the legal implications of this form is vital for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Form 502AC vary by state and can change annually. It is important to be aware of these dates to avoid late fees or penalties. Generally, the form must be submitted by the tax filing deadline, which is typically April fifteenth for individual taxpayers. Checking with state tax authorities for specific deadlines is advisable.

Required Documents

To complete the Form 502AC, several documents may be required. These typically include income statements, previous tax returns, and any documentation supporting deductions claimed. Having these documents on hand will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete form 502ac

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without holdups. Manage [SKS] on any device via the airSlate SignNow Android or iOS applications and simplify any document-related processes today.

How to Modify and eSign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 502AC

Create this form in 5 minutes!

How to create an eSignature for the form 502ac

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 502AC and how can airSlate SignNow help?

Form 502AC is a specific document used for various administrative purposes. With airSlate SignNow, you can easily create, send, and eSign Form 502AC, streamlining your workflow and ensuring compliance. Our platform simplifies the process, making it accessible for businesses of all sizes.

-

What are the pricing options for using airSlate SignNow for Form 502AC?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Whether you are a small startup or a large enterprise, you can choose a plan that fits your budget while efficiently managing Form 502AC. Visit our pricing page for detailed information on each plan.

-

What features does airSlate SignNow provide for managing Form 502AC?

airSlate SignNow includes a variety of features designed to enhance your experience with Form 502AC. These features include customizable templates, secure eSigning, document tracking, and integration with other applications. This ensures that you can manage your documents efficiently and securely.

-

How does airSlate SignNow ensure the security of Form 502AC?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your Form 502AC and other documents. Additionally, our platform complies with industry standards to ensure that your data remains safe and confidential.

-

Can I integrate airSlate SignNow with other software for Form 502AC?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage Form 502AC. You can connect with popular tools like Google Drive, Salesforce, and more, allowing for a streamlined workflow. This integration capability helps you save time and improve productivity.

-

What are the benefits of using airSlate SignNow for Form 502AC?

Using airSlate SignNow for Form 502AC provides numerous benefits, including increased efficiency, reduced turnaround time, and improved accuracy. Our user-friendly interface allows you to manage documents effortlessly, while eSigning eliminates the need for physical signatures. This results in a more agile and responsive business process.

-

Is there customer support available for airSlate SignNow users dealing with Form 502AC?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with any questions or issues related to Form 502AC. Our support team is available through various channels, including chat, email, and phone, ensuring you receive timely assistance whenever you need it.

Get more for Form 502AC

Find out other Form 502AC

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later