Self Employed X Ray Technician Self Employed Independent Contractor Form

What is the Self Employed X Ray Technician Self Employed Independent Contractor

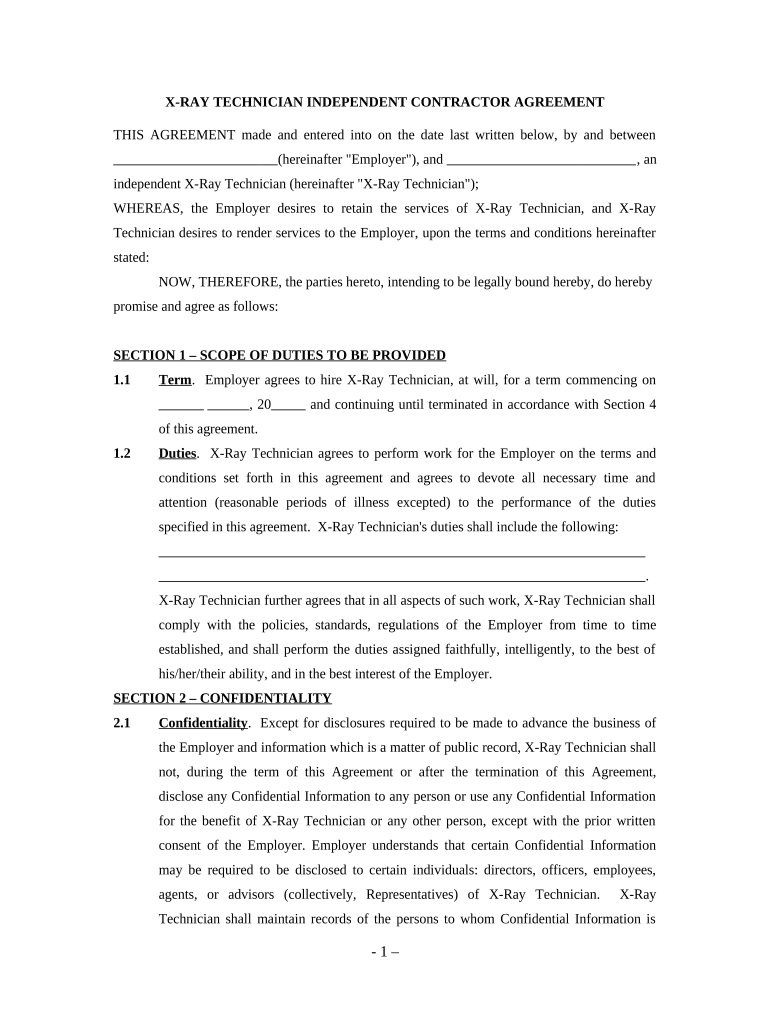

The Self Employed X Ray Technician Self Employed Independent Contractor form is a vital document for individuals who operate independently in the field of radiologic technology. This form serves as a formal agreement outlining the terms of service between the technician and their clients or employers. It is essential for establishing the technician's status as an independent contractor, which has implications for taxation, liability, and business operations.

As an independent contractor, the X Ray technician is responsible for managing their own taxes, insurance, and business expenses. This form typically includes details such as the scope of work, payment terms, and any specific conditions agreed upon by both parties. Understanding this form is crucial for compliance with federal and state regulations governing self-employment.

How to use the Self Employed X Ray Technician Self Employed Independent Contractor

Using the Self Employed X Ray Technician Self Employed Independent Contractor form involves several key steps. First, ensure that all parties involved understand the terms outlined in the document. This includes discussing the services to be provided, payment rates, and timelines.

Next, fill out the form accurately, including all necessary details such as names, addresses, and specific job descriptions. Once completed, both the technician and the client should sign the document. Utilizing a digital signing solution can streamline this process, ensuring that signatures are legally binding and securely stored.

Finally, keep a copy of the signed form for your records. This documentation can be important for tax purposes and in the event of any disputes regarding the terms of service.

Steps to complete the Self Employed X Ray Technician Self Employed Independent Contractor

Completing the Self Employed X Ray Technician Self Employed Independent Contractor form involves a systematic approach to ensure accuracy and compliance. Here are the steps to follow:

- Gather necessary information, including personal details and business specifics.

- Clearly define the services to be provided, including any special requirements.

- Outline payment terms, including rates, payment methods, and due dates.

- Review the form for completeness and accuracy.

- Sign the form electronically or in person, ensuring both parties retain a copy.

Legal use of the Self Employed X Ray Technician Self Employed Independent Contractor

The legal use of the Self Employed X Ray Technician Self Employed Independent Contractor form is governed by various laws and regulations. For the form to be legally binding, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish the validity of electronic signatures and records.

Additionally, it is important to ensure that the form meets any state-specific requirements. This may include adhering to local licensing laws for X Ray technicians and maintaining proper insurance coverage. Familiarizing yourself with these regulations helps protect both the technician and the client in case of disputes or legal issues.

Key elements of the Self Employed X Ray Technician Self Employed Independent Contractor

Several key elements should be included in the Self Employed X Ray Technician Self Employed Independent Contractor form to ensure clarity and legal compliance. These elements include:

- Identifying Information: Names and addresses of both the technician and the client.

- Scope of Work: A detailed description of the services to be provided.

- Payment Terms: Rates, payment schedule, and methods of payment.

- Duration of Agreement: The time frame for which the services will be rendered.

- Liability and Insurance: Any liability clauses and insurance requirements.

IRS Guidelines

Understanding IRS guidelines is crucial for self-employed X Ray technicians operating as independent contractors. The IRS requires that independent contractors report their income using Schedule C (Form 1040) and may need to pay self-employment taxes. It is important to keep accurate records of all income and expenses related to the business.

Additionally, independent contractors may be required to make estimated tax payments throughout the year. Familiarizing yourself with these guidelines helps ensure compliance and avoid penalties.

Quick guide on how to complete self employed x ray technician self employed independent contractor

Complete Self Employed X Ray Technician Self Employed Independent Contractor effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Self Employed X Ray Technician Self Employed Independent Contractor on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign Self Employed X Ray Technician Self Employed Independent Contractor effortlessly

- Locate Self Employed X Ray Technician Self Employed Independent Contractor and then click Get Form to begin.

- Employ the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, laborious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Self Employed X Ray Technician Self Employed Independent Contractor to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the benefits of using airSlate SignNow as a Self Employed X Ray Technician Self Employed Independent Contractor?

As a Self Employed X Ray Technician Self Employed Independent Contractor, using airSlate SignNow streamlines your document management process. You can easily send, eSign, and secure documents in one platform, enhancing efficiency and professionalism in your services. Additionally, the platform offers customizable templates that save you time and help maintain your brand's consistency.

-

How much does airSlate SignNow cost for Self Employed X Ray Technicians?

airSlate SignNow offers a range of pricing plans tailored for businesses, including Self Employed X Ray Technicians. You can start with a free trial, then choose a plan that fits your needs and budget, providing cost-effective solutions for managing your documents as a Self Employed Independent Contractor. Pricing flexibility ensures that you only pay for the features you use.

-

Can airSlate SignNow integrate with other tools I use as a Self Employed X Ray Technician?

Yes, airSlate SignNow seamlessly integrates with various tools essential for a Self Employed X Ray Technician Self Employed Independent Contractor. You can connect it with platforms like Google Drive, Dropbox, and CRM systems to streamline your workflow. These integrations enhance your productivity by enabling easy document access and management.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides essential features such as customizable templates, real-time collaboration, and status tracking, ideal for a Self Employed X Ray Technician Self Employed Independent Contractor. You can create and manage documents effortlessly while ensuring all signatures are legally binding. These features empower you to focus more on your technical work rather than paperwork.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security, which is crucial for a Self Employed X Ray Technician Self Employed Independent Contractor dealing with sensitive medical information. The platform uses advanced encryption protocols to protect your documents and offers features like two-factor authentication. This ensures confidentiality and compliance with industry standards.

-

How can airSlate SignNow improve my efficiency as a Self Employed Independent Contractor?

Using airSlate SignNow can signNowly improve your efficiency by automating the document signing process, which is particularly beneficial for a Self Employed X Ray Technician. The platform allows you to send and sign documents from any device, reducing downtime and speeding up approvals. This streamlined approach means you can spend more time with your clients rather than managing paperwork.

-

Can I customize templates for my services in airSlate SignNow?

Yes, airSlate SignNow allows a Self Employed X Ray Technician Self Employed Independent Contractor to create and customize templates specific to your services. This feature aids in maintaining brand consistency while ensuring that your documents are tailored to client needs. Custom templates save time and help you standardize your communication.

Get more for Self Employed X Ray Technician Self Employed Independent Contractor

- Azdorgovtax creditscertification schoolcertification for school tuition organizationsarizona form

- Azdorgovtax creditscontributions qcos and qfcoscontributions to qcos and qfcosarizona department of revenue form

- Arizona form 301 nonrefundable individual tax credits and arizona form 301 nonrefundable individual tax credits and arizona

- 2020 montana individual income tax return form

- Azdorgovformstax credits formscredit for contributions made or fees paid to public schools

- Wwwirsgovirb2020 12irbinternal revenue bulletin 2020 12 irs tax forms

- Form 8796 a rev 9 2021 request for returninformation federalstate tax exchange program state and local government use only

- Fillable form dcac dependent care assistance credits

Find out other Self Employed X Ray Technician Self Employed Independent Contractor

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF