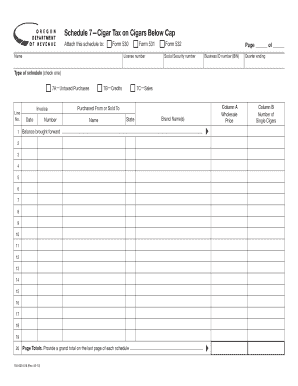

Schedule 7 Cigar Tax on Cigars below Cap Form

Understanding the Schedule 7 Cigar Tax On Cigars Below Cap

The Schedule 7 Cigar Tax On Cigars Below Cap is a specific tax form used in the United States for reporting and paying taxes on cigars that fall below a certain price threshold, known as the cap. This form is essential for businesses and individuals involved in the sale or distribution of cigars, ensuring compliance with federal tax regulations. The cap is defined by the Internal Revenue Service (IRS) and is subject to change, making it crucial for filers to stay updated on current limits.

Steps to Complete the Schedule 7 Cigar Tax On Cigars Below Cap

Completing the Schedule 7 Cigar Tax form involves several steps:

- Gather necessary information, including your business details and the quantity of cigars sold.

- Determine the applicable tax rate based on the current IRS guidelines for cigars below the cap.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total tax owed based on the quantity and applicable rates.

- Review the form for accuracy before submission.

Legal Use of the Schedule 7 Cigar Tax On Cigars Below Cap

The legal use of the Schedule 7 Cigar Tax form is mandated by federal law for businesses that sell or distribute cigars priced below the established cap. Compliance with this form helps avoid penalties and ensures that businesses contribute their fair share of taxes. It is important to understand the legal implications of failing to file or inaccurately reporting information on this form.

Filing Deadlines and Important Dates

Filing deadlines for the Schedule 7 Cigar Tax are typically aligned with the IRS tax calendar. It is essential to be aware of these dates to avoid late fees and penalties. Generally, the form must be submitted by the end of the month following the quarter in which the cigars were sold. Keeping track of these deadlines is crucial for maintaining compliance.

Required Documents for Schedule 7 Cigar Tax On Cigars Below Cap

To complete the Schedule 7 Cigar Tax form, certain documents are required:

- Business identification information, such as your Employer Identification Number (EIN).

- Sales records detailing the quantity and price of cigars sold.

- Previous tax returns, if applicable, to provide context for your current filing.

IRS Guidelines for Schedule 7 Cigar Tax On Cigars Below Cap

The IRS provides specific guidelines for completing the Schedule 7 Cigar Tax form. These guidelines include instructions on how to calculate taxes owed, how to report sales accurately, and the importance of maintaining proper records. Filers should refer to the IRS website or official publications for the most current information and updates related to this form.

Quick guide on how to complete schedule 7 cigar tax on cigars below cap

Complete [SKS] with ease on any device

Online document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred delivery method for your form, be it email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 7 Cigar Tax On Cigars Below Cap

Create this form in 5 minutes!

How to create an eSignature for the schedule 7 cigar tax on cigars below cap

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 7 Cigar Tax On Cigars Below Cap?

The Schedule 7 Cigar Tax On Cigars Below Cap refers to the specific tax regulations applied to cigars that fall under a certain price threshold. Understanding this tax is crucial for businesses involved in the cigar industry to ensure compliance and avoid penalties. airSlate SignNow can help streamline the documentation process related to these tax filings.

-

How can airSlate SignNow assist with Schedule 7 Cigar Tax documentation?

airSlate SignNow provides an easy-to-use platform for businesses to create, send, and eSign documents related to the Schedule 7 Cigar Tax On Cigars Below Cap. This simplifies the process of managing tax-related paperwork, ensuring that all documents are securely signed and stored. Our solution enhances efficiency and reduces the risk of errors in tax submissions.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses, including those dealing with the Schedule 7 Cigar Tax On Cigars Below Cap. Our plans are designed to be cost-effective, providing essential features without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning, which are essential for managing documents related to the Schedule 7 Cigar Tax On Cigars Below Cap. These features help businesses streamline their operations and ensure compliance with tax regulations. Additionally, our platform is user-friendly, making it accessible for all team members.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow can seamlessly integrate with various accounting and tax management software, enhancing your ability to manage the Schedule 7 Cigar Tax On Cigars Below Cap. This integration allows for efficient data transfer and reduces the need for manual entry, saving time and minimizing errors. Our platform supports popular tools to ensure a smooth workflow.

-

What are the benefits of using airSlate SignNow for cigar tax documentation?

Using airSlate SignNow for managing the Schedule 7 Cigar Tax On Cigars Below Cap offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround, ensuring that your tax filings are submitted on time. Additionally, the ability to track document status provides peace of mind.

-

Is airSlate SignNow compliant with tax regulations?

Absolutely! airSlate SignNow is designed to comply with various tax regulations, including those related to the Schedule 7 Cigar Tax On Cigars Below Cap. We prioritize security and compliance, ensuring that your documents are handled in accordance with legal standards. This commitment helps businesses avoid potential legal issues.

Get more for Schedule 7 Cigar Tax On Cigars Below Cap

- First report of the iirc on the rizal park hostage taking form

- Tennessee firearm bill of sale form

- Complete printable 8 sample vehicle bill of sale forms

- Print new mexico inventory for parents and potentially gifted students form

- Otm30 lsi firewall change request louisiana form

- Sellers name seller with a mailing address of form

- Wisconsin general bill of sale form

- Wisconsin legislature tax 11411 form

Find out other Schedule 7 Cigar Tax On Cigars Below Cap

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form