Hawaii Ge Address Change Form 2017-2026

Understanding the Hawaii ITPS COA Form

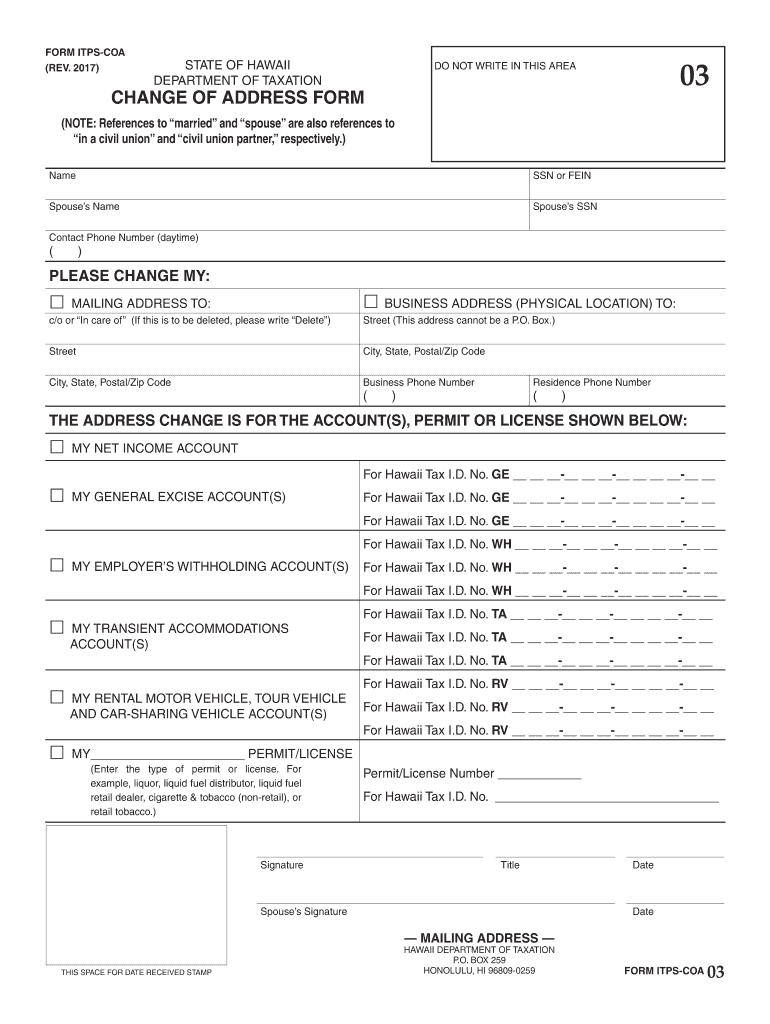

The Hawaii ITPS COA Form, also known as the Change of Address Form, is a crucial document for individuals and businesses wishing to update their address with the state of Hawaii. This form is essential for maintaining accurate records with the Department of Commerce and Consumer Affairs (DCCA). It is used to inform the state of any changes in your residential or business address, ensuring that all correspondence and legal documents are sent to the correct location. Proper completion of this form helps avoid potential issues related to missed communications or legal notices.

Steps to Complete the Hawaii ITPS COA Form

Filling out the Hawaii ITPS COA Form involves several straightforward steps:

- Begin by downloading the form from the official DCCA website or accessing it through a digital platform.

- Fill in your current address details accurately, ensuring that all information matches official records.

- Provide your new address, making sure to include all relevant details such as street number, city, and zip code.

- Sign and date the form, confirming that all information provided is correct to the best of your knowledge.

- Submit the completed form as instructed, either online, by mail, or in person, depending on your preference and the options available.

Legal Use of the Hawaii ITPS COA Form

The Hawaii ITPS COA Form is legally binding once submitted to the DCCA. It is important to ensure that the information provided is accurate and truthful, as any discrepancies may lead to legal complications. The form serves as an official notification to the state regarding your address change, which is necessary for compliance with state regulations. Failure to submit this form may result in penalties or issues with your business or personal legal status.

Form Submission Methods

There are several methods available for submitting the Hawaii ITPS COA Form:

- Online: Many users prefer to submit the form electronically through the DCCA's online portal, which offers a quick and efficient process.

- By Mail: You can print the completed form and mail it to the appropriate DCCA address. Ensure that you send it via a reliable postal service to avoid delays.

- In-Person: For those who prefer face-to-face interactions, submitting the form in person at a DCCA office is an option. This allows for immediate confirmation of receipt.

Required Documents for the Hawaii ITPS COA Form

When completing the Hawaii ITPS COA Form, it is essential to have certain documents ready to ensure a smooth process:

- Your current identification, such as a driver's license or state ID, to verify your identity.

- Any previous correspondence from the DCCA that includes your current address.

- Proof of your new address, which may include utility bills or lease agreements, if applicable.

IRS Guidelines Related to Address Changes

When changing your address, it is also important to notify the IRS to ensure that your tax records are updated. The IRS requires taxpayers to file Form 8822 to report a change of address. This form should be submitted separately from the Hawaii ITPS COA Form. Keeping both state and federal records updated helps prevent issues with tax filings and ensures that you receive important tax documents at your new address.

Penalties for Non-Compliance

Failing to submit the Hawaii ITPS COA Form can lead to various penalties. Individuals and businesses may face fines or complications with their legal status, particularly if important documents are sent to an outdated address. Additionally, non-compliance can affect your ability to conduct business legally in Hawaii, making it essential to keep your address information current.

Quick guide on how to complete hawaii change form 2017 2019

Your instruction manual on how to prepare your Hawaii Ge Address Change Form

If you’re curious about how to generate and submit your Hawaii Ge Address Change Form, here are a few brief guidelines to facilitate tax reporting.

To begin, you simply need to sign up for your airSlate SignNow account to transform your approach to managing documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to modify, create, and finalize your tax paperwork with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures, returning to adjust information as required. Enhance your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to finalize your Hawaii Ge Address Change Form in a matter of minutes:

- Create your account and start working on PDFs shortly.

- Utilize our catalog to find any IRS tax document; browse through various versions and schedules.

- Click Get form to access your Hawaii Ge Address Change Form in our editor.

- Complete the necessary fillable fields with your details (text entries, numbers, checkmarks).

- Use the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and rectify any errors.

- Save changes, print your copy, send it to your intended recipient, and download it to your device.

Make the most of this guide to submit your taxes electronically with airSlate SignNow. Be aware that filing on paper can lead to an increase in return errors and delays in reimbursements. Of course, prior to e-filing your taxes, check the IRS website for declarations rules specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct hawaii change form 2017 2019

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How can I fill out the BITSAT Application Form 2019?

BITSAT 2019 Application Forms are available online. Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

Create this form in 5 minutes!

How to create an eSignature for the hawaii change form 2017 2019

How to make an electronic signature for the Hawaii Change Form 2017 2019 online

How to generate an electronic signature for your Hawaii Change Form 2017 2019 in Google Chrome

How to create an eSignature for signing the Hawaii Change Form 2017 2019 in Gmail

How to create an electronic signature for the Hawaii Change Form 2017 2019 from your mobile device

How to make an electronic signature for the Hawaii Change Form 2017 2019 on iOS devices

How to make an eSignature for the Hawaii Change Form 2017 2019 on Android devices

People also ask

-

What is the hawaii itps coa form and why do I need it?

The hawaii itps coa form is a document required for certain business processes in Hawaii, ensuring compliance with local regulations. Businesses must use this form to maintain proper documentation and avoid legal issues. Utilizing the hawaii itps coa form with airSlate SignNow streamlines the eSignature process, making it more efficient.

-

How does airSlate SignNow enhance the processing of the hawaii itps coa form?

AirSlate SignNow simplifies the completion and signing of the hawaii itps coa form with its user-friendly interface. Users can easily upload, fill out, and send the form for signatures, reducing the time it takes to process documents. This ensures that your business remains compliant while optimizing workflow efficiency.

-

What are the pricing plans for using airSlate SignNow for hawaii itps coa form?

AirSlate SignNow offers various pricing plans that cater to businesses of all sizes. Whether you're a startup or an established enterprise, you can choose a plan that fits your budget. Each plan provides access to essential features for processing the hawaii itps coa form effectively.

-

Can I integrate airSlate SignNow with other software for managing the hawaii itps coa form?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing its functionality when handling the hawaii itps coa form. These integrations allow you to manage your documents alongside your existing tools, ensuring a smoother workflow. This feature is crucial for businesses looking to streamline operations and improve efficiency.

-

What are the benefits of using airSlate SignNow for the hawaii itps coa form?

Using airSlate SignNow for the hawaii itps coa form offers numerous benefits, including time savings and increased accuracy. The eSignature solution reduces the chances of errors associated with manual processing, ensuring your forms are compliant. Additionally, it provides a secure and reliable way to manage important documents.

-

Is airSlate SignNow secure for eSigning the hawaii itps coa form?

Absolutely! AirSlate SignNow prioritizes security when it comes to eSigning the hawaii itps coa form. The platform employs advanced encryption and complies with legal standards, ensuring that your documents are protected and legally binding. You can trust that your sensitive information remains secure while using our service.

-

How do I get started with airSlate SignNow for the hawaii itps coa form?

Getting started with airSlate SignNow for the hawaii itps coa form is easy. Simply sign up for an account, choose a pricing plan that best suits your needs, and start uploading your documents. Our intuitive platform guides you through the process, making it simple to eSign and manage your forms efficiently.

Get more for Hawaii Ge Address Change Form

- Mka cert form

- Lawful gambling return payment pv61 important type in the required information while this form is on the screen and print a

- Form 14653 rev 2 certification by u s person residing outside of the united states for streamlined foreign offshore procedures

- Handling moisture sensitive devices training certification ipctraining form

- Stem careers worksheet form

- Mass mandatory licensee consumer relationship disclosure real estate form

- Loan money contract template form

- Loan for family contract template form

Find out other Hawaii Ge Address Change Form

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free