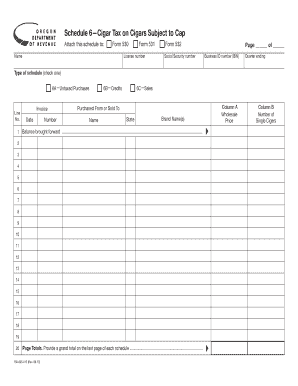

Schedule 6 Cigar Tax on Cigars Subject to Cap Form

What is the Schedule 6 Cigar Tax On Cigars Subject To Cap

The Schedule 6 Cigar Tax On Cigars Subject To Cap is a specific tax form used in the United States for reporting the excise tax on cigars that exceed a certain price threshold. This form is essential for manufacturers and importers of cigars to ensure compliance with federal tax regulations. It outlines the tax liability for cigars that fall under the designated cap, allowing businesses to accurately report their tax obligations to the Internal Revenue Service (IRS).

How to use the Schedule 6 Cigar Tax On Cigars Subject To Cap

Using the Schedule 6 Cigar Tax On Cigars Subject To Cap involves several steps. First, determine if your cigars are subject to the cap based on their retail price. Next, gather the necessary information about your cigar inventory, including quantities and prices. Complete the form by accurately reporting the details, ensuring that all calculations reflect the current tax rates. Finally, submit the form to the IRS by the designated filing deadline to avoid penalties.

Steps to complete the Schedule 6 Cigar Tax On Cigars Subject To Cap

Completing the Schedule 6 Cigar Tax On Cigars Subject To Cap requires attention to detail. Follow these steps:

- Review the current IRS guidelines related to cigar taxation.

- Gather all relevant data about your cigars, including types, quantities, and retail prices.

- Calculate the total tax owed based on the applicable rates for cigars subject to the cap.

- Fill out the form accurately, ensuring all sections are completed.

- Double-check your calculations and ensure all required information is included.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the Schedule 6 Cigar Tax On Cigars Subject To Cap

The Schedule 6 Cigar Tax On Cigars Subject To Cap must be used in accordance with federal tax laws. It is crucial for businesses to understand the legal implications of this form, as improper use can lead to penalties. Compliance with the regulations ensures that all taxes owed are reported accurately, protecting businesses from potential audits or legal issues. It is advisable to consult with a tax professional if there are uncertainties regarding the legal aspects of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 6 Cigar Tax On Cigars Subject To Cap are critical to avoid penalties. Typically, the form must be submitted quarterly, aligning with the IRS's tax calendar. Important dates include the end of each quarter, which marks the deadline for submission. Businesses should keep track of these dates and ensure timely filing to maintain compliance with federal tax obligations.

Required Documents

To complete the Schedule 6 Cigar Tax On Cigars Subject To Cap, certain documents are necessary. These include:

- Records of cigar purchases and sales.

- Inventory lists detailing quantities and retail prices.

- Previous tax forms related to cigar excise taxes.

- Any correspondence with the IRS regarding tax matters.

Having these documents readily available will facilitate the accurate completion of the form and ensure compliance with IRS requirements.

Quick guide on how to complete schedule 6 cigar tax on cigars subject to cap

Complete [SKS] effortlessly on any device

Web-based document management has gained popularity among companies and individuals. It serves as an ideal sustainable substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which only takes a few seconds and carries the same legal authority as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, time-consuming form searches, and errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and assure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 6 Cigar Tax On Cigars Subject To Cap

Create this form in 5 minutes!

How to create an eSignature for the schedule 6 cigar tax on cigars subject to cap

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 6 Cigar Tax On Cigars Subject To Cap?

The Schedule 6 Cigar Tax On Cigars Subject To Cap refers to the specific tax regulations applied to cigars that exceed a certain price threshold. Understanding this tax is crucial for businesses involved in the sale of cigars, as it affects pricing and compliance. airSlate SignNow can help streamline the documentation process related to these tax filings.

-

How can airSlate SignNow assist with Schedule 6 Cigar Tax documentation?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to Schedule 6 Cigar Tax On Cigars Subject To Cap. Our solution simplifies the process of managing tax-related paperwork, ensuring that your documents are compliant and securely stored. This helps businesses save time and reduce errors in their tax submissions.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Whether you are a small retailer or a large distributor, you can find a plan that fits your budget while providing the necessary features to manage Schedule 6 Cigar Tax On Cigars Subject To Cap documentation. Contact us for a detailed pricing breakdown.

-

What features does airSlate SignNow offer for tax compliance?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning, all designed to enhance tax compliance. Specifically for Schedule 6 Cigar Tax On Cigars Subject To Cap, these features ensure that your documents are accurate and submitted on time. Additionally, our audit trail provides transparency and accountability.

-

Can airSlate SignNow integrate with other accounting software?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to manage your Schedule 6 Cigar Tax On Cigars Subject To Cap filings. This integration allows for automatic data transfer, reducing manual entry and the risk of errors. Check our integration options to see how we can fit into your existing workflow.

-

What are the benefits of using airSlate SignNow for cigar tax documentation?

Using airSlate SignNow for your Schedule 6 Cigar Tax On Cigars Subject To Cap documentation offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick access to documents and easy collaboration among team members. This ultimately leads to better compliance and peace of mind.

-

Is airSlate SignNow suitable for businesses of all sizes?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, from small shops to large enterprises. Regardless of your scale, our solution can help you manage Schedule 6 Cigar Tax On Cigars Subject To Cap documentation effectively. Our user-friendly interface ensures that everyone can utilize the platform with ease.

Get more for Schedule 6 Cigar Tax On Cigars Subject To Cap

- Term of responsability alojamento secomunidades form

- Usmc promotion warrant template form

- Certificate of disposal template 22739127 form

- Form g 4 rev 1209

- Form dap 1902 radio licence for an aircraft application caa co

- Emcc transcript form

- Hund anmelden pirmasens form

- Questionnaire for industrial visit form

Find out other Schedule 6 Cigar Tax On Cigars Subject To Cap

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy