Application for Tax Relief Forskarskatten Mnden Form

What is the Application For Tax Relief Forskarskatten Mnden

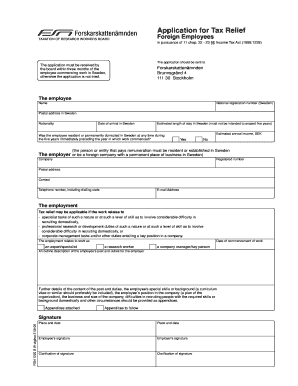

The Application For Tax Relief Forskarskatten Mnden is a formal request submitted by individuals seeking tax relief under specific circumstances. This application is designed to assist taxpayers who may qualify for reductions or exemptions from certain tax obligations. Understanding the purpose of this application is crucial for those who believe they meet the eligibility criteria for tax relief.

Steps to complete the Application For Tax Relief Forskarskatten Mnden

Completing the Application For Tax Relief Forskarskatten Mnden involves several key steps. First, gather all necessary documentation that supports your claim for tax relief, including income statements and any relevant financial records. Next, fill out the application form accurately, ensuring that all sections are completed. After reviewing the form for any errors, submit it along with the required documentation to the appropriate tax authority. It is essential to keep copies of everything submitted for your records.

Eligibility Criteria

To qualify for the Application For Tax Relief Forskarskatten Mnden, applicants must meet specific eligibility criteria. Generally, this includes demonstrating financial hardship or other qualifying conditions that justify a request for tax relief. Factors such as income level, family size, and any extenuating circumstances will be considered during the evaluation process. It is important to review these criteria thoroughly to ensure that your application is valid.

Required Documents

Submitting the Application For Tax Relief Forskarskatten Mnden requires several supporting documents. Typically, these include proof of income, tax returns from previous years, and any documentation that substantiates your claim for relief, such as medical bills or notices of financial hardship. Ensuring that all required documents are included will help facilitate a smoother review process.

Form Submission Methods

The Application For Tax Relief Forskarskatten Mnden can be submitted through various methods, including online, by mail, or in person. Each method has its own set of guidelines and requirements. For online submissions, ensure that you have a secure internet connection and follow the specific instructions provided by the tax authority. If submitting by mail, use a reliable postal service and consider tracking your application to confirm its delivery. In-person submissions may require an appointment, so check the local office's procedures beforehand.

Quick guide on how to complete application for tax relief forskarskatten mnden

Prepare [SKS] effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can access the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which only takes a few seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For Tax Relief Forskarskatten Mnden

Create this form in 5 minutes!

How to create an eSignature for the application for tax relief forskarskatten mnden

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Tax Relief Forskarskatten Mnden?

The Application For Tax Relief Forskarskatten Mnden is a formal request that individuals or businesses submit to seek tax relief under specific conditions. This application helps taxpayers reduce their tax burden by providing necessary documentation and justification for the relief sought.

-

How can airSlate SignNow assist with the Application For Tax Relief Forskarskatten Mnden?

airSlate SignNow streamlines the process of submitting your Application For Tax Relief Forskarskatten Mnden by allowing you to easily create, send, and eSign documents. Our platform ensures that your application is completed accurately and submitted on time, reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax relief applications?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while efficiently managing your Application For Tax Relief Forskarskatten Mnden.

-

What features does airSlate SignNow provide for managing tax relief applications?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools make it easier to manage your Application For Tax Relief Forskarskatten Mnden, ensuring a smooth and efficient process from start to finish.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your tax-related documents, including the Application For Tax Relief Forskarskatten Mnden, offers numerous benefits. You can save time, reduce paperwork, and enhance security, all while ensuring compliance with tax regulations.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax management software. This integration allows you to streamline your workflow and manage your Application For Tax Relief Forskarskatten Mnden alongside other financial documents.

-

Is airSlate SignNow secure for submitting sensitive tax applications?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Application For Tax Relief Forskarskatten Mnden is protected with advanced encryption and secure storage. You can confidently submit sensitive information knowing it is safe.

Get more for Application For Tax Relief Forskarskatten Mnden

- West virginia interlock form

- Dui interlock west virginia department of transportation form

- Notice your decision at any time to be sterilized will not result in the withdrawal or with holding of form

- Occupational medicine forms and resourcesbaptist health

- Chronic obstructive pulmonary disease enrolement form

- Programotolaryngology head and neck surgery form

- Congestive heart failure education program enrollment form

- Po box 8069 claim form little rock arkansas 72203 8069

Find out other Application For Tax Relief Forskarskatten Mnden

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT