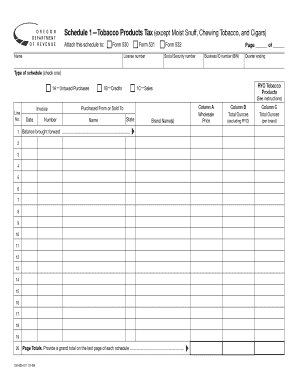

Schedule 1 Tobacco Products Tax Except Moist State of Oregon Form

What is the Schedule 1 Tobacco Products Tax except Moist State Of Oregon

The Schedule 1 Tobacco Products Tax except Moist in the State of Oregon refers to a specific tax form used to report and pay taxes on certain tobacco products, excluding moist snuff. This tax is applicable to manufacturers, distributors, and retailers of tobacco products within the state. The form is essential for ensuring compliance with state tax regulations and for accurately reporting the sale of taxable tobacco items.

How to use the Schedule 1 Tobacco Products Tax except Moist State Of Oregon

To use the Schedule 1 Tobacco Products Tax except Moist, businesses must first determine their tax liability based on the quantity and type of tobacco products sold. The form requires detailed information about the products, including brand names, quantities, and sales prices. After completing the form, it must be submitted to the appropriate state tax authority along with any taxes owed.

Steps to complete the Schedule 1 Tobacco Products Tax except Moist State Of Oregon

Completing the Schedule 1 Tobacco Products Tax except Moist involves several key steps:

- Gather necessary information about all tobacco products sold, including quantities and prices.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total tax owed based on the applicable rates for each product type.

- Review the form for accuracy before submission.

- Submit the completed form and payment to the state tax authority by the specified deadline.

Legal use of the Schedule 1 Tobacco Products Tax except Moist State Of Oregon

The legal use of the Schedule 1 Tobacco Products Tax except Moist is governed by Oregon state tax laws. Businesses must use this form to report their tobacco product sales accurately and pay the associated taxes. Failing to comply with these regulations can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 1 Tobacco Products Tax except Moist are crucial for compliance. Typically, the form must be submitted quarterly, with specific due dates set by the Oregon Department of Revenue. Businesses should keep track of these dates to avoid late fees and ensure timely processing of their tax obligations.

Penalties for Non-Compliance

Non-compliance with the Schedule 1 Tobacco Products Tax except Moist can lead to significant penalties. These may include monetary fines, interest on overdue taxes, and potential legal action. It is essential for businesses to adhere to filing requirements and deadlines to mitigate these risks and maintain good standing with state tax authorities.

Quick guide on how to complete schedule 1 tobacco products tax except moist state of oregon

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or mask sensitive details using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to finalize your changes.

- Choose your preferred method to send your form—via email, SMS, or invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 1 Tobacco Products Tax except Moist State Of Oregon

Create this form in 5 minutes!

How to create an eSignature for the schedule 1 tobacco products tax except moist state of oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 1 Tobacco Products Tax except Moist State Of Oregon?

The Schedule 1 Tobacco Products Tax except Moist State Of Oregon refers to the specific tax regulations applied to tobacco products in Oregon, excluding moist tobacco products. Understanding this tax is crucial for businesses involved in the sale of tobacco products to ensure compliance and avoid penalties.

-

How can airSlate SignNow help with Schedule 1 Tobacco Products Tax except Moist State Of Oregon documentation?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign documents related to the Schedule 1 Tobacco Products Tax except Moist State Of Oregon. This ensures that all necessary paperwork is completed accurately and efficiently, helping businesses stay compliant with state regulations.

-

What features does airSlate SignNow offer for managing tobacco tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically designed for managing tobacco tax documents, including those related to the Schedule 1 Tobacco Products Tax except Moist State Of Oregon. These features enhance efficiency and ensure that all documents are handled securely.

-

Is airSlate SignNow cost-effective for small businesses dealing with tobacco products?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing the Schedule 1 Tobacco Products Tax except Moist State Of Oregon. With flexible pricing plans, businesses can choose a package that fits their budget while still accessing essential features for document management and compliance.

-

Can airSlate SignNow integrate with other software for tobacco product management?

Absolutely! airSlate SignNow offers integrations with various software solutions that can assist in managing tobacco products and compliance with the Schedule 1 Tobacco Products Tax except Moist State Of Oregon. This allows businesses to streamline their operations and maintain accurate records across platforms.

-

What are the benefits of using airSlate SignNow for tobacco tax compliance?

Using airSlate SignNow for tobacco tax compliance, including the Schedule 1 Tobacco Products Tax except Moist State Of Oregon, provides numerous benefits. These include improved document accuracy, faster processing times, and enhanced security, all of which contribute to a more efficient compliance process.

-

How secure is airSlate SignNow for handling sensitive tobacco tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and secure storage solutions for handling sensitive documents related to the Schedule 1 Tobacco Products Tax except Moist State Of Oregon. This ensures that your business's confidential information remains protected at all times.

Get more for Schedule 1 Tobacco Products Tax except Moist State Of Oregon

- 2019 bite reporting and rabies control faq amanual for animal control agencies and shelters form

- Application for certificate of consent to self insure as a dir ca form

- Application cover sheet youth engagement to address tobacco related health disparities grant form

- Att b application cover sheet to be used as the first page for the application form

- Tick borne disease reporting form for animals in los angeles county

- Tick borne disease reporting form for animals in los angeles county tick borne disease reporting form for animals in los

- Complaint form instructions please read what we can do

- Template form for charter school complaints for use by charter schools

Find out other Schedule 1 Tobacco Products Tax except Moist State Of Oregon

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT