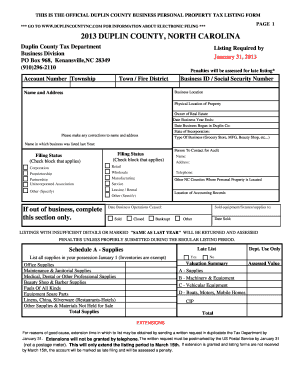

Duplin County Nc Business Personal Property Tax Form

What is the Duplin County NC Business Personal Property Tax?

The Duplin County NC Business Personal Property Tax is a tax levied on tangible personal property owned by businesses within Duplin County, North Carolina. This includes items such as machinery, equipment, furniture, and fixtures used in the operation of a business. The tax is assessed annually and is based on the value of the property as of January first each year. Businesses are required to report their personal property to the county tax office to ensure accurate assessment and compliance with local tax laws.

Steps to Complete the Duplin County NC Business Personal Property Tax

Completing the Duplin County NC Business Personal Property Tax involves several key steps:

- Gather Information: Collect details about all tangible personal property owned by the business, including purchase dates and costs.

- Obtain the Required Form: Access the business personal property tax listing form from the Duplin County tax office or their official website.

- Fill Out the Form: Accurately complete the form by listing all applicable personal property, ensuring values reflect the current market.

- Submit the Form: File the completed form by the designated deadline, which is typically January 31st of each year.

Legal Use of the Duplin County NC Business Personal Property Tax

The legal framework governing the Duplin County NC Business Personal Property Tax mandates that all businesses report their personal property annually. Failure to comply can result in penalties, including fines and interest on unpaid taxes. It is essential for businesses to understand their obligations under North Carolina tax laws to avoid legal repercussions. Additionally, accurate reporting ensures that businesses contribute fairly to local services funded by property taxes.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Duplin County NC Business Personal Property Tax is crucial for compliance. The primary deadline for submitting the personal property tax listing form is January 31st each year. If a business fails to file by this date, they may incur penalties. It is advisable for businesses to mark this date on their calendars and prepare their documentation in advance to ensure timely submission.

Required Documents

To successfully complete the Duplin County NC Business Personal Property Tax form, businesses need to gather several key documents:

- Purchase invoices for all personal property.

- Previous year’s tax listing, if applicable.

- Records of any property disposals or additions during the year.

- Any relevant financial statements that may assist in determining property values.

Who Issues the Form

The Duplin County tax office is responsible for issuing the business personal property tax listing form. This office oversees the assessment and collection of property taxes within the county. Businesses can contact the tax office for assistance with the form, clarification on reporting requirements, and any other inquiries related to personal property taxation.

Quick guide on how to complete duplin county nc business personal property tax

Effortlessly Prepare Duplin County Nc Business Personal Property Tax on Any Device

Digital document management has gained popularity among enterprises and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Duplin County Nc Business Personal Property Tax on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Duplin County Nc Business Personal Property Tax with Ease

- Obtain Duplin County Nc Business Personal Property Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select pertinent sections of the documents or mask sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to the hassle of lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Duplin County Nc Business Personal Property Tax while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the duplin county nc business personal property tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an NC property business tax listing?

An NC property business tax listing is a record that details the taxable property owned by a business in North Carolina. This listing is essential for ensuring compliance with state tax regulations and helps businesses accurately report their property assets for taxation purposes.

-

How can airSlate SignNow assist with NC property business tax listings?

airSlate SignNow provides a streamlined solution for managing documents related to NC property business tax listings. With our eSigning capabilities, businesses can easily send, sign, and store tax-related documents securely, ensuring compliance and efficiency in their tax reporting processes.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling NC property business tax listings. Our plans are designed to be cost-effective, allowing businesses of all sizes to access essential features without breaking the bank.

-

What features does airSlate SignNow offer for managing tax documents?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, all of which are beneficial for managing NC property business tax listings. These tools help streamline the document management process, making it easier for businesses to stay organized and compliant.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax management software. This integration allows businesses to synchronize their NC property business tax listings with their existing systems, enhancing efficiency and reducing the risk of errors.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for NC property business tax listings offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that all documents are easily accessible and securely stored, allowing businesses to focus on their core operations.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate, even those unfamiliar with eSigning. Our intuitive interface simplifies the process of managing NC property business tax listings, ensuring that all users can efficiently handle their documentation.

Get more for Duplin County Nc Business Personal Property Tax

- Financial disclosure statement cuyahoga county domestic domestic cuyahogacounty form

- Chr1 form download

- Philippines purse seine and ringnet logsheet bfar da gov form

- Request for medical consultation identcom form

- How to prepare and present a successful business finance form

- New jersey application form

- Aus178au form

- Auto contract template form

Find out other Duplin County Nc Business Personal Property Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors