W 9 New York State Form 2017-2026

What is the W-9 New York State Form

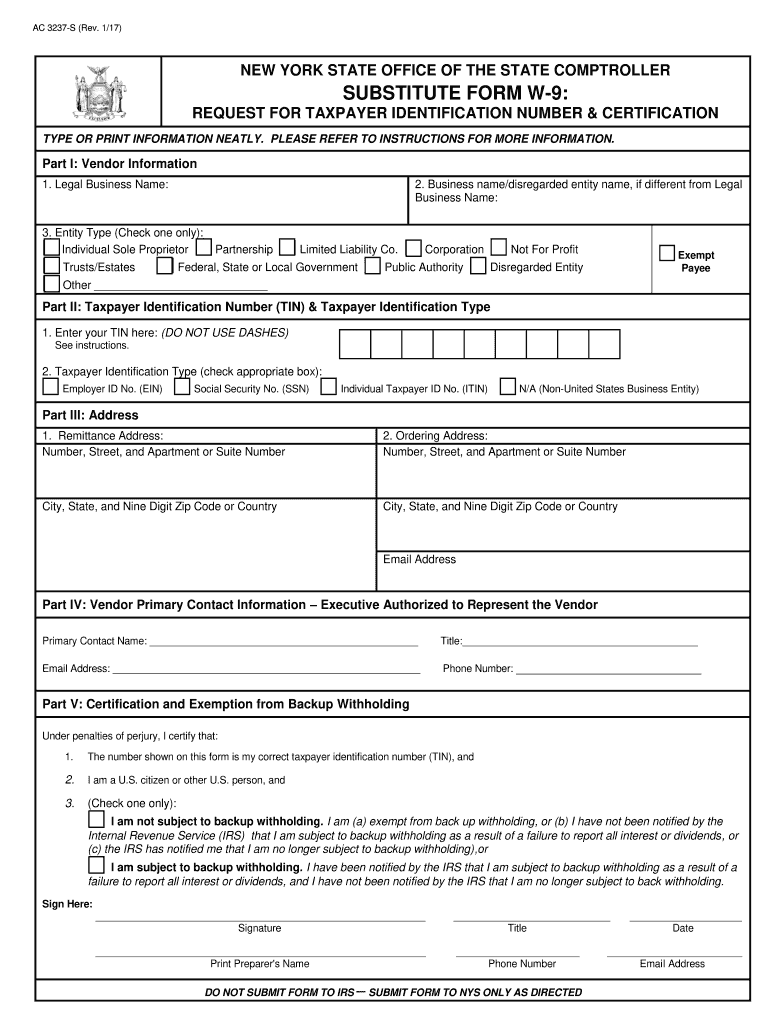

The W-9 form is a request for taxpayer identification number and certification, primarily used in the United States for tax purposes. The New York State variant of this form is utilized by individuals and businesses to provide their taxpayer identification information to entities that will report payments made to them to the IRS. This form is essential for freelancers, contractors, and vendors who need to report income for tax purposes. It ensures that the correct information is submitted to the IRS, thereby avoiding potential penalties and issues with tax filings.

Steps to Complete the W-9 New York State Form

Completing the W-9 form involves several straightforward steps:

- Download the form: Obtain the printable pip form from a reliable source, ensuring you have the most current version.

- Fill in your information: Enter your name, business name (if applicable), and address. Ensure that your taxpayer identification number (TIN) is accurate.

- Certification: Sign and date the form, certifying that the information provided is correct. This signature is crucial as it validates the form.

- Submission: Send the completed form to the entity requesting it, whether by mail or electronically, depending on their requirements.

Legal Use of the W-9 New York State Form

The W-9 form serves a legal purpose by providing a means for businesses and individuals to report income to the IRS. It is important that the information on the form is accurate and truthful. Misrepresentation or failure to provide a W-9 when required can lead to penalties, including backup withholding on payments. Understanding the legal implications of this form is essential for compliance with federal tax laws.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-9 form. It is crucial to follow these guidelines to ensure compliance. The form must be filled out accurately and submitted promptly when requested. The IRS also stipulates that the W-9 form should be used for various purposes, including reporting income for tax purposes and verifying taxpayer identification. Familiarizing oneself with these guidelines can help prevent issues during tax filing.

Form Submission Methods (Online / Mail / In-Person)

The W-9 form can be submitted through various methods, depending on the requirements of the requesting entity:

- Online: Some businesses may allow electronic submission of the form through secure portals.

- Mail: The completed form can be printed and mailed to the requester’s address.

- In-Person: In certain situations, delivering the form in person may be appropriate, especially for local businesses or organizations.

Required Documents

When completing the W-9 form, it is important to have certain documents on hand to ensure accuracy. These may include:

- Your Social Security number (SSN) or Employer Identification Number (EIN).

- Official identification that verifies your identity, such as a driver’s license or state ID.

- Any business documents if you are submitting the form on behalf of a business entity.

Eligibility Criteria

To complete and submit the W-9 form, individuals and businesses must meet specific eligibility criteria. Generally, you must:

- Be a U.S. citizen or a resident alien.

- Have a valid taxpayer identification number (TIN).

- Be able to certify that you are not subject to backup withholding due to failure to report interest and dividends.

Quick guide on how to complete ny w 9 blank 2017 2019 form

Your assistance manual on how to prepare your W 9 New York State Form

If you’re curious about how to generate and submit your W 9 New York State Form, here are a few brief guidelines on how to simplify tax filing.

To start, you simply need to sign up for your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally intuitive and robust document solution that enables you to modify, draft, and finalize your tax documents with ease. Using its editor, you can toggle between text, checkboxes, and eSignatures, and return to amend responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your W 9 New York State Form in no time:

- Create your account and begin working on PDFs in a matter of minutes.

- Utilize our directory to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to access your W 9 New York State Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Review your document and rectify any errors.

- Save changes, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Be aware that filing on paper may lead to return errors and delayed refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ny w 9 blank 2017 2019 form

FAQs

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

Why does my property management ask me to fill out a W-9 form?

To collect data on you in case they want to sue you and enforce a judgment.If the management co is required to pay inerest on security deposits then they need to account to ou for that interest income.If you are in a coop or condo they may apportion tax benefits or capital costs to you for tax purposes.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the ny w 9 blank 2017 2019 form

How to make an electronic signature for the Ny W 9 Blank 2017 2019 Form online

How to make an electronic signature for your Ny W 9 Blank 2017 2019 Form in Chrome

How to generate an eSignature for signing the Ny W 9 Blank 2017 2019 Form in Gmail

How to create an eSignature for the Ny W 9 Blank 2017 2019 Form right from your mobile device

How to generate an eSignature for the Ny W 9 Blank 2017 2019 Form on iOS

How to make an eSignature for the Ny W 9 Blank 2017 2019 Form on Android devices

People also ask

-

What is a printable PIP form?

A printable PIP form is a form that can be downloaded, printed, and filled out by hand. It allows users to collect necessary information without the need for complicated digital processes. This format can be particularly useful for those who prefer physical documentation.

-

How can I create a printable PIP form using airSlate SignNow?

Creating a printable PIP form with airSlate SignNow is straightforward. Simply use our template library to find a PIP form, customize it to meet your needs, and then download it as a printable PDF. This allows for easy distribution and collection of required information.

-

Is there a cost associated with obtaining a printable PIP form?

With airSlate SignNow, users can access a variety of templates, including a printable PIP form, at different pricing tiers. Our flexible subscription options ensure that businesses of all sizes can benefit from our services without breaking the bank. Check our pricing page for more detailed information.

-

Can I integrate a printable PIP form with other applications?

Yes, airSlate SignNow allows for seamless integration with numerous applications. This means that once your printable PIP form is created, you can easily connect it to tools like CRM systems or project management software for streamlined workflows. Enhance your document management process with our integrations.

-

What are the benefits of using a printable PIP form?

The benefits of using a printable PIP form include ease of access, the ability to collect signatures offline, and improved documentation management. By having the option to print, businesses can maintain traditional practices while still adapting to digital efficiencies. This hybrid approach maximizes flexibility.

-

Can I customize my printable PIP form?

Absolutely! airSlate SignNow provides tools for customizing your printable PIP form to fit your specific requirements. You can add your logo, modify fields, and adjust the layout to ensure that it meets your professional standards while still being easy to use.

-

How secure are printable PIP forms created with airSlate SignNow?

Security is a priority at airSlate SignNow. Printable PIP forms are created within a secure environment, ensuring that data is protected. Users benefit from our measures such as encryption and compliance with industry standards, giving peace of mind when handling sensitive information.

Get more for W 9 New York State Form

- North carolina medical license application pdf form

- Descargar hoja de datos escuela nacional preparatoria plantel 1 form

- Joels auctions form

- Sers membership record trumbull county educational service form

- Typeofcall traumamedicaltampmother form

- Thurrock council council tax direct debit instruction form thurrock council council tax direct debit instruction form thurrock

- City of palmer department of finance business license form

- City of coffman cove coffman cove alaska form

Find out other W 9 New York State Form

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract