Form to Request a Taxable Allowance for Communications and

What is the Form To Request A Taxable Allowance For Communications And

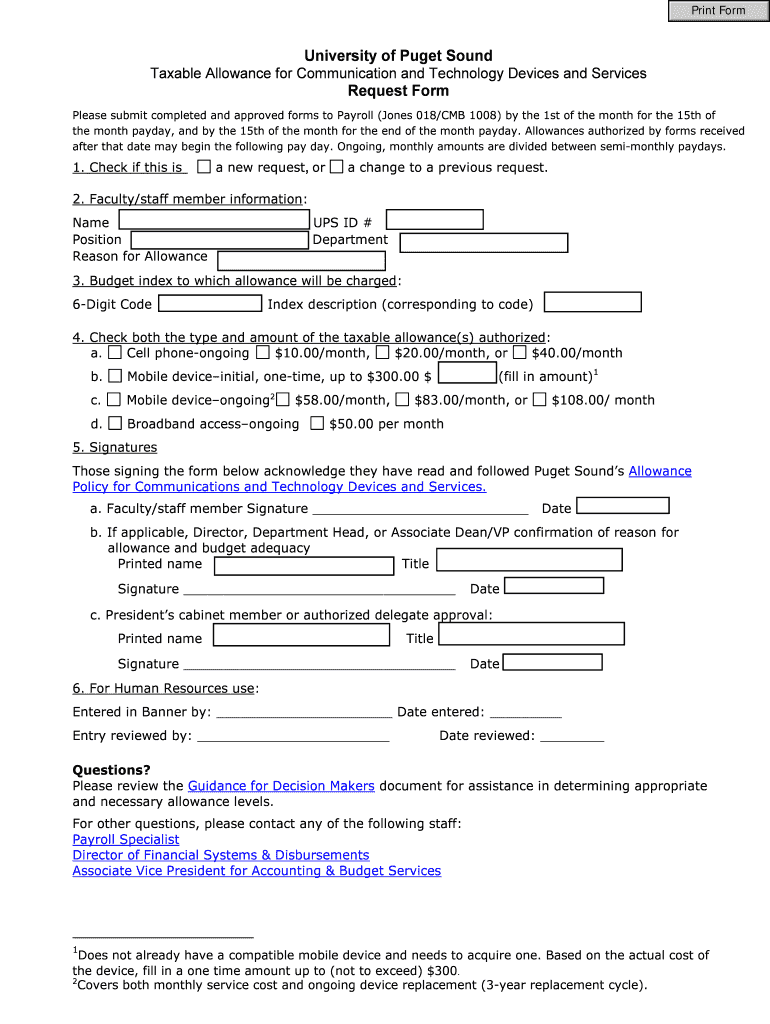

The Form To Request A Taxable Allowance For Communications And is a document used by employees to request reimbursement for communication expenses incurred while performing their job duties. This form is particularly relevant for individuals who utilize personal devices or services for work-related communications. The allowance may cover costs associated with phone calls, internet usage, and other communication methods necessary for job performance. Understanding this form is essential for both employees and employers to ensure compliance with tax regulations and proper reimbursement practices.

How to use the Form To Request A Taxable Allowance For Communications And

Using the Form To Request A Taxable Allowance For Communications And involves several straightforward steps. First, employees should gather all relevant information regarding their communication expenses. This may include bills, receipts, or usage logs. Next, they need to fill out the form accurately, detailing the nature of the expenses and providing any necessary documentation. Once completed, the form should be submitted to the appropriate department within the organization, typically human resources or finance, for review and approval. It is important to keep a copy for personal records.

Steps to complete the Form To Request A Taxable Allowance For Communications And

Completing the Form To Request A Taxable Allowance For Communications And requires careful attention to detail. Here are the essential steps:

- Begin by entering your personal information, including your name, employee ID, and department.

- Provide a clear description of the communication expenses you are requesting reimbursement for.

- Attach any supporting documents, such as bills or receipts, that validate your claims.

- Review the form for accuracy and completeness before submission.

- Submit the form to the designated department and retain a copy for your records.

Key elements of the Form To Request A Taxable Allowance For Communications And

The Form To Request A Taxable Allowance For Communications And includes several key elements that must be accurately completed to ensure proper processing. These elements typically include:

- Employee Information: Name, employee ID, and contact details.

- Expense Details: A breakdown of the communication expenses being claimed.

- Supporting Documentation: Required attachments that substantiate the expenses.

- Signature: The employee's signature to confirm the accuracy of the information provided.

Eligibility Criteria

Eligibility to use the Form To Request A Taxable Allowance For Communications And may vary by organization, but generally includes employees who incur communication expenses as part of their job responsibilities. Employees should verify with their employer whether they meet the criteria for reimbursement, which may include full-time status, specific job roles, or prior approval for using personal devices for work purposes. Understanding these criteria is crucial for ensuring that requests are valid and comply with company policies.

Form Submission Methods

The Form To Request A Taxable Allowance For Communications And can typically be submitted through various methods, depending on the employer's policies. Common submission methods include:

- Online Submission: Many organizations allow employees to submit forms electronically through an internal portal.

- Mail: Employees may also send the completed form via postal mail to the appropriate department.

- In-Person: Some employers may require or allow employees to submit the form in person for immediate processing.

Quick guide on how to complete form to request a taxable allowance for communications and

Prepare [SKS] effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] smoothly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you select. Edit and eSign [SKS] and ensure outstanding communication at every phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form To Request A Taxable Allowance For Communications And

Create this form in 5 minutes!

How to create an eSignature for the form to request a taxable allowance for communications and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Form To Request A Taxable Allowance For Communications And'?

The 'Form To Request A Taxable Allowance For Communications And' is a document designed to help employees request reimbursement for communication expenses. This form simplifies the process of submitting requests and ensures that all necessary information is captured efficiently.

-

How can airSlate SignNow help with the 'Form To Request A Taxable Allowance For Communications And'?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the 'Form To Request A Taxable Allowance For Communications And'. With our solution, businesses can streamline the approval process and ensure timely reimbursements for employees.

-

Is there a cost associated with using the 'Form To Request A Taxable Allowance For Communications And' on airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow, which varies based on the features and number of users. However, our solution is designed to be cost-effective, providing great value for businesses looking to manage forms like the 'Form To Request A Taxable Allowance For Communications And'.

-

What features does airSlate SignNow offer for managing the 'Form To Request A Taxable Allowance For Communications And'?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning for the 'Form To Request A Taxable Allowance For Communications And'. These features enhance efficiency and ensure compliance with company policies.

-

Can I integrate airSlate SignNow with other software for the 'Form To Request A Taxable Allowance For Communications And'?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the 'Form To Request A Taxable Allowance For Communications And' alongside your existing tools. This integration helps streamline your workflow and improves overall productivity.

-

What are the benefits of using airSlate SignNow for the 'Form To Request A Taxable Allowance For Communications And'?

Using airSlate SignNow for the 'Form To Request A Taxable Allowance For Communications And' offers numerous benefits, including faster processing times, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled efficiently and securely.

-

How secure is the 'Form To Request A Taxable Allowance For Communications And' when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The 'Form To Request A Taxable Allowance For Communications And' is protected with advanced encryption and secure access controls, ensuring that sensitive information remains confidential and safe from unauthorized access.

Get more for Form To Request A Taxable Allowance For Communications And

Find out other Form To Request A Taxable Allowance For Communications And

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word