St 119 1 2011-2026

What is the St 119 1?

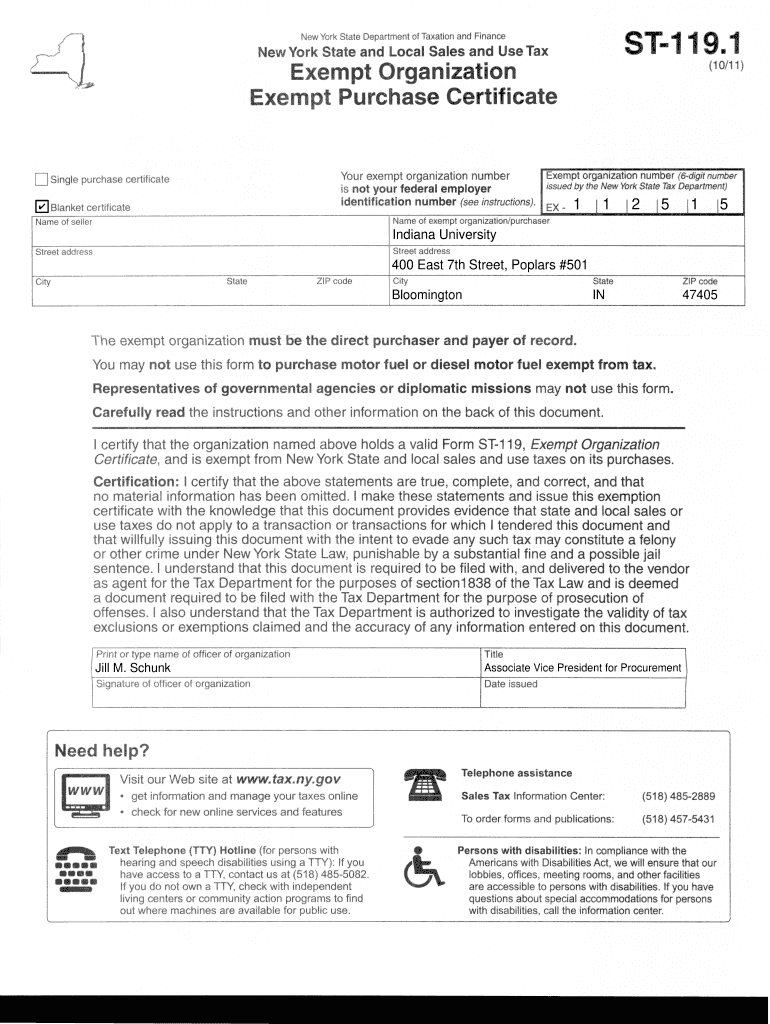

The St 119 1 is a tax exempt form used in New York State, specifically known as the Exempt Purchase Certificate. This form allows eligible purchasers to buy certain goods and services without paying sales tax. It is primarily utilized by organizations that qualify for tax exemptions, such as non-profit entities, government agencies, and specific educational institutions. By submitting the St 119 1, these organizations can streamline their purchasing processes while ensuring compliance with state tax regulations.

How to use the St 119 1

Using the St 119 1 involves several straightforward steps. First, ensure that your organization qualifies for tax-exempt status under New York State law. Next, obtain the blank St 119 1 form, which can be filled out electronically or printed for manual completion. Fill in the required information, including the purchaser's name, address, and the reason for the tax exemption. Once completed, present the form to the vendor at the time of purchase. It is essential to retain a copy for your records, as vendors may require proof of the exemption.

Steps to complete the St 119 1

Completing the St 119 1 form requires careful attention to detail. Follow these steps:

- Download the St 119 1 form from a reliable source.

- Fill in your organization's name, address, and tax identification number.

- Indicate the type of exempt organization you represent.

- Provide a brief description of the items or services being purchased.

- Sign and date the form to certify its accuracy.

After completion, present the form to the vendor to finalize your tax-exempt purchase.

Legal use of the St 119 1

The legal use of the St 119 1 is governed by New York State tax laws. Organizations must ensure they are eligible for tax exemption and use the form solely for qualifying purchases. Misuse of the St 119 1, such as using it for personal purchases or for items that do not qualify for tax exemption, can result in penalties. It is crucial for users to stay informed about the legal requirements and maintain accurate records of all transactions involving the St 119 1.

Examples of using the St 119 1

There are various scenarios where the St 119 1 can be effectively utilized. For instance:

- A non-profit organization purchasing office supplies for its operations can present the St 119 1 to avoid sales tax.

- A government agency acquiring equipment for public use may also utilize the form to exempt the purchase from sales tax.

- Educational institutions buying materials for classroom use can apply the St 119 1 when making such purchases.

These examples illustrate how the St 119 1 facilitates tax-exempt transactions for qualifying entities.

Who Issues the Form

The St 119 1 form is issued by the New York State Department of Taxation and Finance. This department oversees the administration of tax laws and ensures compliance among taxpayers. Organizations seeking to use the St 119 1 must ensure they are registered and recognized as tax-exempt entities by the state to utilize this form legally.

Quick guide on how to complete st 1191 exempt purchase certificate nys 2011 2019 form

Your assistance manual on preparing your St 119 1

If you're curious about how to produce and submit your St 119 1, here are some concise guidelines on how to simplify tax processing.

To begin, simply create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and robust document management solution that enables you to edit, draft, and complete your tax documents with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to update details as necessary. Enhance your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to finish your St 119 1 in just minutes:

- Create your account and start editing PDFs in no time.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your St 119 1 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to include your legally-binding eSignature (if needed).

- Review your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper may lead to return errors and slow reimbursements. Before e-filing your taxes, make sure to check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct st 1191 exempt purchase certificate nys 2011 2019 form

Create this form in 5 minutes!

How to create an eSignature for the st 1191 exempt purchase certificate nys 2011 2019 form

How to generate an eSignature for your St 1191 Exempt Purchase Certificate Nys 2011 2019 Form online

How to generate an electronic signature for the St 1191 Exempt Purchase Certificate Nys 2011 2019 Form in Google Chrome

How to create an electronic signature for putting it on the St 1191 Exempt Purchase Certificate Nys 2011 2019 Form in Gmail

How to generate an eSignature for the St 1191 Exempt Purchase Certificate Nys 2011 2019 Form straight from your smartphone

How to create an electronic signature for the St 1191 Exempt Purchase Certificate Nys 2011 2019 Form on iOS

How to generate an eSignature for the St 1191 Exempt Purchase Certificate Nys 2011 2019 Form on Android devices

People also ask

-

What is the st119 1 blank form?

The st119 1 blank form is a specific document used for tax-related purposes in certain jurisdictions. It allows businesses to provide necessary information for tax exemption and other official requirements, making it essential for compliance. Using airSlate SignNow, you can easily complete and eSign this form digitally.

-

How do I fill out the st119 1 blank form using airSlate SignNow?

Filling out the st119 1 blank form with airSlate SignNow is straightforward. You can upload the form, fill in the required fields with your information, and utilize our user-friendly interface to manage the document. Once completed, you can eSign it and share it securely.

-

Is airSlate SignNow a cost-effective solution for managing the st119 1 blank form?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes. By using our platform to manage the st119 1 blank form, you can save on printing and mailing costs while benefiting from our efficient eSigning features. This helps streamline your document management processes.

-

Can I integrate other tools to manage the st119 1 blank form?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and Salesforce, allowing you to manage the st119 1 blank form alongside your existing workflows. These integrations enhance your productivity and ensure that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the st119 1 blank form?

Using airSlate SignNow for the st119 1 blank form provides numerous benefits. You gain the ability to complete and eSign documents quickly, reducing turnaround time signNowly. Additionally, our platform ensures that your documents are secure and compliant with regulatory standards.

-

Is it safe to eSign the st119 1 blank form with airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your documents, including the st119 1 blank form. Our platform employs advanced encryption protocols and complies with industry standards to protect your sensitive information. You can eSign with confidence knowing your data is secure.

-

What devices can I use to access the st119 1 blank form via airSlate SignNow?

You can access the st119 1 blank form from any device with internet connectivity using airSlate SignNow. Whether you're using a desktop, tablet, or smartphone, our responsive design ensures a seamless experience, allowing you to manage your forms on the go.

Get more for St 119 1

- Special warranty deed 4246114 form

- Adult application 2 whiteys ice cream form

- Individual development plan pdf form

- Application for registration exemption south carolina secretary davmembersportal form

- Therapist imaginal exposure recording form oxford university

- Affidavit of withdrawal of candidacy saffire form

- Forms bernalillo county metropolitan court

- Answer to civil complaint form

Find out other St 119 1

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo