INCOME and EXPENDITURE Halifax Form

What is the INCOME AND EXPENDITURE Halifax

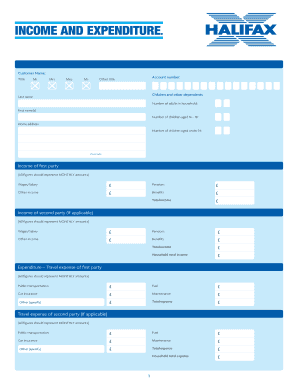

The INCOME AND EXPENDITURE Halifax form is a financial document used to report an individual's or business's income and expenses over a specific period. This form is essential for budgeting, financial analysis, and tax preparation. It provides a clear overview of financial health, allowing users to identify trends and make informed decisions regarding their finances.

How to use the INCOME AND EXPENDITURE Halifax

Using the INCOME AND EXPENDITURE Halifax form involves several straightforward steps. First, gather all relevant financial documents, including pay stubs, invoices, and receipts. Next, categorize your income sources, such as salaries, freelance work, and investment earnings. After that, list all expenses, including fixed costs like rent or mortgage, variable costs like groceries, and discretionary spending. Finally, review the completed form to ensure accuracy and completeness before submission.

Steps to complete the INCOME AND EXPENDITURE Halifax

Completing the INCOME AND EXPENDITURE Halifax form requires careful attention to detail. Follow these steps:

- Collect all necessary financial documents.

- Identify and categorize your income sources.

- List all expenses, ensuring to differentiate between fixed and variable costs.

- Calculate total income and total expenses.

- Review the form for accuracy before finalizing.

Legal use of the INCOME AND EXPENDITURE Halifax

The INCOME AND EXPENDITURE Halifax form is legally recognized for financial reporting and tax purposes. It is crucial for individuals and businesses to use this form accurately to comply with tax regulations. Misreporting income or expenses can lead to penalties or audits, making it essential to maintain accurate records and provide truthful information on the form.

Key elements of the INCOME AND EXPENDITURE Halifax

Key elements of the INCOME AND EXPENDITURE Halifax form include:

- Income sources: Detailed listing of all income streams.

- Expense categories: Breakdown of fixed, variable, and discretionary expenses.

- Total income and total expenses: Summarized figures for financial analysis.

- Net income: Calculation of income minus expenses, indicating financial health.

Examples of using the INCOME AND EXPENDITURE Halifax

Examples of using the INCOME AND EXPENDITURE Halifax form can vary based on individual circumstances. For instance, a self-employed individual may use the form to track business income and expenses, helping to prepare for tax season. A household may utilize it to manage monthly budgets, ensuring that expenses do not exceed income. These examples illustrate the form's versatility in different financial contexts.

Quick guide on how to complete income and expenditure halifax

Effortlessly Prepare INCOME AND EXPENDITURE Halifax on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your paperwork swiftly without any holdups. Handle INCOME AND EXPENDITURE Halifax on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and eSign INCOME AND EXPENDITURE Halifax with Ease

- Locate INCOME AND EXPENDITURE Halifax and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight relevant areas of your documents or conceal sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal standing as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign INCOME AND EXPENDITURE Halifax and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income and expenditure halifax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to INCOME AND EXPENDITURE Halifax?

airSlate SignNow is a powerful eSignature solution that allows businesses to manage their documents efficiently. For those dealing with INCOME AND EXPENDITURE Halifax, it streamlines the process of signing and sending financial documents, ensuring compliance and accuracy.

-

How can airSlate SignNow help with managing INCOME AND EXPENDITURE Halifax?

With airSlate SignNow, businesses can easily create, send, and track documents related to INCOME AND EXPENDITURE Halifax. This not only saves time but also reduces the risk of errors, making financial management more efficient.

-

What are the pricing options for airSlate SignNow for INCOME AND EXPENDITURE Halifax users?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including those focused on INCOME AND EXPENDITURE Halifax. Users can choose from various tiers that provide essential features at competitive rates, ensuring affordability.

-

What features does airSlate SignNow offer for INCOME AND EXPENDITURE Halifax?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking, all of which are beneficial for managing INCOME AND EXPENDITURE Halifax. These tools enhance productivity and ensure that all financial documents are handled efficiently.

-

Is airSlate SignNow secure for handling INCOME AND EXPENDITURE Halifax documents?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that all documents related to INCOME AND EXPENDITURE Halifax are protected, giving users peace of mind.

-

Can airSlate SignNow integrate with other tools for INCOME AND EXPENDITURE Halifax?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing its functionality for INCOME AND EXPENDITURE Halifax. This allows users to connect their financial software and streamline their document management processes.

-

What are the benefits of using airSlate SignNow for INCOME AND EXPENDITURE Halifax?

Using airSlate SignNow for INCOME AND EXPENDITURE Halifax offers numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. These advantages help businesses focus on their core operations while ensuring financial documents are managed effectively.

Get more for INCOME AND EXPENDITURE Halifax

Find out other INCOME AND EXPENDITURE Halifax

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online