Maryland Form 588 Direct Deposit of Maryland Income Tax Refund to More Than One Account

What is the Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

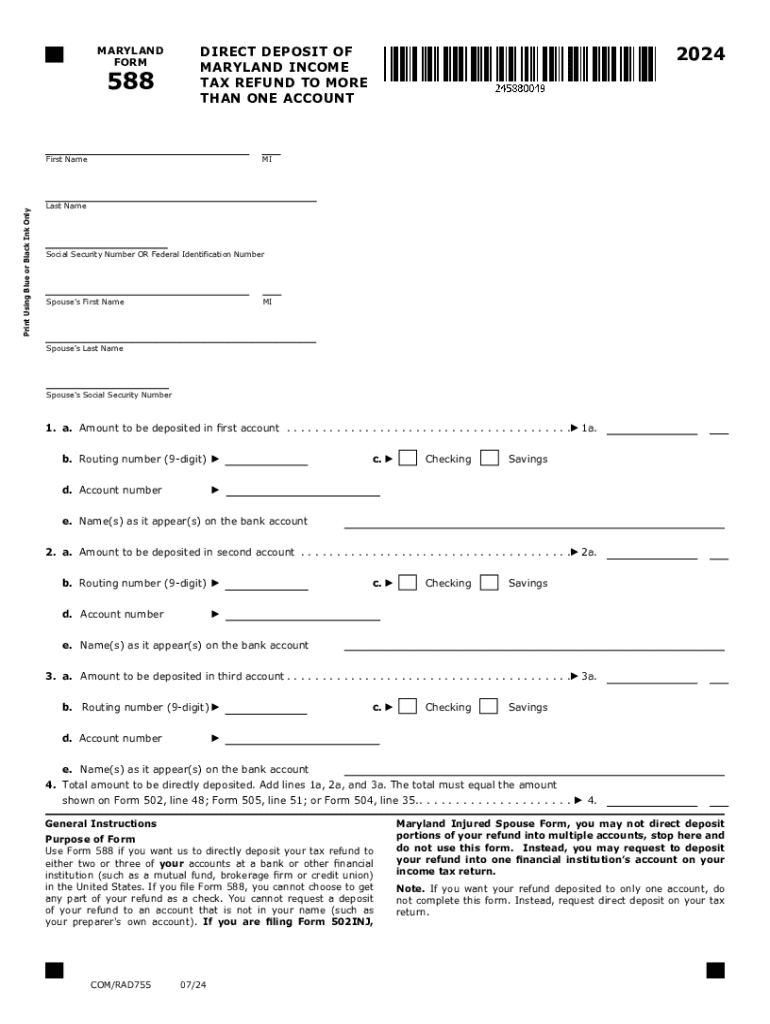

The Maryland Form 588 is a specific tax form used by residents of Maryland to request the direct deposit of their state income tax refunds into more than one bank account. This form allows taxpayers to split their refund into multiple accounts, providing flexibility in managing their finances. It is particularly useful for individuals who wish to allocate funds to different savings or checking accounts, making it easier to budget and save.

How to use the Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

To use the Maryland Form 588, taxpayers must first complete their Maryland state income tax return. After determining the refund amount, they can fill out Form 588 to specify the bank accounts for direct deposit. The form requires the taxpayer's personal information, including their Social Security number and the details of each bank account, such as the account number and routing number. Once completed, the form should be submitted along with the tax return to ensure the refund is processed correctly.

Steps to complete the Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

Completing the Maryland Form 588 involves several steps:

- Gather necessary information, including your tax return and bank account details.

- Fill out your personal information, ensuring accuracy in your Social Security number.

- Indicate the amount of the refund to be deposited into each account.

- Provide the routing and account numbers for each bank account.

- Review the form for any errors before submission.

Once completed, attach the form to your Maryland tax return and submit it to the appropriate state tax authority.

Eligibility Criteria

To use the Maryland Form 588, taxpayers must meet certain eligibility criteria. Primarily, they must be residents of Maryland who are filing a state income tax return and are entitled to a refund. Additionally, the accounts designated for direct deposit must be valid checking or savings accounts at a financial institution that accepts direct deposits. Taxpayers should ensure they have the necessary account information ready to avoid delays in processing their refunds.

Form Submission Methods

The Maryland Form 588 can be submitted in conjunction with your state income tax return. Taxpayers have the option to file their returns electronically or by mail. When filing electronically, ensure that Form 588 is included in the submission process. If mailing the tax return, attach the completed Form 588 to the front of the return to ensure it is processed together with the refund request.

Key elements of the Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

Key elements of the Maryland Form 588 include:

- Taxpayer's name and Social Security number.

- Details of each bank account for direct deposit, including account numbers and routing numbers.

- Specific amounts to be deposited into each account.

- Signature of the taxpayer, affirming the accuracy of the information provided.

These elements ensure that the refund is accurately directed to the intended accounts, facilitating a smooth transaction process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 588 direct deposit of maryland income tax refund to more than one account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account?

The Maryland Form 588 allows taxpayers to direct their income tax refunds to multiple bank accounts. This form is particularly useful for individuals who want to allocate their refunds for different purposes, such as savings or paying off debts. By using the Maryland Form 588, you can ensure that your funds are distributed according to your financial needs.

-

How can I complete the Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account?

To complete the Maryland Form 588, you need to provide your personal information, including your Social Security number and bank account details. The form will guide you through the process of specifying how much of your refund goes to each account. Make sure to double-check your account numbers to avoid any delays in receiving your funds.

-

Is there a fee associated with using the Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account?

There is no fee for filing the Maryland Form 588 itself; however, your bank may have its own policies regarding direct deposits. Using airSlate SignNow to eSign and submit your form can streamline the process at no additional cost. This makes it a cost-effective solution for managing your tax refunds.

-

What are the benefits of using the Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account?

The primary benefit of using the Maryland Form 588 is the flexibility it offers in managing your tax refund. You can allocate funds to multiple accounts, which helps in budgeting and financial planning. Additionally, direct deposit is faster and more secure than receiving a paper check.

-

Can I use airSlate SignNow to eSign the Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account?

Yes, airSlate SignNow provides an easy-to-use platform for eSigning the Maryland Form 588. This feature allows you to complete your form quickly and securely, ensuring that your tax refund is processed without unnecessary delays. The platform is designed to simplify the eSigning process for all users.

-

What integrations does airSlate SignNow offer for managing the Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account?

airSlate SignNow integrates seamlessly with various applications, allowing you to manage your documents efficiently. You can connect it with accounting software and other financial tools to streamline your tax filing process. This integration enhances your ability to handle the Maryland Form 588 effectively.

-

How long does it take to receive my refund after submitting the Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account?

Typically, once the Maryland Form 588 is processed, you can expect to receive your refund within a few weeks. Direct deposits are usually faster than paper checks, making it a preferred option for many taxpayers. Ensure that your form is filled out correctly to avoid any delays.

Get more for Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

- Bond form

- Instructions internal revenue service form

- In accordance with our telephone conversation this week i would like to explain the form

- This letter is notify you that my client a minor child suffered physical and form

- Sample crummy letter for ilit form

- Sample letter response to request for documents form

- Unintended client and non engagement letters aon attorneys form

- Sample letter to unrepresented party opposite regarding respond to form

Find out other Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online