DC5 166 Donation Form Issued 10418

What is the DC5 166 Donation Form Issued 10418

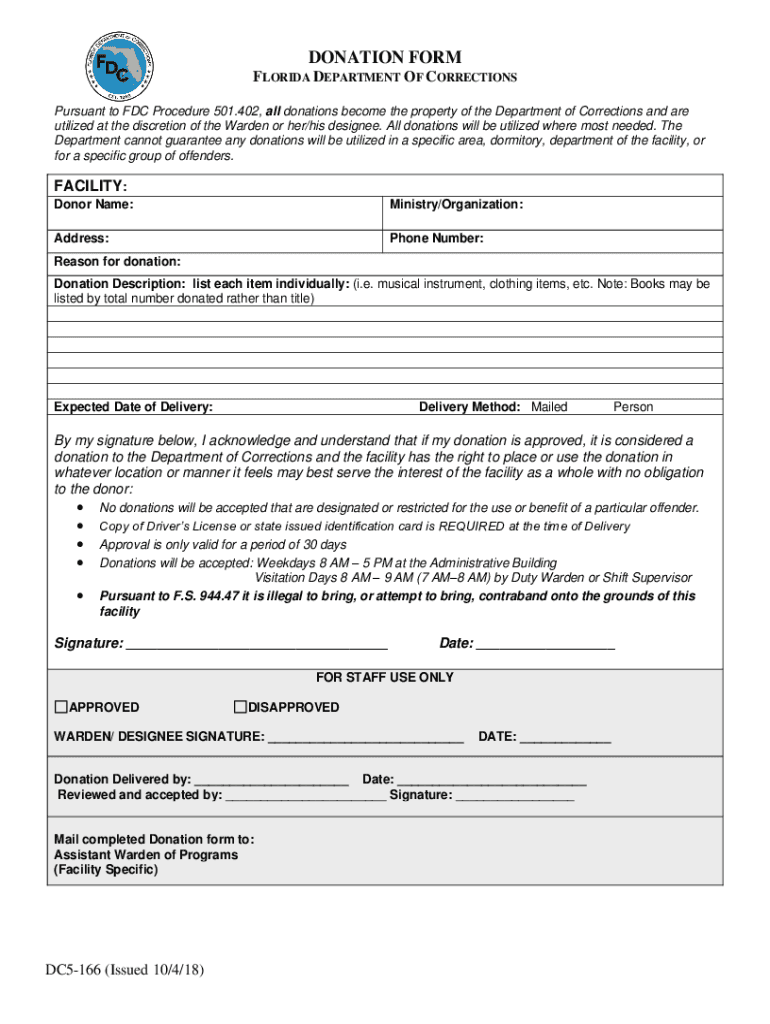

The DC5 166 Donation Form Issued 10418 is a specific document used for reporting charitable donations made by individuals or businesses in the United States. This form serves as an official record for both the donor and the recipient organization, ensuring compliance with IRS regulations. It is essential for taxpayers who wish to claim deductions for their charitable contributions, providing a clear outline of the donations made during the tax year.

How to use the DC5 166 Donation Form Issued 10418

Using the DC5 166 Donation Form Issued 10418 involves several straightforward steps. First, gather all necessary information regarding the donations, including the name of the charitable organization, the date of the donation, and the value of the items or cash donated. Next, accurately fill out the form, ensuring all details are correct and complete. Once completed, retain a copy for your records and submit the form according to the guidelines provided by the IRS, either electronically or via mail.

Steps to complete the DC5 166 Donation Form Issued 10418

Completing the DC5 166 Donation Form Issued 10418 requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, such as the IRS website or a tax professional.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about the charitable organization, including its name and address.

- List the items or cash donated, including their fair market value.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the DC5 166 Donation Form Issued 10418

The DC5 166 Donation Form Issued 10418 is legally recognized by the IRS for documenting charitable donations. Proper use of this form ensures that donors can substantiate their claims for tax deductions. It is essential to follow all IRS guidelines when completing and submitting the form to avoid any issues with tax compliance. Failure to accurately report donations can lead to penalties or disallowance of deductions.

Key elements of the DC5 166 Donation Form Issued 10418

Several key elements are critical to the DC5 166 Donation Form Issued 10418. These include:

- Donor Information: Name, address, and taxpayer identification number.

- Charitable Organization Details: Name and address of the organization receiving the donation.

- Donation Description: A detailed list of items or cash donated, including their fair market value.

- Signature: The donor's signature certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the DC5 166 Donation Form Issued 10418 is crucial for taxpayers. Generally, the form should be submitted along with your annual tax return. For most individuals, this means filing by April 15 of the following year. However, if you are filing for an extension, ensure that the form is included in your extended return submission. Keeping track of these deadlines helps avoid penalties and ensures compliance with tax regulations.

Quick guide on how to complete dc5 166 donation form issued 10418

Complete DC5 166 Donation Form Issued 10418 effortlessly on any device

Online document management has become increasingly prevalent among enterprises and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Manage DC5 166 Donation Form Issued 10418 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign DC5 166 Donation Form Issued 10418 with minimal effort

- Locate DC5 166 Donation Form Issued 10418 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your choice. Edit and eSign DC5 166 Donation Form Issued 10418 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dc5 166 donation form issued 10418

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dc5 166 form and how can airSlate SignNow help?

The dc5 166 form is a document that requires electronic signatures for validation. With airSlate SignNow, you can easily send, sign, and manage the dc5 166 form online, streamlining your workflow and ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for the dc5 166 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget while efficiently managing the dc5 166 form and other documents.

-

What features does airSlate SignNow offer for the dc5 166 form?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for the dc5 166 form. These tools enhance your document management process and improve collaboration.

-

Can I integrate airSlate SignNow with other applications for the dc5 166 form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the dc5 166 form alongside your existing tools. This integration enhances productivity and simplifies your workflow.

-

How does airSlate SignNow ensure the security of the dc5 166 form?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your dc5 166 form. This ensures that your sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for the dc5 166 form?

Using airSlate SignNow for the dc5 166 form offers numerous benefits, including faster turnaround times, reduced paper usage, and improved accuracy. These advantages help businesses operate more efficiently and sustainably.

-

Can I track the status of the dc5 166 form in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of the dc5 166 form in real-time. You will receive notifications when the document is viewed, signed, or completed, keeping you informed throughout the process.

Get more for DC5 166 Donation Form Issued 10418

- Intimation cum preliminary claim form doc

- Antrag auf leistungen fr bildung und teilhabe form

- Ranm form 2402

- Substitution of maintenance order form

- Freshman parking appeal form concordia university cui

- Prior driving experience application form

- Statement of live birth form 2 vital statistics act

- Sun life premium offset form

Find out other DC5 166 Donation Form Issued 10418

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney