IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X Amended Partnership Replacement Tax Return 2020

Understanding the IL 1065 X Amended Partnership Replacement Tax Return

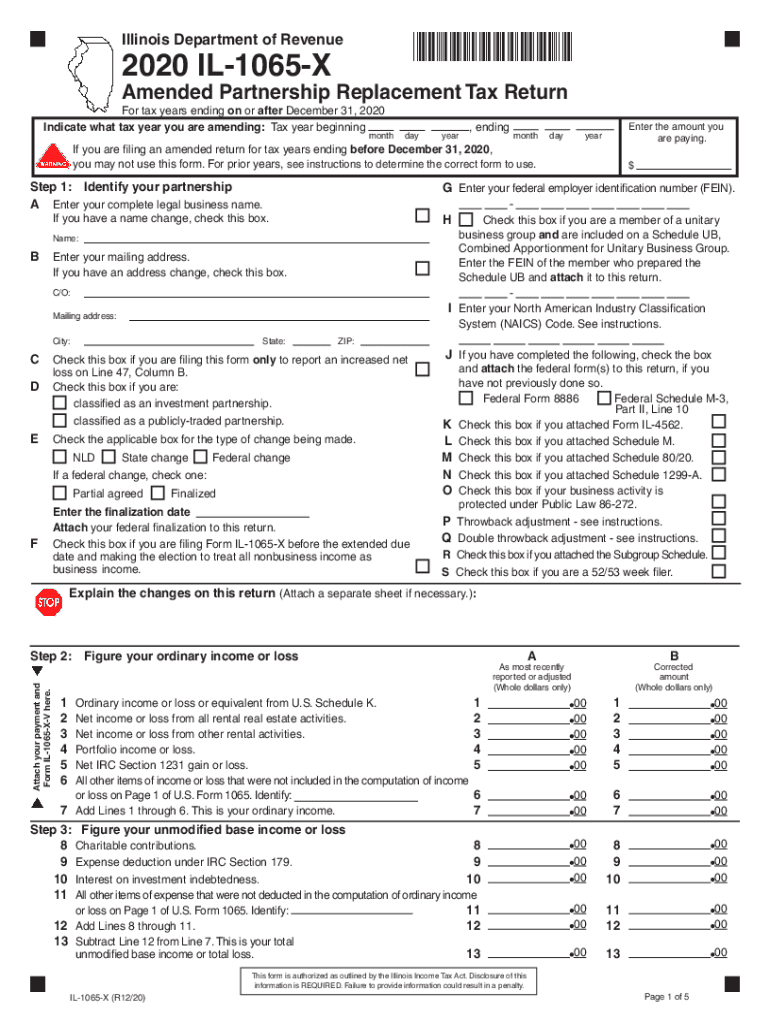

The IL 1065 X Amended Partnership Replacement Tax Return is a critical document for partnerships in Illinois that need to amend their previously filed partnership tax returns. This form allows partnerships to correct errors or make necessary adjustments to their tax filings. It is essential for ensuring compliance with state tax regulations and for accurately reporting income, deductions, and credits. By submitting this amended return, partnerships can rectify discrepancies that may affect their tax obligations and avoid potential penalties.

Steps to Complete the IL 1065 X Amended Partnership Replacement Tax Return

Completing the IL 1065 X requires careful attention to detail. Here are the steps involved:

- Gather all relevant documentation, including the original IL 1065 return and any supporting documents.

- Clearly indicate the changes being made on the amended form, ensuring all adjustments are accurately reflected.

- Fill out the form completely, providing all necessary information about the partnership and its members.

- Review the amended return for accuracy, ensuring that all calculations are correct and that no information is omitted.

- Sign the form where required and prepare it for submission.

How to Obtain the IL 1065 X Amended Partnership Replacement Tax Return

The IL 1065 X can be obtained through the Illinois Department of Revenue’s website. The form is available for download in PDF format, allowing partnerships to print and fill it out manually. Additionally, partnerships may also access the form through various tax preparation software that supports Illinois tax filings. It is important to ensure that the most current version of the form is used to comply with any recent changes in tax regulations.

Key Elements of the IL 1065 X Amended Partnership Replacement Tax Return

Several key elements must be included when completing the IL 1065 X. These include:

- Partnership name and address.

- Federal Employer Identification Number (EIN).

- Details of the changes being made, including specific line items that are being amended.

- Signature of the authorized partner or representative.

- Any additional schedules or documentation that support the changes made.

Filing Deadlines for the IL 1065 X Amended Partnership Replacement Tax Return

Partnerships must be aware of the filing deadlines for the IL 1065 X. Generally, the amended return should be filed within three years from the original due date of the return or within one year of the date the tax was paid, whichever is later. Adhering to these deadlines is crucial to avoid penalties and ensure that the amendments are processed in a timely manner.

Legal Use of the IL 1065 X Amended Partnership Replacement Tax Return

The IL 1065 X serves a legal purpose in correcting partnership tax filings. It is recognized by the Illinois Department of Revenue as the official means for partnerships to amend their tax returns. Proper use of this form helps partnerships maintain compliance with state tax laws and provides a clear record of any changes made to their tax obligations. Failure to use this form appropriately may result in legal repercussions or additional tax liabilities.

Quick guide on how to complete il 1065 x amended partnership replacement tax return il 1065 x amended partnership replacement tax return

Complete IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X Amended Partnership Replacement Tax Return effortlessly on any device

Web-based document management has become popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delay. Handle IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X Amended Partnership Replacement Tax Return on any gadget using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to alter and eSign IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X Amended Partnership Replacement Tax Return with ease

- Find IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X Amended Partnership Replacement Tax Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X Amended Partnership Replacement Tax Return and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 1065 x amended partnership replacement tax return il 1065 x amended partnership replacement tax return

Create this form in 5 minutes!

How to create an eSignature for the il 1065 x amended partnership replacement tax return il 1065 x amended partnership replacement tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1065 X Amended Partnership Replacement Tax Return?

The IL 1065 X Amended Partnership Replacement Tax Return is a form used by partnerships in Illinois to amend their previously filed tax returns. This form allows partnerships to correct errors or make changes to their tax information, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the IL 1065 X Amended Partnership Replacement Tax Return?

airSlate SignNow provides a user-friendly platform for businesses to easily prepare, send, and eSign the IL 1065 X Amended Partnership Replacement Tax Return. Our solution streamlines the process, making it efficient and cost-effective for partnerships to manage their tax documentation.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the preparation and eSigning of the IL 1065 X Amended Partnership Replacement Tax Return, ensuring you get the best value for your investment.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features specifically designed for tax document management, such as templates for the IL 1065 X Amended Partnership Replacement Tax Return, secure storage, and easy sharing options. These features help ensure that your tax documents are organized and accessible when needed.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting software, allowing you to seamlessly manage your IL 1065 X Amended Partnership Replacement Tax Return alongside your other financial documents. This integration enhances workflow efficiency and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for tax returns?

Using airSlate SignNow for your IL 1065 X Amended Partnership Replacement Tax Return offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the eSigning process, making it easier for partners to approve and submit their tax returns.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your IL 1065 X Amended Partnership Replacement Tax Return and other sensitive documents are protected. We utilize advanced encryption and secure storage solutions to safeguard your information.

Get more for IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X Amended Partnership Replacement Tax Return

Find out other IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X Amended Partnership Replacement Tax Return

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast