Online Clean Hands Application Office of Tax and Revenue DC Gov Form

Understanding the Personal Property Tax Return Form

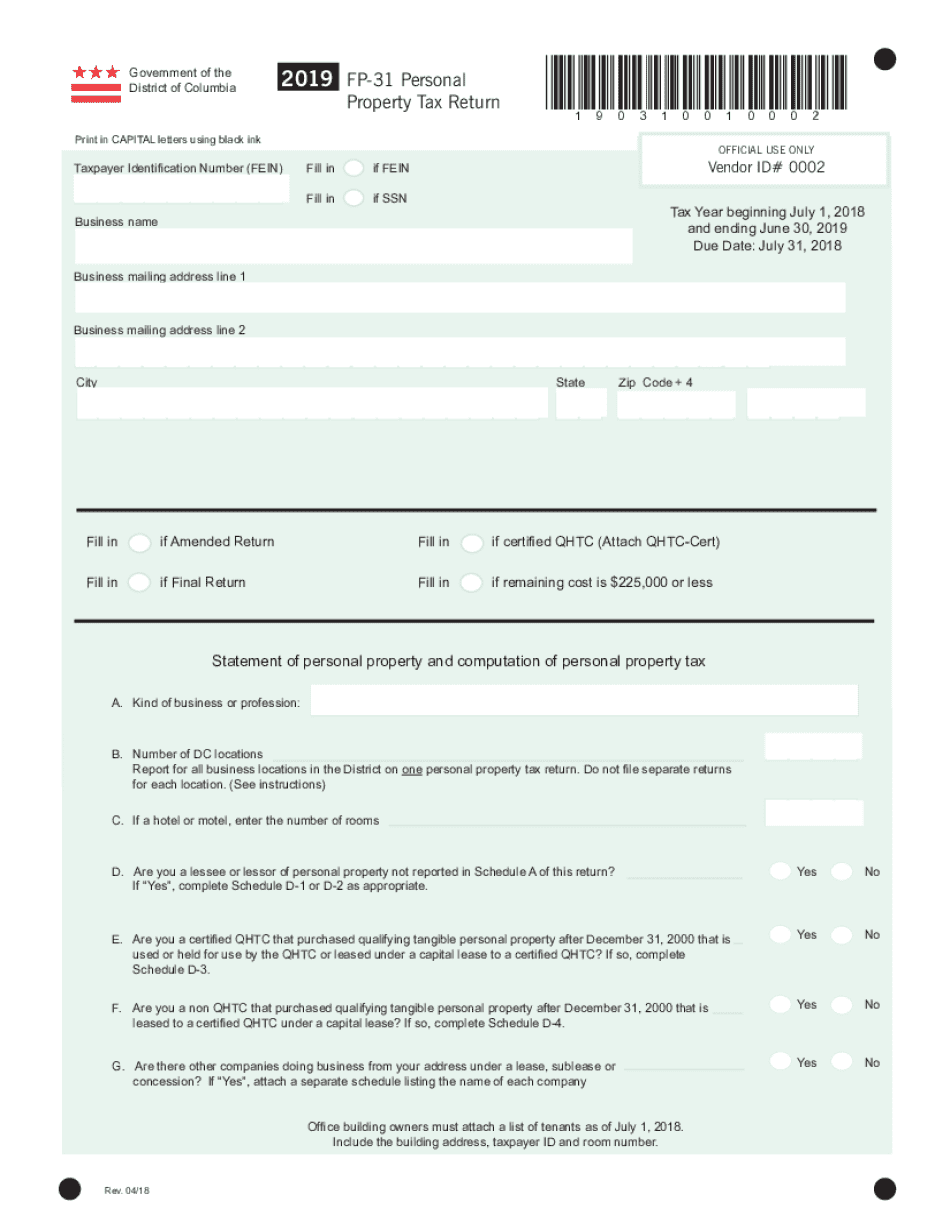

The personal property tax return form is a crucial document for individuals and businesses in the United States that own personal property. This form is used to report the value of personal property to local tax authorities, ensuring that property taxes are assessed accurately. In many jurisdictions, personal property can include items such as vehicles, machinery, equipment, and furniture. Understanding the specifics of this form is essential for compliance with local tax laws.

Required Documents for Filing

When preparing to complete the personal property tax return form, it is important to gather all necessary documentation. This may include:

- Proof of ownership for each item of personal property.

- Purchase receipts or appraisals that establish the value of the property.

- Previous tax returns that may provide context for current filings.

Having these documents ready can streamline the filing process and help ensure accuracy in reporting.

Steps to Complete the Personal Property Tax Return Form

Completing the personal property tax return form involves several key steps:

- Gather all required documents and information about your personal property.

- Obtain the correct version of the personal property tax return form, such as the FP-31 form in Washington, D.C.

- Fill out the form accurately, detailing each item of personal property and its assessed value.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online or by mail, depending on local regulations.

Following these steps can help ensure that your filing is completed correctly and on time.

Form Submission Methods

The personal property tax return form can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

It is advisable to check with your local tax authority for specific submission options and any associated deadlines.

Penalties for Non-Compliance

Failure to file the personal property tax return form on time or inaccuracies in the form can lead to penalties. These may include:

- Late filing fees that increase the longer the form is overdue.

- Interest on unpaid taxes, which can accumulate quickly.

- Potential audits or additional scrutiny from tax authorities.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Eligibility Criteria for Filing

Eligibility to file the personal property tax return form generally depends on ownership of personal property within a given jurisdiction. Key criteria may include:

- Ownership of property that meets local assessment thresholds.

- Residency or business operations within the jurisdiction requiring the filing.

- Compliance with any specific local regulations regarding personal property.

Reviewing these criteria can help determine if you are required to file the form.

Quick guide on how to complete online clean hands application office of tax and revenue dc gov

Complete Online Clean Hands Application Office Of Tax And Revenue DC gov easily on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can find the right form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Online Clean Hands Application Office Of Tax And Revenue DC gov on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Online Clean Hands Application Office Of Tax And Revenue DC gov effortlessly

- Obtain Online Clean Hands Application Office Of Tax And Revenue DC gov and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, monotonous form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Online Clean Hands Application Office Of Tax And Revenue DC gov and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the online clean hands application office of tax and revenue dc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a personal property tax return form?

A personal property tax return form is a document used to report personal property owned by an individual or business for tax purposes. This form helps local governments assess the value of personal property to determine tax liabilities. Using airSlate SignNow, you can easily create and eSign your personal property tax return form, streamlining the filing process.

-

How can airSlate SignNow help with my personal property tax return form?

airSlate SignNow simplifies the process of completing and submitting your personal property tax return form. With our platform, you can fill out the form electronically, add your eSignature, and send it directly to the relevant authorities. This not only saves time but also ensures that your documents are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for my personal property tax return form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. The cost is competitive and reflects the value of our easy-to-use platform for managing documents like the personal property tax return form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for personal property tax return forms?

airSlate SignNow provides a range of features for managing your personal property tax return form, including customizable templates, eSignature capabilities, and secure document storage. Additionally, our platform allows for real-time collaboration, making it easy to work with tax professionals or partners. These features enhance the efficiency of your tax filing process.

-

Can I integrate airSlate SignNow with other software for my personal property tax return form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling your personal property tax return form. Whether you use accounting software or document management systems, our integrations help you maintain a seamless process from start to finish.

-

What are the benefits of using airSlate SignNow for my personal property tax return form?

Using airSlate SignNow for your personal property tax return form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and submitted quickly, minimizing the risk of errors. Additionally, you can track the status of your submissions in real-time.

-

Is airSlate SignNow secure for handling personal property tax return forms?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your personal property tax return form and other documents are protected. We use advanced encryption and secure storage solutions to safeguard your information. You can trust that your sensitive data is handled with the utmost care and confidentiality.

Get more for Online Clean Hands Application Office Of Tax And Revenue DC gov

- Lit transcript request form

- Mykelly com w2 form

- Insurance authorization form 16085658

- Warfighter refractive surgery information briefing sheet afsc

- Mississippinew voter registration form

- Terminix receipt form

- Dumpster permit city of newburgh ny cityofnewburgh ny form

- 5 reasons to join your childs school parent teacher form

Find out other Online Clean Hands Application Office Of Tax And Revenue DC gov

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo