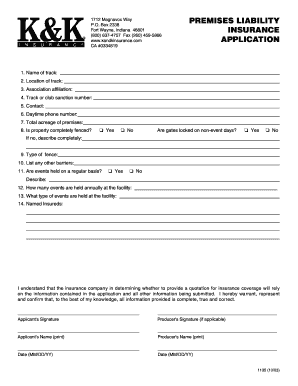

PREMISES LIABILITY INSURANCE APPLICATION Form

What is the PREMISES LIABILITY INSURANCE APPLICATION

The PREMISES LIABILITY INSURANCE APPLICATION is a formal document used by businesses to apply for insurance coverage that protects against claims arising from injuries or accidents occurring on their property. This type of insurance is essential for property owners and businesses, as it provides financial protection against legal liabilities that may arise from incidents such as slip and fall accidents, inadequate security, or unsafe conditions. By completing this application, businesses outline their operations, property details, and risk factors to insurers, allowing them to assess the level of coverage needed.

Steps to complete the PREMISES LIABILITY INSURANCE APPLICATION

Completing the PREMISES LIABILITY INSURANCE APPLICATION involves several key steps to ensure accuracy and comprehensiveness. First, gather all necessary information about your business, including its name, address, and the nature of your operations. Next, provide details about the property, such as its size, age, and any previous insurance claims. It is also important to disclose any safety measures in place, such as security systems or regular maintenance protocols. After filling out the application, review it carefully for any errors or omissions before submitting it to the insurance provider.

Key elements of the PREMISES LIABILITY INSURANCE APPLICATION

Several key elements are essential when filling out the PREMISES LIABILITY INSURANCE APPLICATION. These include:

- Business Information: Name, address, and type of business.

- Property Details: Description of the premises, including square footage and any unique features.

- Risk Factors: Information about previous claims, safety measures, and the nature of business activities.

- Coverage Needs: Desired limits of liability and any additional coverage options.

Providing complete and accurate information in these areas helps insurers assess risk and determine appropriate premiums.

Legal use of the PREMISES LIABILITY INSURANCE APPLICATION

The PREMISES LIABILITY INSURANCE APPLICATION serves a legal purpose in the insurance process. By submitting this application, businesses enter into a contractual agreement with the insurer, which outlines the terms of coverage and responsibilities of both parties. It is crucial to provide truthful and complete information, as any misrepresentation can lead to denial of coverage or cancellation of the policy. Understanding the legal implications of this application is vital for businesses seeking to protect themselves from potential liabilities.

Eligibility Criteria

Eligibility for obtaining premises liability insurance typically depends on various factors related to the business and its operations. Insurers may consider:

- Type of Business: Certain industries may face higher risks, influencing eligibility.

- Claims History: A history of previous claims can affect the approval process.

- Safety Measures: Implementation of safety protocols may enhance eligibility.

- Property Condition: Well-maintained properties may be viewed more favorably.

Understanding these criteria can help businesses prepare for the application process.

How to obtain the PREMISES LIABILITY INSURANCE APPLICATION

Obtaining the PREMISES LIABILITY INSURANCE APPLICATION is a straightforward process. Businesses can typically request the application directly from insurance providers or brokers specializing in commercial insurance. Many insurers also offer downloadable versions of the application on their websites. It is advisable to review multiple insurers to find the best coverage options and rates. Additionally, consulting with an insurance agent can provide valuable insights into the application process and help ensure that all necessary information is included.

Quick guide on how to complete premises liability insurance application

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents quickly and efficiently. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications, and enhance any document-related process today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, endless form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure seamless communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the premises liability insurance application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PREMISES LIABILITY INSURANCE APPLICATION?

A PREMISES LIABILITY INSURANCE APPLICATION is a document used to apply for insurance coverage that protects businesses from claims arising from injuries or accidents occurring on their property. This application typically requires detailed information about the business, its operations, and the premises to assess risk accurately.

-

How can airSlate SignNow help with my PREMISES LIABILITY INSURANCE APPLICATION?

airSlate SignNow streamlines the process of completing and submitting your PREMISES LIABILITY INSURANCE APPLICATION by allowing you to eSign documents quickly and securely. Our platform ensures that your application is filled out accurately and submitted on time, reducing the risk of delays in obtaining coverage.

-

What features does airSlate SignNow offer for managing PREMISES LIABILITY INSURANCE APPLICATIONS?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage to manage your PREMISES LIABILITY INSURANCE APPLICATIONS efficiently. These tools help you keep all your documents organized and accessible, ensuring a smooth application process.

-

Is there a cost associated with using airSlate SignNow for my PREMISES LIABILITY INSURANCE APPLICATION?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost is competitive and reflects the value of our easy-to-use platform, which simplifies the process of completing your PREMISES LIABILITY INSURANCE APPLICATION and enhances your overall efficiency.

-

What are the benefits of using airSlate SignNow for my PREMISES LIABILITY INSURANCE APPLICATION?

Using airSlate SignNow for your PREMISES LIABILITY INSURANCE APPLICATION provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. Our platform allows you to eSign documents from anywhere, making it convenient to manage your insurance applications on the go.

-

Can I integrate airSlate SignNow with other tools for my PREMISES LIABILITY INSURANCE APPLICATION?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications, allowing you to streamline your workflow when handling your PREMISES LIABILITY INSURANCE APPLICATION. This integration capability enhances productivity and ensures that all your documents are connected and easily accessible.

-

How secure is my data when using airSlate SignNow for my PREMISES LIABILITY INSURANCE APPLICATION?

Security is a top priority at airSlate SignNow. When you use our platform for your PREMISES LIABILITY INSURANCE APPLICATION, your data is protected with advanced encryption and secure cloud storage, ensuring that your sensitive information remains confidential and safe from unauthorized access.

Get more for PREMISES LIABILITY INSURANCE APPLICATION

- District court denver county state of colorado 1437 form

- District court adams county state of colorado court form

- Request to access pleadings or documents in the colorado form

- Flood zone statement and authorization form

- As set forth in all closing form

- Documents relative to the property located at address form

- County of state of colorado and described as form

- We are the sole owners of the real estate and improvements quotpropertyquot located form

Find out other PREMISES LIABILITY INSURANCE APPLICATION

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast