New York Life Survivorship Variable Universal Life Accumulator, Form

What is the New York Life Survivorship Variable Universal Life Accumulator

The New York Life Survivorship Variable Universal Life Accumulator is a life insurance product designed for couples. It combines the features of variable universal life insurance with survivorship benefits, meaning the policy pays out upon the death of the second insured individual. This type of policy allows for flexible premium payments and investment options, enabling policyholders to grow their cash value over time. It is particularly beneficial for estate planning, as it can provide liquidity to cover estate taxes or other expenses upon the passing of both insured parties.

How to use the New York Life Survivorship Variable Universal Life Accumulator

Using the New York Life Survivorship Variable Universal Life Accumulator involves several key steps. First, individuals should assess their financial goals and determine how much coverage they need. Next, they can select investment options that align with their risk tolerance and financial objectives. Premium payments can be adjusted based on the policyholder's financial situation, allowing for flexibility. Additionally, policyholders can access the cash value through loans or withdrawals, providing financial support when needed. Regularly reviewing the policy ensures it continues to meet evolving needs.

Key elements of the New York Life Survivorship Variable Universal Life Accumulator

This policy includes several important features. It offers flexible premium payments, allowing policyholders to adjust their contributions based on financial circumstances. The cash value grows based on the performance of selected investment options, which can include stocks, bonds, or mutual funds. The policy also provides a death benefit that is paid out tax-free to beneficiaries. Furthermore, it includes options for riders that can enhance coverage, such as accelerated death benefits or long-term care riders, providing additional security for policyholders.

Eligibility Criteria

Eligibility for the New York Life Survivorship Variable Universal Life Accumulator typically requires both applicants to be of insurable age and in good health. Insurers may assess medical history, lifestyle factors, and financial stability during the application process. Generally, couples looking to secure their financial future and provide for their heirs are ideal candidates. It is advisable to consult with a financial advisor or insurance agent to understand specific eligibility requirements and how they may vary based on individual circumstances.

Application Process & Approval Time

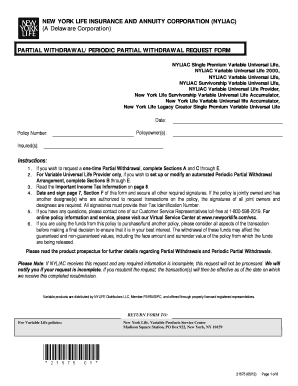

The application process for the New York Life Survivorship Variable Universal Life Accumulator involves several steps. Applicants must complete an application form, providing personal information and details about their health history. After submission, the insurer will conduct a review, which may include medical examinations or additional documentation. The approval time can vary, typically ranging from a few weeks to a couple of months, depending on the complexity of the application and the insurer's requirements. Maintaining open communication with the insurance agent can help expedite the process.

Examples of using the New York Life Survivorship Variable Universal Life Accumulator

One common use of the New York Life Survivorship Variable Universal Life Accumulator is for estate planning. For instance, a couple may purchase this policy to ensure that their heirs have the necessary funds to cover estate taxes upon their passing. Another example could involve a business partnership where the policy provides liquidity to ensure the business can continue operating smoothly after the death of both partners. Additionally, families may use the policy's cash value for educational expenses or retirement funding, showcasing its versatility in financial planning.

Quick guide on how to complete new york life survivorship variable universal life accumulator

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, amend, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and eSign [SKS] without any hassle

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal significance as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to New York Life Survivorship Variable Universal Life Accumulator,

Create this form in 5 minutes!

How to create an eSignature for the new york life survivorship variable universal life accumulator

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York Life Survivorship Variable Universal Life Accumulator?

The New York Life Survivorship Variable Universal Life Accumulator is a flexible life insurance policy designed to provide coverage for two individuals. It accumulates cash value over time, allowing policyholders to benefit from investment options while ensuring financial protection for their beneficiaries.

-

How does the pricing work for the New York Life Survivorship Variable Universal Life Accumulator?

Pricing for the New York Life Survivorship Variable Universal Life Accumulator varies based on factors such as age, health, and coverage amount. It's essential to consult with a licensed agent to get a personalized quote that reflects your specific needs and financial goals.

-

What are the key features of the New York Life Survivorship Variable Universal Life Accumulator?

Key features of the New York Life Survivorship Variable Universal Life Accumulator include flexible premium payments, investment options for cash value growth, and the ability to adjust death benefits. This policy is designed to adapt to your changing financial situation over time.

-

What benefits does the New York Life Survivorship Variable Universal Life Accumulator offer?

The New York Life Survivorship Variable Universal Life Accumulator offers several benefits, including tax-deferred cash value growth and the ability to provide financial security for loved ones. Additionally, it can serve as an estate planning tool, helping to cover estate taxes and other expenses.

-

Can I customize my New York Life Survivorship Variable Universal Life Accumulator policy?

Yes, the New York Life Survivorship Variable Universal Life Accumulator allows for customization based on your financial goals. You can choose different investment options, adjust premium payments, and modify death benefits to suit your unique situation.

-

How does the New York Life Survivorship Variable Universal Life Accumulator integrate with other financial products?

The New York Life Survivorship Variable Universal Life Accumulator can integrate seamlessly with other financial products, such as retirement accounts and investment portfolios. This integration helps create a comprehensive financial strategy that addresses both insurance needs and investment growth.

-

What happens to the cash value in the New York Life Survivorship Variable Universal Life Accumulator?

The cash value in the New York Life Survivorship Variable Universal Life Accumulator grows over time based on the performance of selected investment options. Policyholders can access this cash value through loans or withdrawals, providing flexibility in managing their financial needs.

Get more for New York Life Survivorship Variable Universal Life Accumulator,

- Faq the levoritz law group form

- Based on child support andor maintenance orders form

- Notice of change regarding contact information co courts

- In re petitioner respondentco petitioner court use only form

- The union of form

- Verification and acknowledgement form

- Judgment pursuant to 14 10 122 c form

- Court to execute necessary documents to transfer title pursuant to c form

Find out other New York Life Survivorship Variable Universal Life Accumulator,

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free