Self Help Garnishment of Wages Forms 2022-2026

Understanding the Self Help Garnishment of Wages Forms

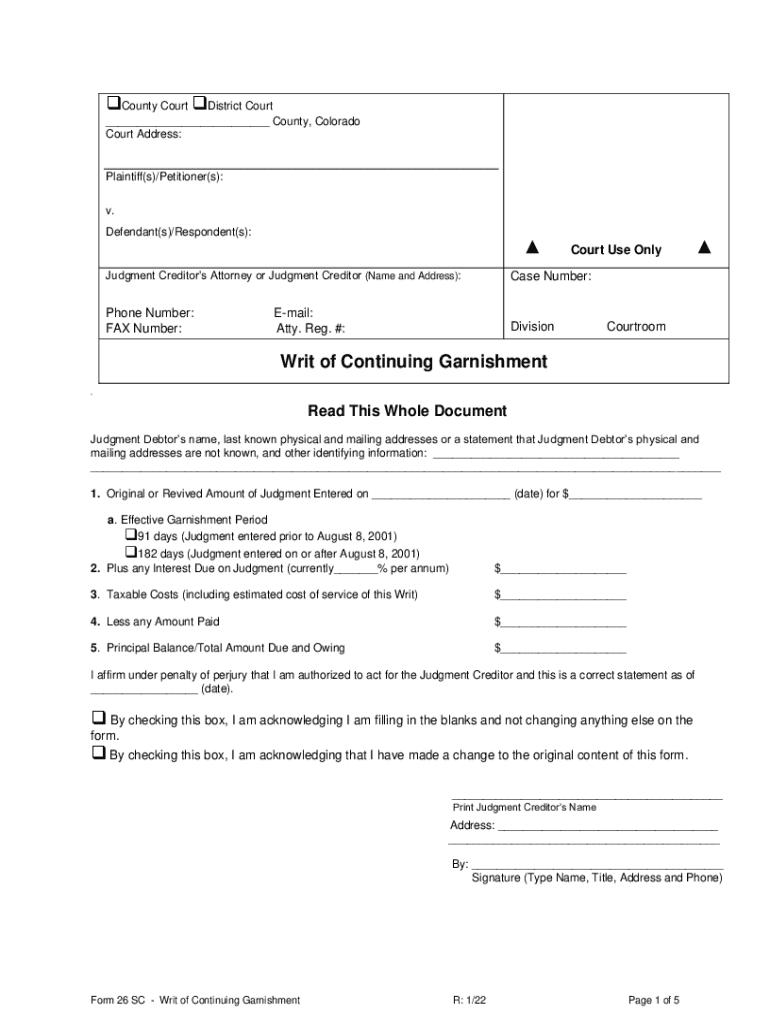

The Self Help Garnishment of Wages forms are legal documents used to initiate the garnishment process for unpaid debts. These forms allow creditors to collect owed amounts directly from a debtor's wages. The forms typically require information about the creditor, debtor, and the amount owed. It is essential to understand the legal framework surrounding these forms to ensure compliance with state laws and regulations.

Steps to Complete the Self Help Garnishment of Wages Forms

Completing the Self Help Garnishment of Wages forms involves several key steps:

- Gather necessary information about the debtor, including their employer's details and the amount owed.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate it.

Legal Use of the Self Help Garnishment of Wages Forms

These forms must be used in accordance with state laws governing wage garnishment. Each state has specific regulations regarding the maximum amount that can be garnished and the process creditors must follow. It is crucial for creditors to adhere to these laws to avoid legal repercussions.

Obtaining the Self Help Garnishment of Wages Forms

Self Help Garnishment of Wages forms can typically be obtained from local court websites, legal aid organizations, or state government offices. Some jurisdictions may also provide these forms in downloadable formats online, ensuring easy access for creditors seeking to initiate garnishment proceedings.

State-Specific Rules for the Self Help Garnishment of Wages Forms

Each state has unique rules regarding the garnishment process. This includes variations in the forms required, filing procedures, and the amount that can be garnished from a debtor's wages. It is important for creditors to familiarize themselves with their state's specific regulations to ensure compliance and effectiveness in the garnishment process.

Penalties for Non-Compliance

Failure to comply with the legal requirements when using the Self Help Garnishment of Wages forms can lead to significant penalties. Creditors may face legal challenges, including lawsuits or fines, if they do not adhere to state laws. Understanding these potential consequences is essential for any creditor looking to pursue wage garnishment.

Quick guide on how to complete self help garnishment of wages forms

Prepare Self Help Garnishment Of Wages Forms effortlessly on any device

The management of online documents has gained traction among businesses and individuals alike. It serves as a flawless eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Manage Self Help Garnishment Of Wages Forms on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to modify and eSign Self Help Garnishment Of Wages Forms with ease

- Locate Self Help Garnishment Of Wages Forms and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet signature.

- Review the details and click on the Done button to apply your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced paperwork, tedious browsing of forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and eSign Self Help Garnishment Of Wages Forms and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct self help garnishment of wages forms

Create this form in 5 minutes!

How to create an eSignature for the self help garnishment of wages forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CO Form 26 SC and how can airSlate SignNow help?

CO Form 26 SC is a crucial document for businesses that need to comply with specific regulatory requirements. airSlate SignNow simplifies the process of sending and eSigning CO Form 26 SC, ensuring that your documents are handled efficiently and securely.

-

What features does airSlate SignNow offer for CO Form 26 SC?

airSlate SignNow provides a range of features for CO Form 26 SC, including customizable templates, real-time tracking, and secure cloud storage. These features enhance the efficiency of document management and ensure compliance with legal standards.

-

How much does it cost to use airSlate SignNow for CO Form 26 SC?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while ensuring you have all the necessary tools to manage CO Form 26 SC effectively.

-

Can I integrate airSlate SignNow with other software for CO Form 26 SC?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to streamline your workflow for CO Form 26 SC. This integration helps in automating processes and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for CO Form 26 SC?

Using airSlate SignNow for CO Form 26 SC offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. These advantages help businesses focus on their core operations while ensuring compliance.

-

Is airSlate SignNow user-friendly for managing CO Form 26 SC?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage CO Form 26 SC. The intuitive interface allows users to navigate the platform effortlessly, even without prior experience.

-

How does airSlate SignNow ensure the security of CO Form 26 SC?

airSlate SignNow prioritizes security by implementing advanced encryption and authentication measures for CO Form 26 SC. This ensures that your sensitive documents are protected from unauthorized access and bsignNowes.

Get more for Self Help Garnishment Of Wages Forms

Find out other Self Help Garnishment Of Wages Forms

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online