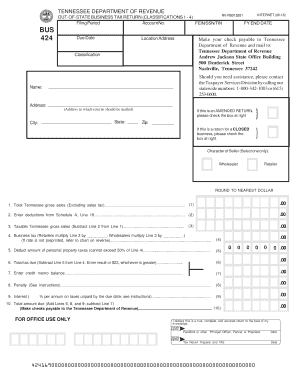

Tn Bus 424 Form

What is the TN Bus 424?

The TN Bus 424 is the official form used for filing the Tennessee business tax return. It is essential for businesses operating within the state to report their income and calculate their tax obligations accurately. This form is designed for various business entities, including corporations, partnerships, and limited liability companies (LLCs). Understanding the TN Bus 424 is crucial for compliance with state tax regulations and for ensuring that businesses meet their financial responsibilities.

Steps to Complete the TN Bus 424

Completing the TN Bus 424 involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the form accurately, ensuring all sections are completed, including business identification information and financial data.

- Calculate the total tax due based on the reported income and applicable tax rates.

- Review the completed form for accuracy and completeness before submission.

Taking the time to follow these steps carefully can help prevent errors that may lead to penalties or delays in processing.

Filing Deadlines / Important Dates

It is important for businesses to be aware of the filing deadlines associated with the TN Bus 424. Generally, the form must be filed by the 15th day of the fourth month following the end of the business's fiscal year. For businesses operating on a calendar year, this typically means the form is due on April 15. Missing this deadline can result in penalties and interest on unpaid taxes.

Required Documents

When preparing to file the TN Bus 424, businesses should have several key documents on hand:

- Income statements detailing revenue generated during the tax year.

- Expense reports outlining all business-related expenditures.

- Previous tax returns for reference and consistency.

- Any additional documentation required for specific deductions or credits.

Having these documents readily available can streamline the filing process and ensure accuracy in reporting.

Form Submission Methods

The TN Bus 424 can be submitted through various methods to accommodate different preferences:

- Online: Many businesses choose to file electronically, which can expedite processing times.

- Mail: The completed form can be printed and mailed to the appropriate state tax office.

- In-Person: Businesses may also have the option to submit the form in person at designated tax offices.

Each submission method has its own advantages, and businesses should choose the one that best fits their needs.

Penalties for Non-Compliance

Failing to file the TN Bus 424 or submitting it late can lead to significant penalties. These may include:

- Late filing penalties, which can accumulate based on the amount of tax due.

- Interest charges on unpaid taxes, which can increase the total amount owed.

- Potential audits or increased scrutiny from state tax authorities.

Understanding these penalties highlights the importance of timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete tn bus 424

Effortlessly Prepare Tn Bus 424 on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it in the cloud. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and efficiently. Handle Tn Bus 424 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign Tn Bus 424 with Ease

- Obtain Tn Bus 424 and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Mark pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to distribute your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Tn Bus 424 while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tn bus 424

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Tennessee business tax return?

A Tennessee business tax return is a form that businesses operating in Tennessee must file to report their income and calculate their tax liability. This return is essential for compliance with state tax laws and helps ensure that businesses meet their financial obligations.

-

How can airSlate SignNow help with my Tennessee business tax return?

airSlate SignNow simplifies the process of preparing and submitting your Tennessee business tax return by allowing you to easily send and eSign necessary documents. Our platform streamlines document management, making it easier to gather signatures and ensure timely submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to features that can assist with managing your Tennessee business tax return efficiently.

-

What features does airSlate SignNow offer for tax document management?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing your Tennessee business tax return. These tools help ensure that your documents are organized and easily accessible.

-

Is airSlate SignNow compliant with Tennessee tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those related to the Tennessee business tax return. Our platform prioritizes security and compliance, ensuring that your documents are handled according to legal standards.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your Tennessee business tax return alongside your financial records. This integration helps streamline your workflow and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow for your Tennessee business tax return offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our user-friendly platform allows you to focus on your business while we handle the document management.

Get more for Tn Bus 424

Find out other Tn Bus 424

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online