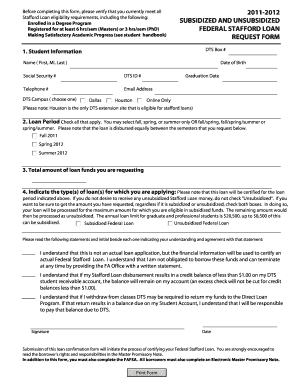

Subsidized and Unsubsidized Federal Stafford Loan Form

What is the Subsidized and Unsubsidized Federal Stafford Loan

The Subsidized and Unsubsidized Federal Stafford Loan is a type of federal student loan designed to help eligible students pay for their education. The subsidized loan is based on financial need, meaning the government pays the interest while the student is enrolled at least half-time, during the grace period, and during deferment periods. In contrast, the unsubsidized loan is available to all students regardless of financial need, but interest begins accruing immediately upon disbursement. Both loans have fixed interest rates and offer flexible repayment options, making them accessible to a wide range of students.

How to Obtain the Subsidized and Unsubsidized Federal Stafford Loan

To obtain a Subsidized or Unsubsidized Federal Stafford Loan, students must complete the Free Application for Federal Student Aid (FAFSA). This application determines eligibility for federal financial aid, including these loans. After submitting the FAFSA, students will receive a Student Aid Report (SAR) detailing their financial aid eligibility. Schools will then provide a financial aid package, which may include Stafford loans. It is essential to review the terms and conditions of the loans offered and accept the loans that best meet the student's needs.

Eligibility Criteria

Eligibility for the Subsidized and Unsubsidized Federal Stafford Loan is primarily based on the student's enrollment status and financial need. To qualify, students must:

- Be a U.S. citizen or eligible non-citizen.

- Be enrolled or accepted for enrollment in an eligible degree or certificate program.

- Maintain satisfactory academic progress in college or career school.

- Complete the FAFSA to determine financial need for subsidized loans.

Unsubsidized loans are available to all eligible students, regardless of financial need.

Steps to Complete the Subsidized and Unsubsidized Federal Stafford Loan

Completing the process for obtaining Stafford loans involves several key steps:

- Complete the FAFSA to determine eligibility for federal student aid.

- Receive the Student Aid Report (SAR) and review the financial aid package from your school.

- Accept the offered Stafford loans through your school's financial aid office.

- Complete entrance counseling to understand the loan terms and repayment options.

- Sign the Master Promissory Note (MPN) to agree to the loan terms.

Key Elements of the Subsidized and Unsubsidized Federal Stafford Loan

Several key elements define the Subsidized and Unsubsidized Federal Stafford Loan:

- Interest Rates: Both loans have fixed interest rates set by the government.

- Loan Limits: There are annual and aggregate loan limits based on the student's year in school and dependency status.

- Repayment Plans: Various repayment plans are available, including standard, graduated, and income-driven options.

- Deferment and Forbearance: Options are available to temporarily postpone payments under certain circumstances.

Examples of Using the Subsidized and Unsubsidized Federal Stafford Loan

Students can use the Subsidized and Unsubsidized Federal Stafford Loan to cover various educational expenses, including:

- Tuition and fees for college or university.

- Room and board for on-campus living.

- Books and supplies necessary for courses.

- Other related educational costs, such as transportation and personal expenses.

These loans provide financial support to help students focus on their studies without the burden of immediate repayment.

Quick guide on how to complete subsidized and unsubsidized federal stafford loan

Effortlessly Prepare [SKS] on Any Device

Digital document management is increasingly embraced by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and safely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without wait. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign [SKS] without hassle

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure confidential information using tools that airSlate SignNow offers for that specific need.

- Create your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Select your preferred method to send your form, whether by email, SMS, invite link, or by downloading it to your computer.

Eliminate the issues of lost or disorganized documents, tedious form searches, or errors that necessitate generating new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign [SKS], ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Subsidized And Unsubsidized Federal Stafford Loan

Create this form in 5 minutes!

How to create an eSignature for the subsidized and unsubsidized federal stafford loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Subsidized And Unsubsidized Federal Stafford Loans?

Subsidized And Unsubsidized Federal Stafford Loans are types of federal student loans designed to help students pay for their education. Subsidized loans are based on financial need, while unsubsidized loans are available to all eligible students regardless of financial need. Understanding the differences can help you make informed decisions about your financing options.

-

How do I apply for Subsidized And Unsubsidized Federal Stafford Loans?

To apply for Subsidized And Unsubsidized Federal Stafford Loans, you need to complete the Free Application for Federal Student Aid (FAFSA). This application will determine your eligibility for federal financial aid, including these loan types. Make sure to submit your FAFSA as early as possible to maximize your funding opportunities.

-

What are the interest rates for Subsidized And Unsubsidized Federal Stafford Loans?

The interest rates for Subsidized And Unsubsidized Federal Stafford Loans are set by the federal government and can vary each academic year. Typically, subsidized loans have lower interest rates compared to unsubsidized loans. It's important to check the current rates when planning your financing.

-

What are the repayment options for Subsidized And Unsubsidized Federal Stafford Loans?

Repayment options for Subsidized And Unsubsidized Federal Stafford Loans include standard, graduated, and income-driven repayment plans. Each option offers different terms and flexibility to suit your financial situation. Understanding these options can help you choose the best plan for your needs.

-

Are there any benefits to choosing Subsidized And Unsubsidized Federal Stafford Loans?

Yes, there are several benefits to choosing Subsidized And Unsubsidized Federal Stafford Loans, including lower interest rates and flexible repayment options. Additionally, subsidized loans do not accrue interest while you are in school, which can save you money in the long run. These loans are a great way to finance your education affordably.

-

Can I consolidate Subsidized And Unsubsidized Federal Stafford Loans?

Yes, you can consolidate Subsidized And Unsubsidized Federal Stafford Loans through a Direct Consolidation Loan. This process combines multiple federal loans into one, simplifying your repayment process. However, be aware that consolidating may affect your interest rates and repayment terms.

-

What happens if I miss a payment on my Subsidized And Unsubsidized Federal Stafford Loans?

If you miss a payment on your Subsidized And Unsubsidized Federal Stafford Loans, it can negatively impact your credit score and lead to additional fees. It's crucial to communicate with your loan servicer if you're having trouble making payments, as they may offer options to help you avoid default. Staying informed about your loans can prevent financial difficulties.

Get more for Subsidized And Unsubsidized Federal Stafford Loan

- Mississippi plain language model jury instructions civil form

- Federal civil jury instructions of the seventh circuit form

- Trial processjackson county ms form

- Should you find for the plaintiff in this case return a verdict against all of the defendants form

- Jury instruction no form

- Should you return a verdict for the plaintiff and against both defendants in this cause form

- United states proposed jury instructionsatrdepartment form

- Mississippi rules of evidence mississippi supreme court form

Find out other Subsidized And Unsubsidized Federal Stafford Loan

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application