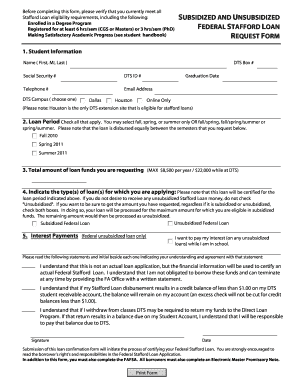

SUBSIDIZED and UNSUBSIDIZED FEDERAL STAFFORD LOAN Form

What is the subsidized and unsubsidized federal Stafford loan

The subsidized and unsubsidized federal Stafford loan is a type of federal student loan designed to help students finance their education. These loans are available to both undergraduate and graduate students. The key difference between the two types lies in the interest payment responsibility. For subsidized loans, the federal government pays the interest while the student is in school, during the grace period, and during deferment periods. Unsubsidized loans, on the other hand, accrue interest from the moment they are disbursed, and the borrower is responsible for all interest payments.

Eligibility criteria for the subsidized and unsubsidized federal Stafford loan

To qualify for a subsidized Stafford loan, students must demonstrate financial need, as determined by the Free Application for Federal Student Aid (FAFSA). Eligibility for unsubsidized loans does not require financial need, making them accessible to a broader range of students. Both types of loans require students to be enrolled at least half-time in an eligible degree or certificate program at a participating institution.

Application process and approval time

The application process for both subsidized and unsubsidized Stafford loans begins with completing the FAFSA. Once submitted, the school will determine the student's eligibility and the amount they can borrow. Approval times can vary, but students typically receive a financial aid offer within a few weeks after submitting their FAFSA. It is important to keep track of deadlines and ensure all required documentation is submitted promptly to avoid delays.

Key elements of the subsidized and unsubsidized federal Stafford loan

Key elements of these loans include interest rates, repayment terms, and loan limits. Interest rates for federal Stafford loans are fixed, making them predictable for borrowers. Loan limits vary based on the student's year in school and dependency status. Additionally, repayment typically begins six months after graduation, leaving school, or dropping below half-time enrollment. Understanding these elements is crucial for effective financial planning.

Steps to complete the subsidized and unsubsidized federal Stafford loan

Completing the Stafford loan process involves several steps:

- Complete the FAFSA to determine eligibility.

- Review the financial aid offer from your school.

- Accept the loan amount you wish to borrow.

- Complete entrance counseling to understand your responsibilities.

- Sign the Master Promissory Note (MPN) to agree to the loan terms.

Legal use of the subsidized and unsubsidized federal Stafford loan

Both types of Stafford loans must be used for eligible educational expenses, which include tuition, fees, room and board, and other necessary costs associated with attending school. Misuse of loan funds can lead to penalties, including loan repayment demands or loss of eligibility for future federal student aid. It is essential for borrowers to keep accurate records of how loan funds are spent to ensure compliance with federal regulations.

Quick guide on how to complete subsidized and unsubsidized federal stafford loan 12174095

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly option to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Use the tools we offer to complete your form.

- Select important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that aim.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign [SKS] and maintain effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SUBSIDIZED AND UNSUBSIDIZED FEDERAL STAFFORD LOAN

Create this form in 5 minutes!

How to create an eSignature for the subsidized and unsubsidized federal stafford loan 12174095

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the main differences between subsidized and unsubsidized federal Stafford loans?

The primary difference between subsidized and unsubsidized federal Stafford loans lies in the interest rates and repayment terms. Subsidized loans are need-based and do not accrue interest while you are in school, whereas unsubsidized loans begin accruing interest immediately. Understanding these differences is crucial for managing your finances effectively.

-

How can I apply for subsidized and unsubsidized federal Stafford loans?

To apply for subsidized and unsubsidized federal Stafford loans, you must complete the Free Application for Federal Student Aid (FAFSA). This application determines your eligibility for federal financial aid, including both types of Stafford loans. Make sure to submit your FAFSA early to maximize your funding opportunities.

-

What are the eligibility requirements for subsidized and unsubsidized federal Stafford loans?

Eligibility for subsidized and unsubsidized federal Stafford loans generally requires you to be enrolled at least half-time in an eligible degree program. Additionally, you must demonstrate financial need for subsidized loans, while unsubsidized loans are available regardless of financial need. Always check with your school's financial aid office for specific requirements.

-

What are the interest rates for subsidized and unsubsidized federal Stafford loans?

Interest rates for subsidized and unsubsidized federal Stafford loans are set by the federal government and can vary each academic year. As of the latest updates, subsidized loans typically have lower interest rates compared to unsubsidized loans. It's important to stay informed about current rates to make the best financial decisions.

-

What are the repayment options for subsidized and unsubsidized federal Stafford loans?

Repayment options for subsidized and unsubsidized federal Stafford loans include standard, graduated, and income-driven repayment plans. Borrowers can choose a plan that best fits their financial situation. Understanding these options can help you manage your loan payments effectively after graduation.

-

Can I consolidate my subsidized and unsubsidized federal Stafford loans?

Yes, you can consolidate your subsidized and unsubsidized federal Stafford loans through a Direct Consolidation Loan. This process combines multiple federal loans into a single loan with one monthly payment. Consolidation can simplify your repayment process, but it's important to consider the implications on interest rates and loan benefits.

-

What are the benefits of choosing subsidized over unsubsidized federal Stafford loans?

The main benefit of choosing subsidized federal Stafford loans is that they do not accrue interest while you are in school, which can save you money in the long run. Additionally, subsidized loans often have more favorable repayment terms. If you qualify based on financial need, opting for subsidized loans can signNowly reduce your overall debt burden.

Get more for SUBSIDIZED AND UNSUBSIDIZED FEDERAL STAFFORD LOAN

- Aclu appeals case of georgia woman fired for getting her form

- Joint motion for judgment of dismissal with prejudice form

- Title 2 classification administration ampamp personnelcity of form

- Eldorado valley transfer area deed iis windows server form

- Complaint to establish easement form

- Development code form based codes institute

- Deed of dedication final city of diamondhead form

- Right of way instrument form

Find out other SUBSIDIZED AND UNSUBSIDIZED FEDERAL STAFFORD LOAN

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast