EmployeeIndependent Contract Classification Checklist the Form

What is the Employee Independent Contract Classification Checklist

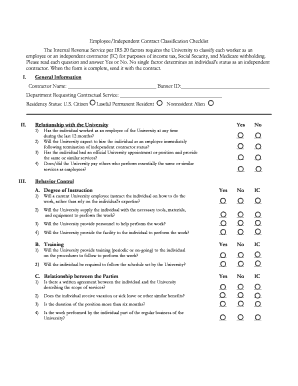

The Employee Independent Contract Classification Checklist is a vital tool used by businesses to determine the proper classification of workers. This checklist helps differentiate between employees and independent contractors based on various criteria, including the nature of the work relationship, control over work, and financial arrangements. Misclassification can lead to significant legal and financial consequences, making this checklist essential for compliance with labor laws.

How to use the Employee Independent Contract Classification Checklist

To effectively use the Employee Independent Contract Classification Checklist, businesses should follow a systematic approach. Begin by gathering relevant information about the worker, including the nature of their tasks, payment structure, and working conditions. Next, review each item on the checklist, which typically includes questions about the degree of control the business has over the worker, the worker's independence in completing tasks, and the financial aspects of the relationship. After completing the checklist, assess the results to determine the appropriate classification.

Key elements of the Employee Independent Contract Classification Checklist

Several key elements are critical in the Employee Independent Contract Classification Checklist. These include:

- Control: Assess how much control the business has over the worker's tasks and schedule.

- Independence: Evaluate the worker's ability to operate independently and make decisions regarding their work.

- Financial aspects: Consider how the worker is compensated and whether they incur business expenses.

- Relationship nature: Determine the permanence of the relationship and whether any benefits are provided.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that help clarify the classification of workers. According to the IRS, the determination hinges on three main categories: behavioral control, financial control, and the relationship of the parties. Understanding these guidelines is crucial for businesses to ensure compliance and avoid penalties associated with misclassification.

Penalties for Non-Compliance

Failure to properly classify workers can result in severe penalties for businesses. These may include back taxes, fines, and potential legal action from misclassified workers. Additionally, businesses may face increased scrutiny from the IRS and state agencies, leading to audits and further complications. It is essential for employers to take the Employee Independent Contract Classification Checklist seriously to mitigate these risks.

State-specific rules for the Employee Independent Contract Classification Checklist

Different states may have specific rules and regulations regarding worker classification. For example, some states have stricter criteria for defining independent contractors, which can differ from federal guidelines. Employers should be aware of their state’s regulations to ensure compliance and avoid potential legal issues. Consulting with legal professionals familiar with state laws can provide valuable insights into these requirements.

Quick guide on how to complete employeeindependent contract classification checklist the

Complete [SKS] effortlessly on any device

Online document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that function.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employeeindependent contract classification checklist the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EmployeeIndependent Contract Classification Checklist The?

The EmployeeIndependent Contract Classification Checklist The is a comprehensive tool designed to help businesses accurately classify their workers as employees or independent contractors. This checklist ensures compliance with legal standards and helps avoid costly misclassification penalties.

-

How can the EmployeeIndependent Contract Classification Checklist The benefit my business?

Using the EmployeeIndependent Contract Classification Checklist The can streamline your hiring process and reduce legal risks. By ensuring proper classification, you can save on taxes and avoid potential lawsuits related to misclassification.

-

Is the EmployeeIndependent Contract Classification Checklist The easy to use?

Yes, the EmployeeIndependent Contract Classification Checklist The is designed to be user-friendly and straightforward. With clear guidelines and a step-by-step approach, businesses can easily navigate the classification process without confusion.

-

What features does the EmployeeIndependent Contract Classification Checklist The offer?

The EmployeeIndependent Contract Classification Checklist The includes features such as customizable templates, automated workflows, and compliance tracking. These features help ensure that your classification process is efficient and meets all necessary legal requirements.

-

Can I integrate the EmployeeIndependent Contract Classification Checklist The with other tools?

Absolutely! The EmployeeIndependent Contract Classification Checklist The can be integrated with various HR and payroll systems, enhancing your existing workflows. This integration allows for seamless data transfer and improved efficiency in managing employee classifications.

-

What is the pricing structure for the EmployeeIndependent Contract Classification Checklist The?

The pricing for the EmployeeIndependent Contract Classification Checklist The is competitive and designed to fit various business budgets. We offer flexible plans that cater to different needs, ensuring that you only pay for what you require.

-

How does the EmployeeIndependent Contract Classification Checklist The ensure compliance?

The EmployeeIndependent Contract Classification Checklist The is regularly updated to reflect the latest legal standards and regulations. This ensures that your business remains compliant with federal and state laws regarding worker classification.

Get more for EmployeeIndependent Contract Classification Checklist The

- Section 30037 case file creation and indexing of claims that form

- Notice of treatment issues disputed bill issues forms

- Notice of treatment issuesdisputed bill issues workers form

- Justia notice to chair of carriers action on claim for benefits form

- Nys workers compensation board an albany new york form

- Workers compensation board yelp form

- Southern tier officenysedc new york state economic form

- Your guide to small claims ampampamp commercial small claims in form

Find out other EmployeeIndependent Contract Classification Checklist The

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast