P a YROLL Etsu Form

What is the P A YROLL Etsu

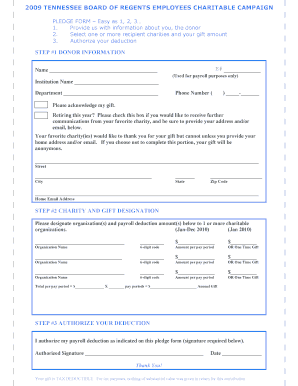

The P A YROLL Etsu is a specific payroll form used by employers to report wages and tax information for employees. This form is essential for ensuring compliance with federal and state payroll regulations. It captures critical data such as employee earnings, tax withholdings, and contributions to benefits. Understanding this form is vital for businesses to accurately manage payroll processes and fulfill their tax obligations.

How to use the P A YROLL Etsu

Using the P A YROLL Etsu involves several steps to ensure accurate reporting. Employers need to gather necessary employee information, including Social Security numbers, wages paid, and tax withholdings. Once the information is collected, it can be entered into the form, either digitally or on paper. After completing the form, employers must submit it to the appropriate tax authorities, following the specific guidelines for filing.

Steps to complete the P A YROLL Etsu

Completing the P A YROLL Etsu requires careful attention to detail. Here are the steps involved:

- Gather employee information, including names, addresses, and Social Security numbers.

- Calculate total wages paid to each employee during the reporting period.

- Determine the appropriate tax withholdings based on current tax rates.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the relevant tax authority by the specified deadline.

Legal use of the P A YROLL Etsu

The P A YROLL Etsu must be used in compliance with federal and state laws governing payroll reporting. Employers are legally required to report employee wages and tax withholdings accurately. Failure to do so can result in penalties and fines. It is important for businesses to stay informed about any changes in payroll regulations to ensure ongoing compliance.

Key elements of the P A YROLL Etsu

Key elements of the P A YROLL Etsu include:

- Employee identification details, such as name and Social Security number.

- Total wages earned by the employee during the reporting period.

- Federal and state tax withholdings.

- Contributions to retirement plans and other benefits.

- Employer identification number (EIN) for tax reporting purposes.

Filing Deadlines / Important Dates

Filing deadlines for the P A YROLL Etsu are critical for compliance. Employers must be aware of the specific dates for submission to avoid penalties. Typically, forms are due on a quarterly or annual basis, depending on the reporting requirements. It is advisable to maintain a calendar of these important dates to ensure timely filing.

Quick guide on how to complete p a yroll etsu

Effortlessly Create [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign [SKS] effortlessly

- Find [SKS] and click on Obtain Form to begin.

- Utilize the tools at your disposal to complete your document.

- Mark signNow sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Finish button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure smooth communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to P A YROLL Etsu

Create this form in 5 minutes!

How to create an eSignature for the p a yroll etsu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is P A YROLL Etsu and how does it work?

P A YROLL Etsu is a comprehensive payroll management solution designed to streamline your payroll processes. It allows businesses to automate calculations, manage employee data, and ensure compliance with tax regulations. By integrating P A YROLL Etsu, you can save time and reduce errors in your payroll operations.

-

What features does P A YROLL Etsu offer?

P A YROLL Etsu includes features such as automated payroll calculations, tax management, and employee self-service portals. Additionally, it provides customizable reporting tools to help you analyze payroll data effectively. These features make P A YROLL Etsu a powerful tool for managing your payroll needs.

-

How much does P A YROLL Etsu cost?

The pricing for P A YROLL Etsu varies based on the size of your business and the specific features you require. Typically, it offers flexible pricing plans that cater to different budgets. For a detailed quote, it's best to contact our sales team to discuss your unique needs.

-

Can P A YROLL Etsu integrate with other software?

Yes, P A YROLL Etsu is designed to integrate seamlessly with various accounting and HR software. This integration allows for a smooth flow of data between systems, enhancing efficiency and reducing manual entry. You can easily connect P A YROLL Etsu with your existing tools to optimize your payroll processes.

-

What are the benefits of using P A YROLL Etsu?

Using P A YROLL Etsu can signNowly reduce the time spent on payroll processing and minimize errors. It enhances compliance with tax regulations and provides employees with easy access to their payroll information. Overall, P A YROLL Etsu helps businesses operate more efficiently and effectively.

-

Is P A YROLL Etsu suitable for small businesses?

Absolutely! P A YROLL Etsu is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective solutions make it an ideal choice for small business owners looking to simplify their payroll management.

-

How secure is P A YROLL Etsu?

P A YROLL Etsu prioritizes the security of your payroll data by implementing robust encryption and security protocols. Regular updates and compliance with industry standards ensure that your sensitive information is protected. You can trust P A YROLL Etsu to keep your payroll data safe and secure.

Get more for P A YROLL Etsu

- Hi do 11 instructions when should this form be used both parties

- State of south carolina in the family court judicial form

- State of south carolina county of greenwood in the court form

- Fillable online angelinacad request for hearing evidence form

- Review of the report by the commission on form

- Certificate of exemption civil ampamp family adr form

- Guarantor shall deliver any payments to the lessor at the following address form

- Being submitted to landlord form

Find out other P A YROLL Etsu

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free