Tiers 3, 4, 5 & 6 Loan Application for Members Covered by Articles 14, 15 or 22 RS5025 a for NYSLRS Tier 3, 4, 5 & 6 Mem Form

Understanding the Tiers 3, 4, 5 & 6 Loan Application

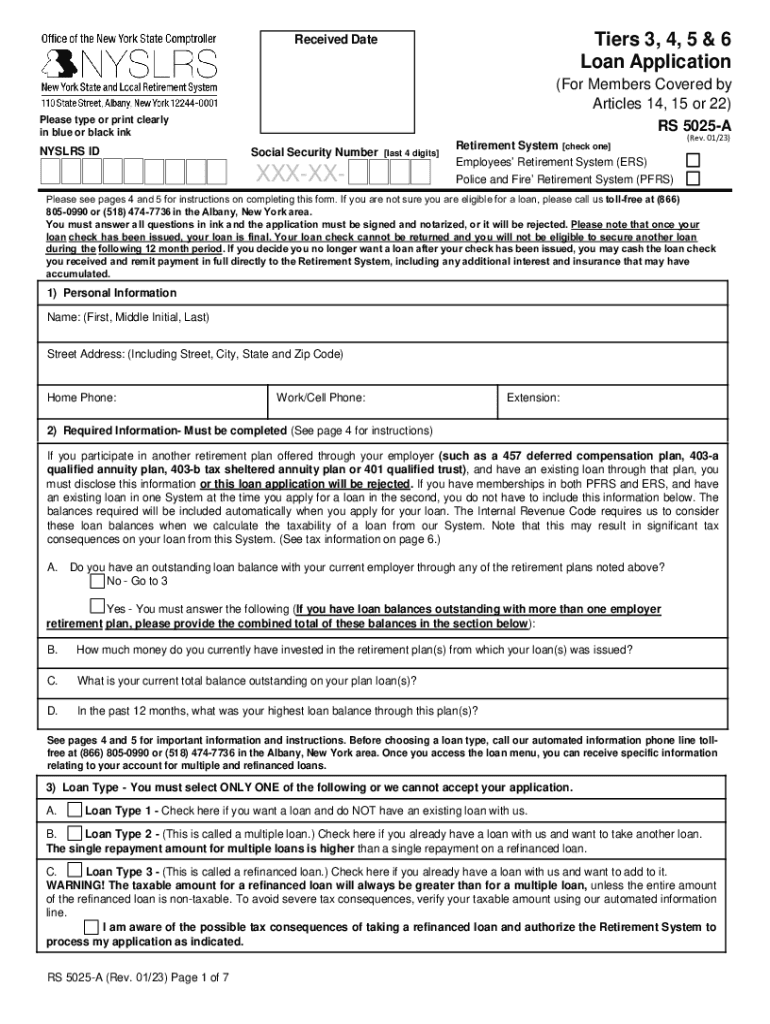

The Tiers 3, 4, 5, and 6 loan application is specifically designed for members of the New York State and Local Retirement System (NYSLRS) covered by Articles 14, 15, or 22. This application allows eligible members to request a loan against their retirement savings. It is essential for members to understand the purpose of this application, as it provides access to funds while still maintaining their retirement benefits.

Steps to Complete the Tiers 3, 4, 5 & 6 Loan Application

Completing the loan application involves several key steps to ensure accuracy and compliance. Members should:

- Gather necessary personal and employment information.

- Complete the application form, ensuring all sections are filled out correctly.

- Review the application for any errors or missing information.

- Submit the application via the designated method, whether online or by mail.

Following these steps carefully can help facilitate a smoother approval process.

Eligibility Criteria for the Loan Application

To qualify for the Tiers 3, 4, 5, and 6 loan application, members must meet specific eligibility requirements. These typically include:

- Being a member of NYSLRS under Tiers 3, 4, 5, or 6.

- Having a minimum balance in their retirement account.

- Meeting any additional criteria set forth by NYSLRS.

Understanding these criteria is crucial for members to determine their eligibility before applying.

Required Documents for the Loan Application

Members must provide certain documents when submitting the loan application. Commonly required documents include:

- Proof of identity, such as a government-issued ID.

- Documentation of employment status.

- Any additional forms or information requested by NYSLRS.

Having these documents ready can expedite the application process and reduce delays.

Form Submission Methods

Members have several options for submitting the Tiers 3, 4, 5, and 6 loan application. These methods typically include:

- Online submission through the NYSLRS website.

- Mailing the completed application to the appropriate NYSLRS office.

- In-person submission at designated locations.

Choosing the right submission method can enhance the efficiency of the application process.

Key Elements of the Loan Application

The loan application contains several key elements that members should be aware of, including:

- The member's personal information and retirement tier.

- The loan amount requested and repayment terms.

- Signature and date fields to validate the application.

Understanding these elements ensures that members complete the application accurately and comprehensively.

Quick guide on how to complete tiers 3 4 5 amp 6 loan application for members covered by articles 14 15 or 22 rs5025 a for nyslrs tier 3 4 5 amp 6 members

Complete Tiers 3, 4, 5 & 6 Loan Application For Members Covered By Articles 14, 15 Or 22 RS5025 A For NYSLRS Tier 3, 4, 5 & 6 Mem effortlessly on any device

Digital document management has become desirable for businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents rapidly without interruptions. Manage Tiers 3, 4, 5 & 6 Loan Application For Members Covered By Articles 14, 15 Or 22 RS5025 A For NYSLRS Tier 3, 4, 5 & 6 Mem on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented function today.

How to edit and eSign Tiers 3, 4, 5 & 6 Loan Application For Members Covered By Articles 14, 15 Or 22 RS5025 A For NYSLRS Tier 3, 4, 5 & 6 Mem with ease

- Obtain Tiers 3, 4, 5 & 6 Loan Application For Members Covered By Articles 14, 15 Or 22 RS5025 A For NYSLRS Tier 3, 4, 5 & 6 Mem and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tiers 3, 4, 5 & 6 Loan Application For Members Covered By Articles 14, 15 Or 22 RS5025 A For NYSLRS Tier 3, 4, 5 & 6 Mem and ensure outstanding communication at any step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tiers 3 4 5 amp 6 loan application for members covered by articles 14 15 or 22 rs5025 a for nyslrs tier 3 4 5 amp 6 members

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nys retirement loan application process?

The nys retirement loan application process involves submitting a completed application form along with any required documentation. Once submitted, your application will be reviewed for eligibility. airSlate SignNow simplifies this process by allowing you to eSign and send your documents securely and efficiently.

-

How much does the nys retirement loan application cost?

The cost associated with the nys retirement loan application can vary based on the specific loan amount and terms. However, using airSlate SignNow can help reduce costs by streamlining the application process and minimizing paperwork. Our platform offers a cost-effective solution for managing your documents.

-

What features does airSlate SignNow offer for the nys retirement loan application?

airSlate SignNow offers features such as eSigning, document templates, and secure cloud storage to facilitate the nys retirement loan application. These features ensure that your documents are handled efficiently and securely. Additionally, our user-friendly interface makes it easy to navigate the application process.

-

What are the benefits of using airSlate SignNow for the nys retirement loan application?

Using airSlate SignNow for the nys retirement loan application provides numerous benefits, including faster processing times and enhanced security. Our platform allows you to track the status of your application in real-time, ensuring you stay informed throughout the process. This efficiency can lead to quicker access to your retirement funds.

-

Can I integrate airSlate SignNow with other tools for the nys retirement loan application?

Yes, airSlate SignNow offers integrations with various tools and platforms to enhance your nys retirement loan application experience. You can connect with CRM systems, cloud storage services, and more to streamline your workflow. This flexibility allows you to manage your documents more effectively.

-

Is airSlate SignNow secure for submitting the nys retirement loan application?

Absolutely! airSlate SignNow prioritizes security, ensuring that your nys retirement loan application and personal information are protected. We utilize advanced encryption and secure servers to safeguard your data. You can trust that your documents are safe with us.

-

How can I track my nys retirement loan application status with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your nys retirement loan application through our platform. You will receive notifications when your documents are viewed or signed, keeping you updated throughout the process. This feature enhances transparency and helps you stay informed.

Get more for Tiers 3, 4, 5 & 6 Loan Application For Members Covered By Articles 14, 15 Or 22 RS5025 A For NYSLRS Tier 3, 4, 5 & 6 Mem

- Idaho ged age waiver form

- Modal verbs exercises pdf form

- Mechanical permit application city of lacey form

- Ubh asd aba assessment request form provider express

- Bazaar registration form

- La valley college transcripts form

- Substitution of trustee and full reconveyance state of california slocounty ca form

- Principia college new international students application for financial aid this form is required if you intend to apply for

Find out other Tiers 3, 4, 5 & 6 Loan Application For Members Covered By Articles 14, 15 Or 22 RS5025 A For NYSLRS Tier 3, 4, 5 & 6 Mem

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form