Rtso1 2023

What is the Rtso1

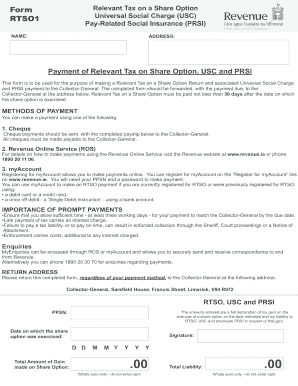

The Rtso1 is a specific form utilized in various administrative processes, primarily focusing on compliance and reporting requirements. This form is designed to collect essential information needed by regulatory bodies, ensuring that individuals or businesses meet their legal obligations. The Rtso1 is particularly relevant for those involved in specific industries or activities that require formal documentation for transparency and accountability.

How to use the Rtso1

Using the Rtso1 involves several straightforward steps. First, gather all necessary information and documents required to complete the form. This may include personal identification, business details, or financial records, depending on the context in which the form is used. Next, fill out the form accurately, ensuring that all sections are completed to avoid delays. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person.

Steps to complete the Rtso1

Completing the Rtso1 requires careful attention to detail. Follow these steps for a successful submission:

- Review the form to understand all required fields.

- Collect supporting documents that may be necessary for completion.

- Fill out the form, ensuring all information is accurate and up to date.

- Double-check for any errors or omissions before submission.

- Submit the form through the designated method, ensuring it is sent to the correct address or online portal.

Legal use of the Rtso1

The legal use of the Rtso1 is paramount for compliance with federal and state regulations. It serves as a formal declaration or request that must be filed within specific timeframes to avoid penalties. Understanding the legal implications of this form is crucial for individuals and businesses, as improper use or failure to submit can result in legal consequences.

Required Documents

To successfully complete the Rtso1, certain documents are typically required. These may include:

- Identification documents, such as a driver's license or social security number.

- Business registration information, if applicable.

- Financial statements or tax records relevant to the information being reported.

- Any additional documentation specified in the instructions for the Rtso1.

Form Submission Methods

The Rtso1 can be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online submission via a designated portal.

- Mailing a physical copy to the appropriate agency.

- In-person submission at specified locations, if required.

IRS Guidelines

When dealing with the Rtso1, it is important to adhere to IRS guidelines that govern its use. These guidelines outline the necessary procedures for completing the form, deadlines for submission, and the consequences of non-compliance. Familiarizing oneself with these regulations can help ensure that all requirements are met and that the form is used correctly.

Quick guide on how to complete rtso1

Handle Rtso1 smoothly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any holdups. Manage Rtso1 on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to alter and electronically sign Rtso1 with ease

- Obtain Rtso1 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Rtso1 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rtso1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rtso1 and how does it relate to airSlate SignNow?

rtso1 is a key feature of airSlate SignNow that enhances document signing and management processes. It allows users to streamline their workflows, ensuring that documents are signed quickly and efficiently. By utilizing rtso1, businesses can improve their overall productivity and reduce turnaround times.

-

How much does airSlate SignNow cost with the rtso1 feature?

The pricing for airSlate SignNow varies based on the plan selected, but all plans include the rtso1 feature. This cost-effective solution is designed to fit the budgets of businesses of all sizes, ensuring that you get the best value for your investment in document management.

-

What are the main benefits of using rtso1 in airSlate SignNow?

Using rtso1 in airSlate SignNow provides numerous benefits, including enhanced efficiency and improved document security. It simplifies the eSigning process, allowing users to send and receive signed documents in real-time. Additionally, rtso1 helps businesses maintain compliance with legal standards.

-

Can I integrate rtso1 with other software applications?

Yes, airSlate SignNow with the rtso1 feature offers seamless integrations with various software applications. This allows businesses to connect their existing tools and streamline their workflows. Popular integrations include CRM systems, project management tools, and cloud storage services.

-

Is rtso1 suitable for small businesses?

Absolutely! The rtso1 feature in airSlate SignNow is designed to cater to the needs of small businesses. Its user-friendly interface and cost-effective pricing make it an ideal solution for small teams looking to enhance their document signing processes without breaking the bank.

-

How does rtso1 improve document security?

rtso1 enhances document security by implementing advanced encryption and authentication measures. This ensures that all signed documents are protected from unauthorized access and tampering. With airSlate SignNow, businesses can trust that their sensitive information remains secure.

-

What types of documents can I send using rtso1?

With rtso1 in airSlate SignNow, you can send a wide variety of documents for eSigning, including contracts, agreements, and forms. The platform supports multiple file formats, making it easy to manage all your document needs in one place. This versatility helps streamline your business operations.

Get more for Rtso1

Find out other Rtso1

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document