615 741 3101 2020

What is the

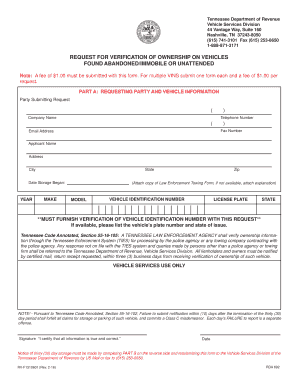

The is a specific form used in various administrative and legal contexts. It is essential for individuals and businesses to understand its purpose, which typically involves the collection of information necessary for compliance with state or federal regulations. This form may be required for tax reporting, legal documentation, or other official purposes.

How to use the

Using the involves several steps to ensure that all required information is accurately provided. Begin by carefully reading the instructions associated with the form. Gather all necessary documents that may be required, such as identification or financial records. Complete the form by entering the requested information in the designated fields, ensuring clarity and accuracy. Once completed, review the form for any errors before submission.

Steps to complete the

Completing the can be broken down into clear steps:

- Obtain the form from an official source.

- Read the instructions thoroughly to understand the requirements.

- Collect any supporting documents needed for submission.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for errors or omissions.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the

The legal use of the is crucial for compliance with applicable laws and regulations. It is important to ensure that the form is filled out correctly to avoid any legal repercussions. Misuse or errors in the form can lead to penalties or delays in processing. Always refer to the latest guidelines to ensure that the form is used appropriately within the legal framework.

Required Documents

When preparing to complete the, certain documents may be required. These can include:

- Identification documents, such as a driver's license or passport.

- Financial records relevant to the information requested on the form.

- Previous versions of the form, if applicable, for reference.

- Any additional documentation specified in the instructions accompanying the form.

Filing Deadlines / Important Dates

Filing deadlines for the can vary based on the specific context in which the form is used. It is essential to be aware of these deadlines to avoid penalties. Generally, deadlines may coincide with tax seasons or specific legal requirements. Always check for the most current dates to ensure timely submission.

Quick guide on how to complete 615 741 3101

Effortlessly Manage 615 741 3101 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle 615 741 3101 on any device using the airSlate SignNow apps available for Android or iOS and enhance any document-based workflow today.

How to modify and electronically sign 615 741 3101 with ease

- Find 615 741 3101 and click on Access Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark relevant sections of the documents or redact sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and click on the Complete button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from a device of your choice. Modify and electronically sign 615 741 3101 while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 615 741 3101

Create this form in 5 minutes!

How to create an eSignature for the 615 741 3101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help my business?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. By using airSlate SignNow, you can streamline your document workflows, reduce turnaround times, and enhance productivity. For more information, you can signNow out to us at 615 741 3101.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans are designed to provide cost-effective solutions while ensuring you have access to all essential features. For detailed pricing information, please contact us at 615 741 3101.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a variety of features such as document templates, real-time tracking, and secure cloud storage. These features are designed to simplify the signing process and enhance collaboration among team members. For a complete list of features, feel free to call us at 615 741 3101.

-

How does airSlate SignNow ensure document security?

Security is a top priority for airSlate SignNow. We utilize advanced encryption methods and comply with industry standards to protect your documents and data. If you have specific security concerns, please signNow out to us at 615 741 3101 for more information.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, including CRM and project management tools. This allows you to enhance your existing workflows and improve efficiency. For a list of available integrations, contact us at 615 741 3101.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including faster turnaround times, reduced paper usage, and improved document tracking. These advantages can lead to signNow cost savings and increased productivity for your business. For more insights, call us at 615 741 3101.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Our user-friendly interface and affordable pricing make it an ideal choice for small teams looking to streamline their document processes. For more details, please signNow out to us at 615 741 3101.

Get more for 615 741 3101

Find out other 615 741 3101

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free