CDTFA95 S1F REV 21 421STATE of CALIFORNIASALE Form

Understanding the CDTFA95 S1F REV 21 421

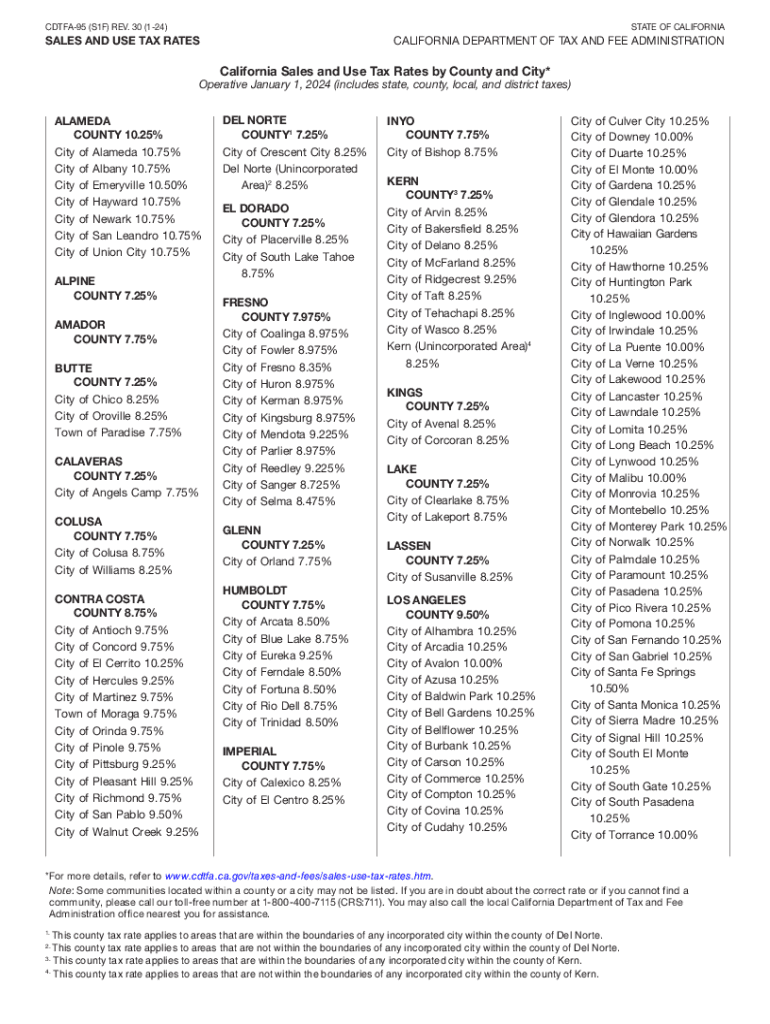

The CDTFA95 S1F REV 21 421 is a form issued by the California Department of Tax and Fee Administration (CDTFA). This form is essential for businesses operating in California to report sales tax. It outlines the specific sales tax rates applicable within the state, ensuring compliance with California tax laws. Understanding this form is crucial for accurate tax reporting and maintaining good standing with state tax authorities.

Steps to Complete the CDTFA95 S1F REV 21 421

Completing the CDTFA95 S1F REV 21 421 involves several key steps:

- Gather all necessary financial records, including sales receipts and previous tax returns.

- Determine the applicable sales tax rates based on your business location and the nature of your sales.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid penalties.

Legal Use of the CDTFA95 S1F REV 21 421

The CDTFA95 S1F REV 21 421 must be used in accordance with California tax regulations. Businesses are legally required to report their sales and remit the appropriate sales tax using this form. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is essential to understand the legal implications of filing this form accurately and on time.

Key Elements of the CDTFA95 S1F REV 21 421

Key elements of the CDTFA95 S1F REV 21 421 include:

- Identification of the business and its tax identification number.

- A detailed breakdown of total sales and taxable sales.

- Calculation of the total sales tax owed based on the applicable rates.

- Signature of the business owner or authorized representative.

Filing Deadlines and Important Dates

It is crucial to adhere to filing deadlines for the CDTFA95 S1F REV 21 421 to avoid penalties. Typically, the form must be submitted quarterly, with specific due dates falling on the last day of the month following the end of each quarter. For example, the due date for the first quarter (January to March) is April 30. Keeping track of these dates ensures timely compliance with California tax laws.

Examples of Using the CDTFA95 S1F REV 21 421

Examples of when to use the CDTFA95 S1F REV 21 421 include:

- A retail store reporting sales of tangible goods.

- An online business selling products to California residents.

- A service provider that collects sales tax on certain taxable services.

Each of these scenarios requires the accurate completion of the form to ensure proper tax reporting.

Quick guide on how to complete cdtfa95 s1f rev 21 421state of californiasale

Effortlessly Prepare CDTFA95 S1F REV 21 421STATE OF CALIFORNIASALE on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents promptly without delays. Handle CDTFA95 S1F REV 21 421STATE OF CALIFORNIASALE on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign CDTFA95 S1F REV 21 421STATE OF CALIFORNIASALE with Ease

- Obtain CDTFA95 S1F REV 21 421STATE OF CALIFORNIASALE and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, cumbersome form navigation, or errors that necessitate reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign CDTFA95 S1F REV 21 421STATE OF CALIFORNIASALE to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cdtfa95 s1f rev 21 421state of californiasale

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the current CA sales tax rates?

CA sales tax rates vary by location and can change frequently. It's essential to check the California Department of Tax and Fee Administration for the most up-to-date rates. airSlate SignNow can help you manage documents related to sales tax compliance efficiently.

-

How can airSlate SignNow assist with CA sales tax documentation?

airSlate SignNow streamlines the process of sending and eSigning documents related to CA sales tax rates. Our platform allows you to create, send, and store tax-related documents securely, ensuring compliance and easy access for your team.

-

Are there any features in airSlate SignNow that help with tax calculations?

While airSlate SignNow primarily focuses on document management, it integrates with various accounting software that can calculate CA sales tax rates. This integration ensures that your documents reflect accurate tax calculations, simplifying your workflow.

-

What benefits does airSlate SignNow offer for businesses dealing with CA sales tax?

Using airSlate SignNow can signNowly reduce the time spent on paperwork related to CA sales tax rates. Our user-friendly platform allows for quick document creation and eSigning, helping businesses stay organized and compliant with tax regulations.

-

Is airSlate SignNow cost-effective for managing CA sales tax documents?

Yes, airSlate SignNow offers a cost-effective solution for managing CA sales tax documents. With various pricing plans, businesses can choose the option that best fits their needs while ensuring they have the tools necessary to handle tax-related paperwork efficiently.

-

Can airSlate SignNow integrate with other tax software for CA sales tax?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax software, allowing you to manage CA sales tax rates and documentation in one place. This integration enhances your workflow and ensures accuracy in your tax filings.

-

How does airSlate SignNow ensure compliance with CA sales tax regulations?

airSlate SignNow helps ensure compliance with CA sales tax regulations by providing a secure platform for document management. Our features allow you to track changes, maintain records, and easily access necessary documents for audits or reviews.

Get more for CDTFA95 S1F REV 21 421STATE OF CALIFORNIASALE

- The martian worksheet pdf answers form

- Med tech certification online form

- Code blue competency checklist form

- Form dl1 93 255614790

- Annuity common quotation form

- Standing order for the administration of school supplied stock epinephrine auto injectors for potentially life threatening form

- Impuesto sobre sucesiones y donaciones form

- Cobb county business license application form

Find out other CDTFA95 S1F REV 21 421STATE OF CALIFORNIASALE

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now