AR Deduction Form

What is the AR Deduction Form

The AR Deduction Form is a specific tax document used by individuals and businesses in the United States to claim deductions related to certain expenses. This form is essential for taxpayers looking to reduce their taxable income by reporting eligible deductions. It is particularly relevant for those who have incurred expenses that qualify under state-specific tax regulations.

How to use the AR Deduction Form

Using the AR Deduction Form involves several key steps. First, gather all necessary documentation that supports your deduction claims, such as receipts, invoices, or other relevant records. Next, accurately fill out the form, ensuring that all information is complete and correct to avoid delays or issues with processing. Once completed, submit the form according to the instructions provided, either electronically or by mail.

Steps to complete the AR Deduction Form

Completing the AR Deduction Form requires careful attention to detail. Follow these steps:

- Download the AR Deduction Form from an official source.

- Read the instructions thoroughly to understand what information is required.

- Fill in your personal and financial details accurately.

- List all eligible deductions, providing supporting documentation as necessary.

- Review the form for any errors or omissions.

- Submit the form by the specified deadline.

Key elements of the AR Deduction Form

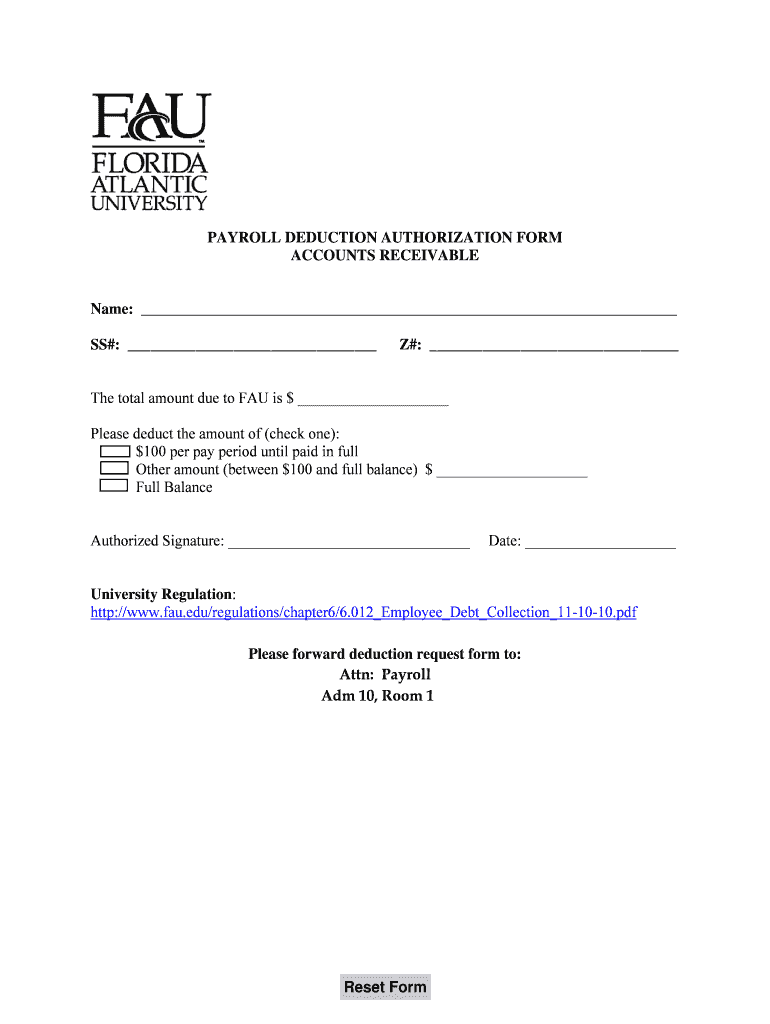

The AR Deduction Form includes several key elements that are crucial for proper completion. These elements typically consist of:

- Taxpayer identification information, including name and Social Security number.

- A section for detailing specific deductions being claimed.

- Instructions for providing supporting documentation.

- Signature line for verification of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the AR Deduction Form are critical to ensure compliance with tax regulations. Typically, the form must be submitted by April fifteenth of the tax year. However, it is advisable to check for any updates or changes to deadlines, as extensions may apply in certain circumstances.

Required Documents

To successfully complete the AR Deduction Form, certain documents are required. These may include:

- Receipts for expenses being claimed.

- Invoices or statements that verify the amounts.

- Any other documentation that supports the deductions listed on the form.

Eligibility Criteria

Eligibility for using the AR Deduction Form varies based on the type of deductions being claimed. Generally, taxpayers must meet specific criteria related to their income level, the nature of the expenses, and whether they are itemizing deductions or taking the standard deduction. Understanding these criteria is essential for accurate filing.

Quick guide on how to complete ar deduction form

Accomplish [SKS] effortlessly on any gadget

Digital document handling has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to produce, modify, and electronically sign your documents quickly without interruptions. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar deduction form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an AR Deduction Form?

An AR Deduction Form is a document used by businesses to request deductions from accounts receivable. It helps streamline the process of managing customer payments and disputes. Using airSlate SignNow, you can easily create, send, and eSign AR Deduction Forms, ensuring a smooth workflow.

-

How can airSlate SignNow help with AR Deduction Forms?

airSlate SignNow provides a user-friendly platform for creating and managing AR Deduction Forms. With features like eSignature, document tracking, and templates, you can efficiently handle deductions and improve your accounts receivable process. This saves time and reduces errors in your documentation.

-

Is there a cost associated with using airSlate SignNow for AR Deduction Forms?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan includes features for managing AR Deduction Forms, such as unlimited eSignatures and document storage. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for AR Deduction Forms?

airSlate SignNow includes features like customizable templates, eSignature capabilities, and real-time document tracking for AR Deduction Forms. These features enhance efficiency and ensure that your documents are processed quickly and securely. Additionally, you can integrate with other tools to streamline your workflow.

-

Can I integrate airSlate SignNow with other software for AR Deduction Forms?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to connect your AR Deduction Forms with your existing systems. This integration helps automate workflows and ensures that your documents are seamlessly managed across platforms.

-

What are the benefits of using airSlate SignNow for AR Deduction Forms?

Using airSlate SignNow for AR Deduction Forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. The platform allows for quick eSigning and easy document management, which can signNowly improve your accounts receivable processes. This leads to faster resolution of payment issues.

-

How secure is airSlate SignNow when handling AR Deduction Forms?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your AR Deduction Forms. Your documents are stored securely, and access is controlled to ensure that sensitive information remains confidential. You can trust airSlate SignNow to handle your documents safely.

Get more for AR Deduction Form

- Copyright license agreement written work ampamp guide form

- Life request letter statefarmcom and non statefarmcom use form

- Electronic mail email policy empire state college form

- Philosophy has a sexual harassment problemsaloncom form

- Addendum to agreement dated august 12 2003 by and between form

- Notice of termination due to work rules violation legal form

- Design services agreement this agreement is entered into form

- Cancellation of leave of absence form

Find out other AR Deduction Form

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement