Employee Withholding Allowance Certificate W 4 Form

What is the Employee Withholding Allowance Certificate W-4

The Employee Withholding Allowance Certificate W-4 is a tax form used in the United States by employees to inform their employers about their tax situation. This form helps determine the amount of federal income tax to withhold from an employee's paycheck. By providing information on allowances, marital status, and additional withholdings, the W-4 ensures that the right amount of tax is deducted, which can help prevent underpayment or overpayment of taxes throughout the year.

Steps to complete the Employee Withholding Allowance Certificate W-4

Completing the Employee Withholding Allowance Certificate W-4 involves several straightforward steps:

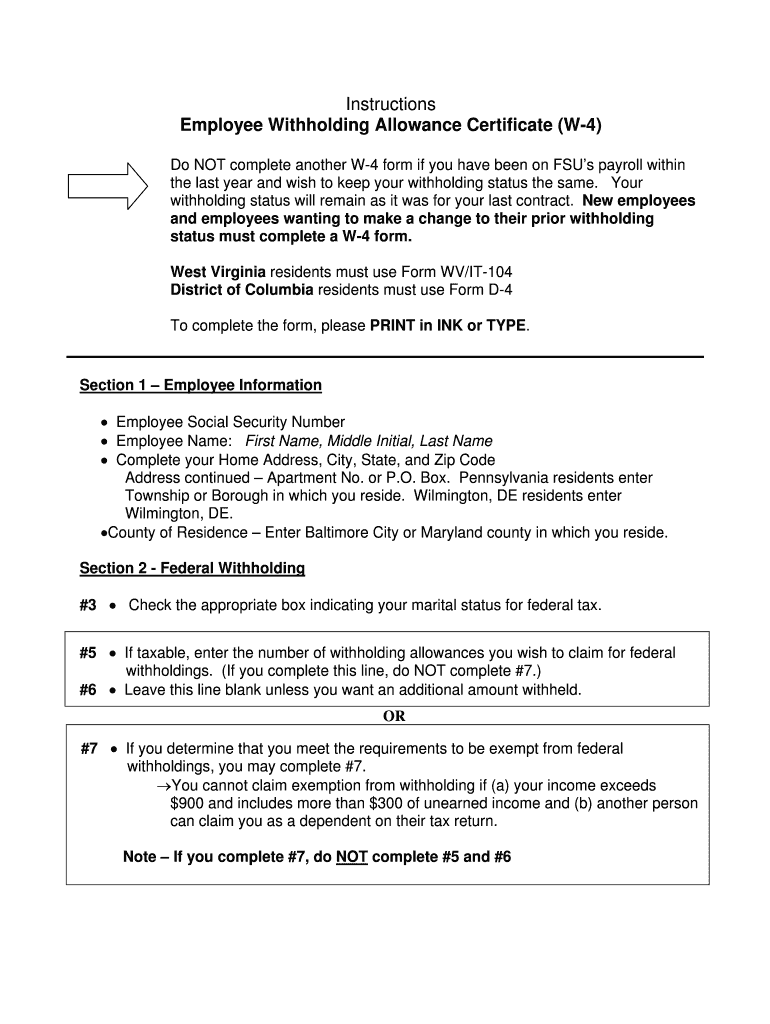

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Claim allowances based on your personal circumstances, such as dependents and other deductions.

- Decide if you want additional amounts withheld from your paycheck.

- Sign and date the form to certify the information provided is accurate.

How to use the Employee Withholding Allowance Certificate W-4

To use the Employee Withholding Allowance Certificate W-4 effectively, submit the completed form to your employer's payroll department. This form should be filled out when starting a new job or when your financial situation changes, such as marriage, divorce, or the birth of a child. Regularly reviewing and updating your W-4 can help ensure that your tax withholding aligns with your current circumstances, thereby minimizing any surprises during tax season.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing the W-4 form. It is essential to follow these guidelines to ensure compliance with federal tax laws. The IRS recommends using the online withholding calculator to determine the appropriate number of allowances to claim based on your income, deductions, and credits. Additionally, the IRS updates the W-4 form periodically, so it is crucial to use the latest version available to avoid any discrepancies.

Legal use of the Employee Withholding Allowance Certificate W-4

The Employee Withholding Allowance Certificate W-4 must be used in accordance with U.S. tax laws. Employers are required to withhold federal income tax based on the information provided on the W-4. Employees must ensure that the information they submit is accurate and truthful, as providing false information can lead to penalties. The W-4 is a legal document, and both employees and employers must adhere to the guidelines set forth by the IRS regarding its use.

Who Issues the Form

The Employee Withholding Allowance Certificate W-4 is issued by the Internal Revenue Service (IRS). The IRS provides the form and instructions for its completion, ensuring that employees have the necessary tools to accurately report their tax withholding preferences. Employers also play a role in distributing the W-4 form to new hires and ensuring that it is properly collected and processed.

Quick guide on how to complete employee withholding allowance certificate w 4

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and seamlessly. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select pertinent sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Employee Withholding Allowance Certificate W 4

Create this form in 5 minutes!

How to create an eSignature for the employee withholding allowance certificate w 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Employee Withholding Allowance Certificate W 4?

The Employee Withholding Allowance Certificate W 4 is a form used by employees to indicate their tax withholding preferences to their employer. By completing this certificate, employees can specify the number of allowances they wish to claim, which directly affects their federal income tax withholding. Understanding this form is crucial for accurate tax planning and compliance.

-

How can airSlate SignNow help with the Employee Withholding Allowance Certificate W 4?

airSlate SignNow simplifies the process of completing and submitting the Employee Withholding Allowance Certificate W 4 by providing an intuitive eSigning platform. Users can easily fill out the form electronically, ensuring accuracy and compliance. This streamlines the workflow for both employees and employers, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the Employee Withholding Allowance Certificate W 4?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to a range of features, including the ability to manage the Employee Withholding Allowance Certificate W 4 efficiently. Investing in this solution can save time and reduce errors in document handling.

-

What features does airSlate SignNow offer for managing the Employee Withholding Allowance Certificate W 4?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for the Employee Withholding Allowance Certificate W 4. These tools enhance the user experience by ensuring that documents are completed accurately and promptly. Additionally, the platform supports collaboration among team members for seamless document management.

-

Can I integrate airSlate SignNow with other software for the Employee Withholding Allowance Certificate W 4?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate the Employee Withholding Allowance Certificate W 4 into your existing workflows. This flexibility allows businesses to streamline their processes and maintain consistency across different platforms.

-

What are the benefits of using airSlate SignNow for the Employee Withholding Allowance Certificate W 4?

Using airSlate SignNow for the Employee Withholding Allowance Certificate W 4 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that sensitive information is protected while allowing for quick access and easy sharing of documents. This ultimately leads to a more organized and compliant tax process.

-

How does airSlate SignNow ensure the security of the Employee Withholding Allowance Certificate W 4?

airSlate SignNow prioritizes security by employing advanced encryption and authentication measures for the Employee Withholding Allowance Certificate W 4. This ensures that all data is protected during transmission and storage. Users can trust that their sensitive information remains confidential and secure.

Get more for Employee Withholding Allowance Certificate W 4

- Sample stock purchase and investor rights agreement of form

- Ebook vietnam education financing form

- Staples inc def 14a sec form

- Dialdata s form

- Agreement and plan of merger torvec subsidiary corp form

- Chapter 11 aspect software parent inc et al cases form

- Web advertising agreement mpath interactive inc and form

- Playbox us inc small business stock registration sb 2 form

Find out other Employee Withholding Allowance Certificate W 4

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement