Flex Employee Enrollment Form 2

What is the Flex Employee Enrollment Form 2

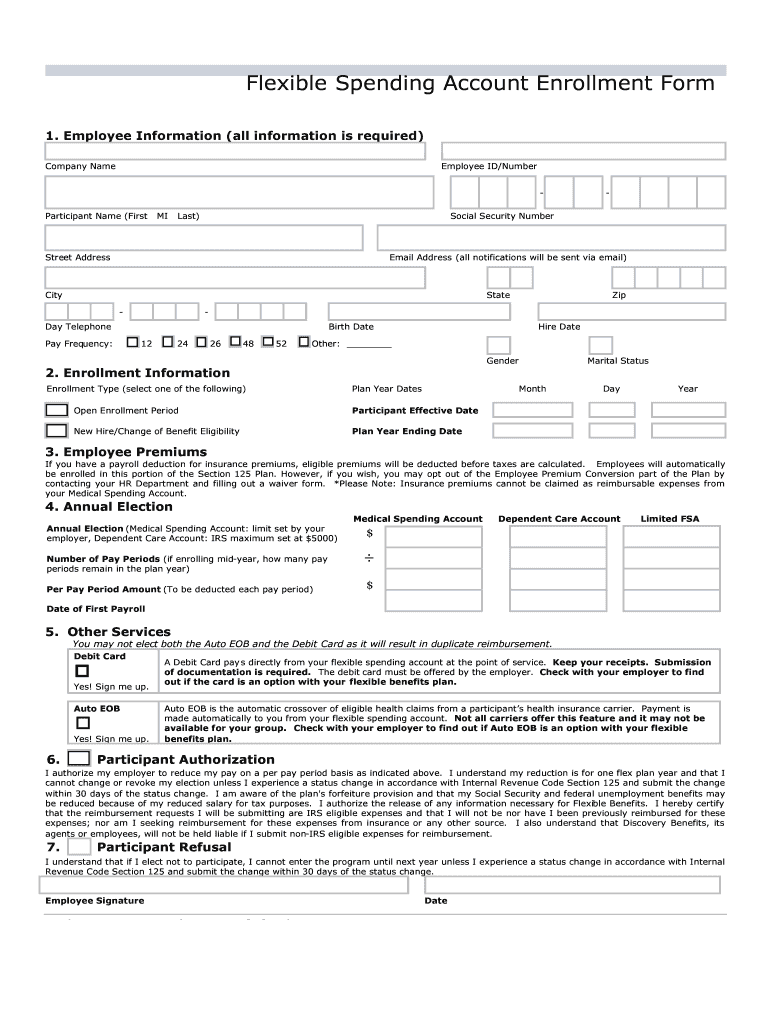

The Flex Employee Enrollment Form 2 is a crucial document used by employers to enroll employees in flexible benefits plans. These plans often include options such as health savings accounts, flexible spending accounts, and other employee benefits that allow for pre-tax contributions. This form ensures that employees can select the benefits that best meet their personal and financial needs while complying with federal regulations.

How to use the Flex Employee Enrollment Form 2

To effectively use the Flex Employee Enrollment Form 2, employees should first review the available benefits offered by their employer. Once familiar with the options, they can fill out the form by providing necessary personal information, selecting desired benefits, and indicating contribution amounts. It is important to complete the form accurately to avoid delays in enrollment or issues with benefit access.

Steps to complete the Flex Employee Enrollment Form 2

Completing the Flex Employee Enrollment Form 2 involves several key steps:

- Gather personal information, including your name, address, and Social Security number.

- Review the benefits options provided by your employer.

- Select the benefits you wish to enroll in, ensuring you understand any associated costs.

- Indicate your contribution amounts for each selected benefit.

- Sign and date the form to confirm your selections.

- Submit the completed form to your HR department by the specified deadline.

Key elements of the Flex Employee Enrollment Form 2

The Flex Employee Enrollment Form 2 contains several important elements that ensure clarity and compliance:

- Employee Information: Personal details such as name, contact information, and Social Security number.

- Benefit Selection: A list of available benefits with checkboxes for employee selection.

- Contribution Amounts: Sections for employees to specify how much they wish to contribute to each benefit.

- Signature Line: A space for employees to sign and date the form, indicating their agreement.

Eligibility Criteria

Eligibility for enrolling in the Flex Employee Enrollment Form 2 typically depends on employment status and the specific benefits offered by the employer. Generally, full-time employees are eligible, while part-time employees may have different criteria. It is essential for employees to verify their eligibility with the HR department before completing the form.

Form Submission Methods

Employees can submit the Flex Employee Enrollment Form 2 through various methods, depending on their employer's policies:

- Online Submission: Many employers allow digital submission via an employee portal.

- Mail: Employees may also send the completed form through postal mail to the HR department.

- In-Person: Submitting the form directly to HR can provide immediate confirmation of receipt.

Legal use of the Flex Employee Enrollment Form 2

The Flex Employee Enrollment Form 2 must be used in accordance with federal and state regulations governing employee benefits. Employers are responsible for ensuring that the form complies with applicable laws, including those related to tax implications and employee privacy. Employees should also be aware of their rights and responsibilities when enrolling in benefit plans.

Quick guide on how to complete flex employee enrollment form 2

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without any delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or mask sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Flex Employee Enrollment Form 2

Create this form in 5 minutes!

How to create an eSignature for the flex employee enrollment form 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Flex Employee Enrollment Form 2?

The Flex Employee Enrollment Form 2 is a digital document designed to streamline the enrollment process for employees in flexible benefits programs. It allows businesses to collect necessary information efficiently and securely, ensuring compliance and ease of use.

-

How does the Flex Employee Enrollment Form 2 benefit my business?

Using the Flex Employee Enrollment Form 2 can signNowly reduce paperwork and administrative tasks, allowing HR teams to focus on more strategic initiatives. It enhances the employee experience by providing a straightforward and user-friendly enrollment process.

-

Is the Flex Employee Enrollment Form 2 customizable?

Yes, the Flex Employee Enrollment Form 2 is fully customizable to meet your organization's specific needs. You can tailor the form fields, branding, and layout to align with your company's identity and requirements.

-

What are the pricing options for the Flex Employee Enrollment Form 2?

Pricing for the Flex Employee Enrollment Form 2 varies based on the features and volume of usage. airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, ensuring you get the best value for your investment.

-

Can I integrate the Flex Employee Enrollment Form 2 with other software?

Absolutely! The Flex Employee Enrollment Form 2 can be seamlessly integrated with various HR and payroll systems. This integration helps streamline data transfer and enhances overall operational efficiency.

-

How secure is the Flex Employee Enrollment Form 2?

The Flex Employee Enrollment Form 2 is built with top-notch security features to protect sensitive employee information. airSlate SignNow employs encryption and secure access protocols to ensure that your data remains confidential and secure.

-

What features are included with the Flex Employee Enrollment Form 2?

The Flex Employee Enrollment Form 2 includes features such as electronic signatures, automated workflows, and real-time tracking. These features simplify the enrollment process and enhance the overall user experience for both employees and administrators.

Get more for Flex Employee Enrollment Form 2

- Or in any way related to childs participation in any of the events or activities conducted by on the form

- Contractual agreement please read carefully this form

- Forever discharge from any and all claims demands debts contracts form

- For burning form

- Waiver and release from liability for fairgrounds owner form

- Minors only iowa state recreation services form

- Liability waiversaveafox form

- Waiver release and hold harmless agreement 3 i waive all form

Find out other Flex Employee Enrollment Form 2

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer