13 Debt Management Budget and Loan Worksheet 13 Budget and Loan Worksheet Gtu Form

What is the 13 Debt Management Budget And Loan Worksheet?

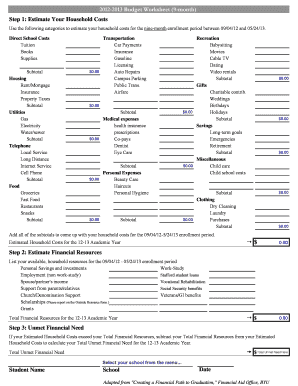

The 13 Debt Management Budget and Loan Worksheet is a financial tool designed to assist individuals in managing their debts and loans effectively. This worksheet provides a structured format for users to document their income, expenses, and outstanding debts. By organizing this information, users can gain a clearer understanding of their financial situation, which is essential for creating a realistic budget and repayment plan. This form is particularly useful for those seeking to consolidate debts or develop a strategy for financial recovery.

How to use the 13 Debt Management Budget And Loan Worksheet

Using the 13 Debt Management Budget and Loan Worksheet involves several straightforward steps. First, gather all relevant financial information, including income sources and monthly expenses. Next, input this data into the designated sections of the worksheet. It is important to categorize expenses accurately, distinguishing between fixed and variable costs. After entering all information, review the worksheet to identify areas where spending can be reduced. This analysis will help in formulating a budget that prioritizes debt repayment while ensuring essential living expenses are covered.

Steps to complete the 13 Debt Management Budget And Loan Worksheet

Completing the 13 Debt Management Budget and Loan Worksheet requires careful attention to detail. Begin by listing all sources of income, including salaries, bonuses, and any additional earnings. Then, outline all monthly expenses, categorizing them into essential and non-essential items. Next, document all outstanding debts, including the total amount owed, minimum monthly payments, and interest rates. Once all information is entered, calculate the total income and total expenses to determine the net income. This final figure will guide users in making informed decisions about their financial priorities.

Key elements of the 13 Debt Management Budget And Loan Worksheet

The key elements of the 13 Debt Management Budget and Loan Worksheet include sections for income, expenses, and debt listings. The income section should capture all forms of earnings, while the expenses section should detail both fixed costs, such as rent and utilities, and variable costs, such as groceries and entertainment. Additionally, the debt section is crucial, as it outlines each debt's balance, payment terms, and interest rates. These components work together to provide a comprehensive overview of an individual's financial standing, facilitating better financial management.

Examples of using the 13 Debt Management Budget And Loan Worksheet

Examples of using the 13 Debt Management Budget and Loan Worksheet can illustrate its practical application. For instance, an individual may use the worksheet to assess their ability to repay credit card debt while managing monthly living expenses. By inputting their income and expenses, they can identify surplus funds that can be allocated toward debt repayment. Another example could involve a family using the worksheet to plan for a large purchase, like a home, by evaluating their current financial commitments and savings goals.

Legal use of the 13 Debt Management Budget And Loan Worksheet

The legal use of the 13 Debt Management Budget and Loan Worksheet involves adhering to financial regulations and guidelines. This worksheet is not a legally binding document but serves as a personal financial management tool. It is essential for users to ensure that the information provided is accurate and truthful, as discrepancies could lead to issues in financial planning or debt negotiations. Furthermore, individuals considering bankruptcy or debt settlement should consult with a financial advisor or legal professional to understand the implications of their financial decisions.

Quick guide on how to complete 13 debt management budget and loan worksheet 13 budget and loan worksheet gtu

Complete [SKS] easily on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly solution to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, alter, and eSign your documents quickly without interruptions. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Use the tools available to complete your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose your desired method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Modify and eSign [SKS] and ensure smooth communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu

Create this form in 5 minutes!

How to create an eSignature for the 13 debt management budget and loan worksheet 13 budget and loan worksheet gtu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu?

The 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu is a comprehensive tool designed to help individuals manage their debts and loans effectively. It provides a structured format for tracking expenses, income, and loan details, making it easier to create a budget that works for you.

-

How can the 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu benefit me?

Using the 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu can signNowly improve your financial management. It helps you visualize your financial situation, prioritize debts, and develop a repayment plan, ultimately leading to better financial health.

-

Is the 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu easy to use?

Absolutely! The 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu is designed with user-friendliness in mind. Its intuitive layout allows users of all experience levels to easily input their financial data and generate actionable insights.

-

What features are included in the 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu?

The 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu includes features such as customizable budget categories, loan tracking, expense monitoring, and visual charts for better understanding of your financial status. These features work together to provide a holistic view of your finances.

-

Can I integrate the 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu with other financial tools?

Yes, the 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu can be integrated with various financial tools and software. This allows for seamless data transfer and enhances your overall financial management experience.

-

What is the pricing for the 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu?

The pricing for the 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu is competitive and designed to provide value for users. You can choose from different subscription plans based on your needs, ensuring you get the best solution for your budget.

-

Is there customer support available for the 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu?

Yes, customer support is readily available for users of the 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu. Our dedicated support team is here to assist you with any questions or issues you may encounter while using the worksheet.

Get more for 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu

Find out other 13 Debt Management Budget And Loan Worksheet 13 Budget And Loan Worksheet Gtu

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free

- How To Sign Kentucky Affidavit of Heirship

- Can I Sign Louisiana Affidavit of Heirship

- How To Sign New Jersey Affidavit of Heirship

- Sign Oklahoma Affidavit of Heirship Myself