New Alabama Business Application Form

What is the New Alabama Business Application

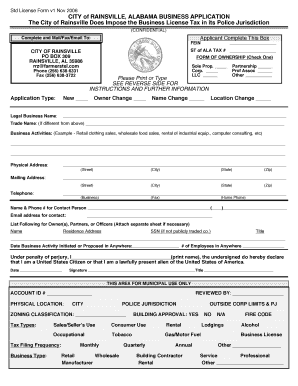

The New Alabama Business Application is a crucial form for businesses operating in Alabama. It serves as a formal request for registering a new business entity with the state. This application collects essential information about the business, including its name, structure, and ownership details. Understanding this application is vital for compliance with state regulations and for ensuring that your business is legally recognized in Alabama.

Steps to complete the New Alabama Business Application

Completing the New Alabama Business Application involves several key steps:

- Gather necessary information, including your business name, address, and structure (LLC, corporation, etc.).

- Determine the appropriate business entity type and its corresponding requirements.

- Fill out the application form accurately, ensuring all fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application through the designated method, whether online, by mail, or in person.

Required Documents

When applying for the New Alabama Business Application, certain documents are typically required to support your submission. These may include:

- Proof of identity for the business owner(s), such as a driver's license or passport.

- Operating agreements or articles of incorporation, depending on the business structure.

- Any applicable licenses or permits required for your specific industry.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines associated with the New Alabama Business Application. Generally, businesses should aim to submit their application before commencing operations to avoid penalties. Specific deadlines may vary based on the business structure and local regulations, so checking with the Alabama Secretary of State's office for the most current information is advisable.

Who Issues the Form

The New Alabama Business Application is issued by the Alabama Secretary of State's office. This office is responsible for overseeing business registrations and ensuring compliance with state laws. It is crucial to submit your application to the correct department to facilitate a smooth registration process.

Penalties for Non-Compliance

Failure to properly file the New Alabama Business Application can result in significant penalties. Businesses that do not register may face fines, legal action, or difficulties in obtaining necessary permits and licenses. Additionally, operating without proper registration can jeopardize the business's legal status and limit access to certain benefits.

Quick guide on how to complete new alabama business application

Prepare New Alabama Business Application effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly without any holdups. Handle New Alabama Business Application on any platform using airSlate SignNow apps for Android or iOS and enhance your document-focused workflow today.

The simplest way to update and eSign New Alabama Business Application with ease

- Locate New Alabama Business Application and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or obscure confidential information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Update and eSign New Alabama Business Application and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new alabama business application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Alabama business tax and how does it affect my business?

Alabama business tax is a tax imposed on businesses operating within the state. It is essential for business owners to understand their obligations regarding this tax to ensure compliance and avoid penalties. airSlate SignNow can help streamline document management related to tax filings, making it easier to stay organized and compliant.

-

How can airSlate SignNow assist with Alabama business tax documentation?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning documents related to Alabama business tax. This ensures that all necessary forms are completed accurately and submitted on time. By using our solution, businesses can save time and reduce the risk of errors in their tax documentation.

-

What are the pricing options for airSlate SignNow for Alabama businesses?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of Alabama businesses. Our cost-effective solutions ensure that you only pay for what you need, making it easier to manage your budget while staying compliant with Alabama business tax requirements. Visit our pricing page for detailed information on available plans.

-

Are there any features specifically designed for managing Alabama business tax?

Yes, airSlate SignNow includes features that simplify the management of Alabama business tax documents. With customizable templates and automated workflows, you can efficiently handle tax-related paperwork. This allows you to focus on growing your business while ensuring that all tax obligations are met.

-

Can I integrate airSlate SignNow with other tools for Alabama business tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage Alabama business tax efficiently. These integrations allow for smooth data transfer and improved collaboration, ensuring that your tax documents are always up to date.

-

What benefits does airSlate SignNow offer for Alabama businesses regarding tax compliance?

Using airSlate SignNow helps Alabama businesses maintain compliance with tax regulations by providing a secure and efficient way to manage documents. Our platform reduces the risk of errors and ensures timely submissions, which is crucial for avoiding penalties related to Alabama business tax. Additionally, our solution enhances overall productivity.

-

Is airSlate SignNow suitable for small businesses dealing with Alabama business tax?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses navigating Alabama business tax. Our intuitive platform simplifies the eSigning process and document management, making it accessible for small business owners who may not have extensive resources. This empowers them to handle tax obligations effectively.

Get more for New Alabama Business Application

- 2021 schedule d 1 sales of business property 2021 schedule d 1 sales of business property form

- Veterans pension rate tableeffective 12119 pension form

- 2020 form ca ftb 592 a fill online printable fillable

- Form 14039 rev 3 2022 identity theft affidavit

- Cdtfa 95 california sales and use tax rates by county and city cdtfa 95 state county local and district taxes form

- F1040pdf form 1040 us individual income tax return 2022 filing

- 2021 california form 3809 targeted tax area deduction and credit summary

- Pennsylvania exemption certificate this form cannot be used to studylib

Find out other New Alabama Business Application

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free