212 1 02 Form

What is the 212 1 02

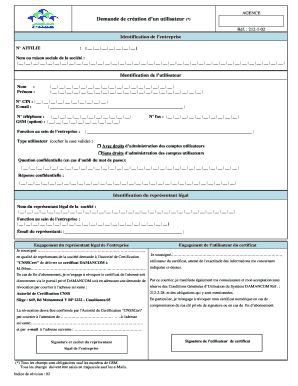

The 212 1 02 form is a specific document used primarily for tax purposes in the United States. It is often associated with various reporting requirements that help ensure compliance with federal regulations. This form is crucial for individuals and businesses alike, as it provides necessary information that the Internal Revenue Service (IRS) requires for accurate tax assessment and processing.

How to use the 212 1 02

Using the 212 1 02 form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents that pertain to the reporting period. Next, carefully fill out the form, ensuring that each section is completed with accurate data. Once completed, review the form for any errors or omissions before submitting it to the appropriate tax authority. It is important to keep a copy for your records as well.

Steps to complete the 212 1 02

Completing the 212 1 02 form involves a systematic approach:

- Gather all relevant financial documents, such as income statements and expense reports.

- Fill out the personal information section, including your name, address, and Social Security number.

- Complete the income and deduction sections accurately, ensuring all figures are correct.

- Review the form for completeness and accuracy.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the 212 1 02

The legal use of the 212 1 02 form is essential for compliance with U.S. tax laws. This form must be completed and submitted by individuals or entities that meet specific criteria set forth by the IRS. Failing to use the form correctly or submitting it late can result in penalties or legal repercussions. It is advisable to consult with a tax professional if there are any uncertainties regarding its use.

Required Documents

To complete the 212 1 02 form, several documents may be required, including:

- Income statements, such as W-2s or 1099s.

- Expense receipts that support deductions claimed.

- Previous year’s tax return for reference.

- Any additional documentation requested by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 212 1 02 form are typically aligned with the annual tax return deadlines. Generally, individuals must file by April 15 of each year. However, if the deadline falls on a weekend or holiday, it may be extended. It is crucial to stay informed about any changes to these deadlines to avoid late filing penalties.

Handy tips for filling out 212 1 02 online

Quick steps to complete and e-sign 212 1 02 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining filling in forms could be. Gain access to a GDPR and HIPAA compliant platform for maximum simpleness. Use signNow to electronically sign and send out 212 1 02 for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 212 1 02

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 212 1 02 and how does it relate to airSlate SignNow?

212 1 02 refers to a specific feature set within airSlate SignNow that enhances document management and eSigning capabilities. This feature allows users to streamline their workflows, making it easier to send and sign documents securely and efficiently.

-

How much does airSlate SignNow cost for using the 212 1 02 feature?

The pricing for airSlate SignNow, including the 212 1 02 feature, is competitive and designed to fit various business needs. You can choose from different subscription plans that offer flexibility and scalability, ensuring you only pay for what you need.

-

What are the key benefits of using the 212 1 02 feature in airSlate SignNow?

Using the 212 1 02 feature in airSlate SignNow provides numerous benefits, including increased efficiency in document processing and enhanced security for sensitive information. This feature also simplifies the eSigning process, allowing for quicker turnaround times and improved customer satisfaction.

-

Can I integrate airSlate SignNow with other applications while using the 212 1 02 feature?

Yes, airSlate SignNow supports integrations with various applications, even when utilizing the 212 1 02 feature. This allows businesses to connect their existing tools and streamline their workflows, making document management more cohesive and efficient.

-

Is the 212 1 02 feature user-friendly for new users?

Absolutely! The 212 1 02 feature in airSlate SignNow is designed with user-friendliness in mind. New users can easily navigate the platform, thanks to its intuitive interface and helpful resources, ensuring a smooth onboarding experience.

-

What types of documents can I send and eSign using the 212 1 02 feature?

With the 212 1 02 feature in airSlate SignNow, you can send and eSign a wide variety of documents, including contracts, agreements, and forms. This versatility makes it an ideal solution for businesses across different industries looking to manage their documentation efficiently.

-

How does airSlate SignNow ensure the security of documents signed with the 212 1 02 feature?

airSlate SignNow prioritizes security, especially for documents signed using the 212 1 02 feature. The platform employs advanced encryption methods and complies with industry standards to protect sensitive information, ensuring that your documents remain secure throughout the signing process.

Get more for 212 1 02

- Ghp family prior authorization form

- Account information sheet

- Managed forest law form 9300 029a

- Travelers casualty and surety company of america hartford form

- Isaca journal subscription request isaca form

- If your application for a residence permit is rejected and form

- Room rent lease agreement template form

- Room sublease agreement template form

Find out other 212 1 02

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure