Dcb Bank Rtgs Form Printable 2018-2026

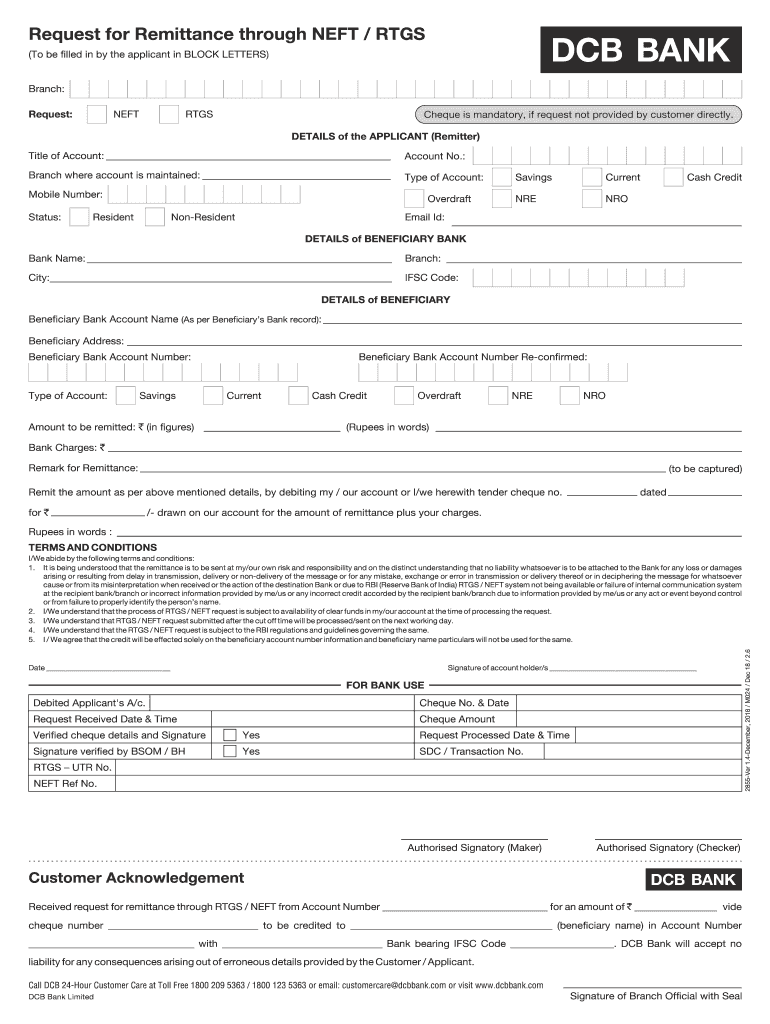

What is the DCB Bank RTGS Form?

The DCB Bank RTGS form is a document used for initiating Real Time Gross Settlement transactions through DCB Bank. This form allows customers to transfer funds electronically from one bank account to another, typically for larger amounts that exceed the limits set for other payment methods like NEFT. The form is essential for ensuring that transactions are processed efficiently and securely, complying with banking regulations.

How to Obtain the DCB Bank RTGS Form

To obtain the DCB Bank RTGS form, customers can visit the official DCB Bank website where the form is often available for download in PDF format. Alternatively, customers can visit a local DCB Bank branch to request a physical copy of the form. It is advisable to ensure that the latest version of the form is used to avoid any discrepancies during the transaction process.

Steps to Complete the DCB Bank RTGS Form

Completing the DCB Bank RTGS form involves several key steps:

- Fill in personal details: Include your name, account number, and contact information.

- Provide beneficiary details: Enter the recipient's name, account number, and bank details.

- Specify transaction amount: Clearly state the amount to be transferred.

- Sign the form: Ensure you provide your signature to authorize the transaction.

- Submit the form: Deliver the completed form to your bank branch or use the online submission option if available.

Legal Use of the DCB Bank RTGS Form

The DCB Bank RTGS form is legally recognized for facilitating electronic fund transfers. It must be filled out accurately to ensure compliance with banking regulations. Any inaccuracies or incomplete information may result in delays or rejections of the transaction. Users should keep a copy of the submitted form for their records, as it serves as proof of the transaction request.

Key Elements of the DCB Bank RTGS Form

Important elements of the DCB Bank RTGS form include:

- Sender's information: Name, account number, and contact details.

- Beneficiary's information: Name, account number, and bank details.

- Transaction details: Amount, purpose of transfer, and date.

- Signature: Required for authorization of the transaction.

Digital vs. Paper Version of the DCB Bank RTGS Form

The DCB Bank RTGS form is available in both digital and paper formats. The digital version can be filled out and submitted online, offering convenience and speed. The paper version, while still widely used, requires physical submission at a bank branch. Both formats serve the same purpose, but the digital version may reduce processing time and enhance security.

Quick guide on how to complete neft rtgs formcdr

A brief overview on how to create your Dcb Bank Rtgs Form Printable

Locating the correct template can be difficult when you must provide formal international documentation. Even when you possess the necessary form, it may be cumbersome to swiftly prepare it in compliance with all the criteria if you are using printed versions rather than handling everything digitally. airSlate SignNow is the web-based electronic signature solution that assists you in overcoming these challenges. It enables you to select your Dcb Bank Rtgs Form Printable and efficiently fill it out and sign it on-site without needing to reprint documents whenever you make an error.

Here are the actions you need to take to create your Dcb Bank Rtgs Form Printable with airSlate SignNow:

- Hit the Get Form button to instantly add your document to our editor.

- Begin at the first blank area, enter your information, and move on with the Next button.

- Complete the empty fields using the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to emphasize the most important details.

- Click on Image and upload one if your Dcb Bank Rtgs Form Printable requires it.

- Utilize the right-side panel to add more fields for you or others to fill in if needed.

- Review your responses and validate the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the form modification by pressing the Done button and selecting your file-sharing preferences.

Once your Dcb Bank Rtgs Form Printable is ready, you can share it according to your preferences - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely keep all your finalized documents in your account, organized in folders based on your choices. Don’t waste time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct neft rtgs formcdr

FAQs

-

What should we do if we wanted to transfer money by NEFT and it is done by RTGS (because for both modes filling form is the same)?

If the party involved to whom the money was to be transferred is same, it makes no difference whether RTGS is used or NEFT is used…In fact RTGS is in real time and the funds would have been transferred immediately…So, there is no logical reason for cancelling the RTGS and trying to do NEFT…

-

What we have to fill in "remitter bank's RTGS/NEFT code" column?

NEFT code is nothing but IFSC code. IFSC stands for Indian Financial System Code . It is aunique code no. assigned each bank branch containg the following details:First four characters - Identity (Bank )Fifth Character: 0 ( default and kept for future use)Remaining six characters: Branch codeTotal 11 characterse.g. HDFC0000215 HDFC bank Rajahmundry Thus when you mention this number in your NEFT application it is understood that you are wishing to remit funds to an account holder ( a/c no. to be mentioned) to HDFC Bank Rajahmundry.The code consists of 11 Characters - First 4 characters represent the entity; Fifth position has been defaulted with a '0' (Zero) for future use; and the Last 6 character denotes the branch identity. IFSC is being identified by the RBI as the code to be used for various payment system projects within the country, and it would, in due course, cover all networked branches in the country. In due course, when all bank branches participate in electronic payment systems, they would need to have a single identifiable unique code and IFSC would serve the purpose effectively.

-

How should I decide whether to transfer money through NEFT or RTGS?

You Should know the below before deciding which one to use:What are the minimum and maximum amount of remittance under RTGS and NEFT?RTGS: Minimum Amount: RS 2 lakhs Maximum Amount: No upper ceiling NEFT: Minimum Amount: No minimum limitMaximum Amount: No upper ceilingWhat are the operating hours of RTGS and NEFT ? RBI has prescribed the following operating hours for NEFT : Presently, NEFT operates in hourly batches - there are twelve settlements from 8 am to 7 pm on week days (Monday through Friday) and six settlements from 8 am to 1 pm on Saturdays. RBI has prescrbed the following operating hours for RTGS : The RTGS service window for customer's transactions is available from 9.00 hours to 16.30 hours on week days and from 9.00 hours to 13.30 hours on Saturdays for settlement at the RBI end. However, remember that the timings of both RTGS and NEFT at the bank can vary depending on the customer timings of the bank branches. Moreover, normally, banks close their own window for accepting the transactions, about 15 minutes before the above time as to allow them to put the transaction in the system so that it signNowes by the upper time limit at the RBI window. Thus, for each bank / branch the above timings may sometimes vary.What are the processing / service Charges for RTGS and NEFT transactions : RTGS : (a) Inward Transactions : Free, no charge to be levied; (b) Outward Transactions: Rs 2 lakh to Rs 5 lakh - Not exceeding Rs 30 per transaction; Above Rs 5 lakh - not exceeding Rs 55 transactions; NEFT :a) Inward transactions at destination bank branches (for credit to beneficiary accounts) - Free, no charges to be levied from beneficiariesb) Outward transactions at originating bank branches – charges applicable for the remitter- For transactions up to Rs 10,000 : not exceeding Rs 2.50 (+ Service Tax)- For transactions above Rs 10,000 up to Rs 1 lakh: not exceeding Rs 5 (+ Service Tax)- For transactions above Rs 1 lakh and up to Rs 2 lakhs: not exceeding Rs 15 (+ Service Tax)- For transactions above Rs 2 lakhs: not exceeding Rs 25 (+ Service Tax) How Much Time it takes to transfer the funds through RTGS? I do not see that transfer takes place on real time basis? In terms of the procedure as laid down by RBI, the beneficiary branches are expected to receive the funds on real time basis as soon as funds are transferred by the remitting bank. However, there are delays due to processing at the remitting and receiving bank. RBI has allowed the beneficiary banks to credit the beneficiary's account within two hours of receiving the funds transfer message. Thus, we do not see the transfers on real time basis and there are some delays. It is hoped that slowly this time will get reduced as more and bank and branches improve their internal transfer system.Hope it helps. Thanks.

-

How do I deposit money to a Koinex wallet via NEFT, IMPS, and RTGS?

i have recently posted a full guide for koinex on my blog. please click here, to visit the article.

-

How much time does it take to transfer money from one account to another in NEFT, RTGS and IMPS?

You ask to know about the”time taken” for transfer of fund, means the gap between the debit from the sender’s account and the crediting the beneficiary’s account.In IMPS and RTGS the time is the least, means the electronic transfer timimng through the server. It can be at the worst cases maximum 30 minutes. Time taken by crediting banker’s server. But in NEFT it is transferred in batches and every batch is of 3 hours gaps. so maximum it can take 3 hours 30 minutes at the maximum.

-

Why do I have to fill RTGS form if I want to transfer money from one bank to another bank?

There are multiple ways to transfer funds from one bank to another. Based on the amount being transferred (minimum amount requirement for few modes) and the time of the day for the transaction (few modes have cutoff time) the mode of transfer will be decided.Now in RTGS (as well as for NEFT and IMPS) there is no mandate for the beneficiary bank to do name validation, which means even if the beneficiary name captured in RTGS message differs from the name of the account maintained in the beneficiary bank, the funds can be credited to the account as far as account number is a valid account number and IFSC code is correct.So to avoid any possible transfer to incorrect account and to avoid later disputes (due to communicate gap/error) application forms are to be filled. Also the beneficiary account has to be captured twice in the application form. Expectation is the person filling the form will refer to the source documents twice for account number while filling the form to avoid oversight (but generally people copy the account number from top while filling the second time, so if the first time account number is wrong, second time also it will be wrong defeating the purpose).However this handled properly in online channels (mobile app & internet banking website), while capturing the account number for the first time it is masked (******) forcing the user to refer the source document for the beneficiary account while entering second time.In nutshell the application form is to avoid transfer to incorrect account and to avoid disputes.Trust i had answered your query.

Create this form in 5 minutes!

How to create an eSignature for the neft rtgs formcdr

How to generate an eSignature for the Neft Rtgs Formcdr in the online mode

How to create an electronic signature for the Neft Rtgs Formcdr in Google Chrome

How to make an electronic signature for signing the Neft Rtgs Formcdr in Gmail

How to make an electronic signature for the Neft Rtgs Formcdr from your smartphone

How to make an electronic signature for the Neft Rtgs Formcdr on iOS

How to create an eSignature for the Neft Rtgs Formcdr on Android devices

People also ask

-

What is the Dcb Bank RTGS Form Printable and how can I use it?

The Dcb Bank RTGS Form Printable is a document that allows you to initiate Real-Time Gross Settlement transactions through Dcb Bank. This form can be easily printed, filled out, and submitted to the bank for processing your fund transfers securely and quickly.

-

How do I obtain the Dcb Bank RTGS Form Printable?

You can obtain the Dcb Bank RTGS Form Printable directly from the Dcb Bank website or through your banking branch. Additionally, using airSlate SignNow, you can easily create and manage this form for electronic signing and submission.

-

Is there a cost associated with using the Dcb Bank RTGS Form Printable?

While the Dcb Bank RTGS Form Printable itself is typically free to download, there may be fees associated with the actual RTGS transactions, depending on the bank’s policy. Using airSlate SignNow can help you minimize costs by providing an affordable eSignature solution for processing these forms.

-

What features does the airSlate SignNow platform offer for the Dcb Bank RTGS Form Printable?

With airSlate SignNow, you can easily upload, edit, and eSign the Dcb Bank RTGS Form Printable. The platform also offers features like document tracking, templates, and integration with your existing tools, making the process seamless and efficient.

-

Can I integrate airSlate SignNow with other banking applications for the Dcb Bank RTGS Form Printable?

Yes, airSlate SignNow can be integrated with various banking and financial applications, allowing you to streamline your workflow for the Dcb Bank RTGS Form Printable. This integration ensures that you can manage your documents and transactions from a single platform.

-

What are the benefits of using airSlate SignNow for the Dcb Bank RTGS Form Printable?

Using airSlate SignNow for the Dcb Bank RTGS Form Printable offers numerous benefits, including enhanced security, quick turnaround times for signatures, and the ability to access your forms from anywhere. This can signNowly simplify your banking processes and save you time.

-

Is the Dcb Bank RTGS Form Printable secure when using airSlate SignNow?

Absolutely! The Dcb Bank RTGS Form Printable processed through airSlate SignNow is protected with advanced security features, including encryption and multi-factor authentication. This ensures that your sensitive banking information remains safe and confidential.

Get more for Dcb Bank Rtgs Form Printable

- Ice o matic warranty verification form

- Montana conditional waiver and release upon final payment mca 71 3 521 et seq montana final release form

- Revision checklist for olevel islamiyat form

- Assupol client portal form

- Hunting permission cards form

- Partner scorecard template form

- Defense service office west form

- Family contract template form

Find out other Dcb Bank Rtgs Form Printable

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template