Enhanced Form NYC 208, Claim for New York City Enhanced Real 2019-2026

What is the Enhanced Form NYC 208, Claim For New York City Enhanced Real

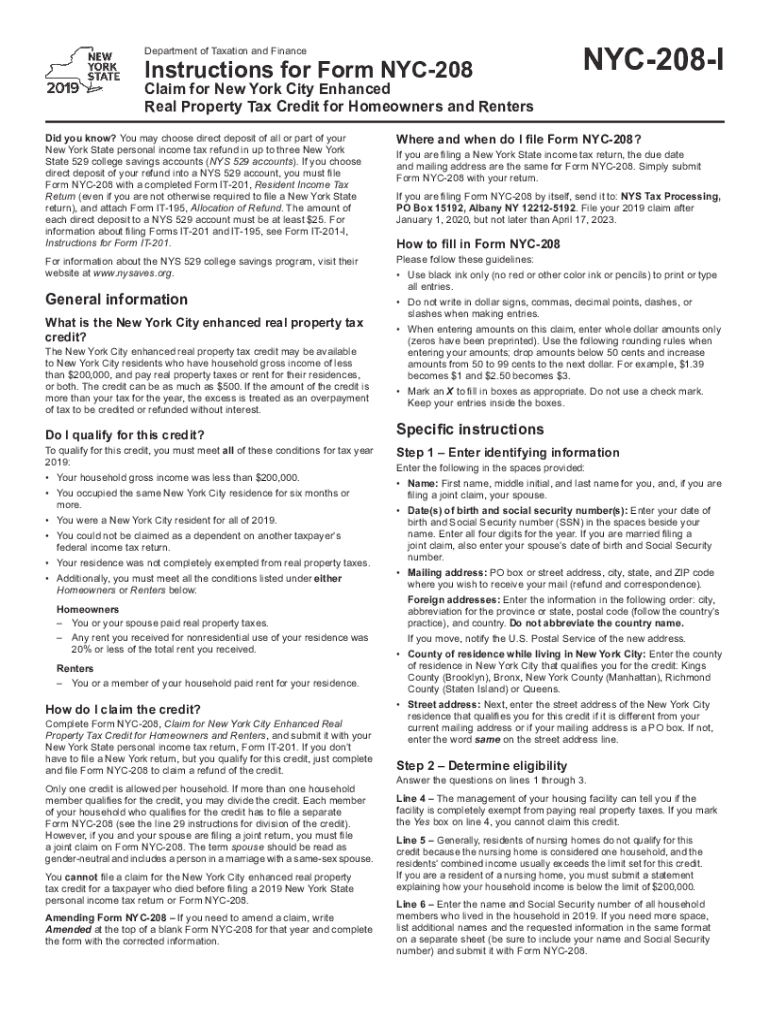

The Enhanced Form NYC 208 is a specific document used to claim enhanced real estate benefits in New York City. This form is essential for individuals seeking to access certain tax benefits or exemptions related to real property. It is designed to streamline the process of claiming these benefits, ensuring that applicants can efficiently present their case to the relevant authorities.

How to use the Enhanced Form NYC 208, Claim For New York City Enhanced Real

Using the Enhanced Form NYC 208 involves several straightforward steps. First, ensure you have all necessary information regarding your property and the specific benefits you are claiming. Next, fill out the form accurately, providing all required details. After completing the form, submit it according to the guidelines provided, ensuring that you keep a copy for your records. This process helps maintain transparency and allows for easy tracking of your claim.

Steps to complete the Enhanced Form NYC 208, Claim For New York City Enhanced Real

Completing the Enhanced Form NYC 208 requires careful attention to detail. Follow these steps:

- Gather all relevant information about your property, including address and ownership details.

- Review the eligibility criteria to ensure you qualify for the benefits.

- Fill out the form, ensuring all sections are completed accurately.

- Attach any required documentation that supports your claim.

- Review the completed form for accuracy before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Required Documents

When submitting the Enhanced Form NYC 208, certain documents are necessary to support your claim. These may include:

- Proof of property ownership, such as a deed.

- Identification documents to verify your identity.

- Any prior tax returns or assessments related to the property.

- Additional documentation as specified by the form instructions.

Eligibility Criteria

To qualify for the benefits associated with the Enhanced Form NYC 208, applicants must meet specific eligibility criteria. Generally, this includes:

- Ownership of the property in question.

- Meeting the income thresholds set by the city.

- Compliance with any other local regulations or requirements.

Form Submission Methods (Online / Mail / In-Person)

The Enhanced Form NYC 208 can be submitted through various methods to accommodate different preferences. Options include:

- Online submission through the official city portal.

- Mailing the completed form to the designated office.

- In-person submission at local government offices.

Quick guide on how to complete enhanced form nyc 208 claim for new york city enhanced real

Complete Enhanced Form NYC 208, Claim For New York City Enhanced Real effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without any hold-ups. Handle Enhanced Form NYC 208, Claim For New York City Enhanced Real on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

Effortlessly edit and eSign Enhanced Form NYC 208, Claim For New York City Enhanced Real

- Find Enhanced Form NYC 208, Claim For New York City Enhanced Real and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark important sections of the documents or redact sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Enhanced Form NYC 208, Claim For New York City Enhanced Real and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct enhanced form nyc 208 claim for new york city enhanced real

Create this form in 5 minutes!

How to create an eSignature for the enhanced form nyc 208 claim for new york city enhanced real

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Enhanced Form NYC 208, Claim For New York City Enhanced Real?

The Enhanced Form NYC 208, Claim For New York City Enhanced Real is a specific form used for claiming enhanced real property tax benefits in New York City. This form is essential for property owners looking to maximize their tax savings and ensure compliance with local regulations.

-

How can airSlate SignNow help with the Enhanced Form NYC 208?

airSlate SignNow provides a streamlined platform for completing and eSigning the Enhanced Form NYC 208, Claim For New York City Enhanced Real. Our solution simplifies the document management process, allowing users to fill out, sign, and submit forms efficiently.

-

What are the pricing options for using airSlate SignNow for the Enhanced Form NYC 208?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Users can choose from monthly or annual subscriptions, ensuring they have access to the tools necessary for managing the Enhanced Form NYC 208, Claim For New York City Enhanced Real at a cost-effective rate.

-

What features does airSlate SignNow offer for the Enhanced Form NYC 208?

Key features of airSlate SignNow include customizable templates, secure eSigning, and real-time collaboration. These tools enhance the user experience when completing the Enhanced Form NYC 208, Claim For New York City Enhanced Real, making the process faster and more efficient.

-

Are there any benefits to using airSlate SignNow for the Enhanced Form NYC 208?

Using airSlate SignNow for the Enhanced Form NYC 208, Claim For New York City Enhanced Real offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely while streamlining the submission process.

-

Can airSlate SignNow integrate with other software for the Enhanced Form NYC 208?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow when dealing with the Enhanced Form NYC 208, Claim For New York City Enhanced Real. This integration allows users to connect their existing tools and improve overall productivity.

-

Is airSlate SignNow user-friendly for completing the Enhanced Form NYC 208?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and complete the Enhanced Form NYC 208, Claim For New York City Enhanced Real. Our intuitive interface ensures that users can quickly learn how to use the platform without extensive training.

Get more for Enhanced Form NYC 208, Claim For New York City Enhanced Real

Find out other Enhanced Form NYC 208, Claim For New York City Enhanced Real

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT