Statement of Business or Professional Activities T2125 and Form

What is the Statement of Business or Professional Activities T2125?

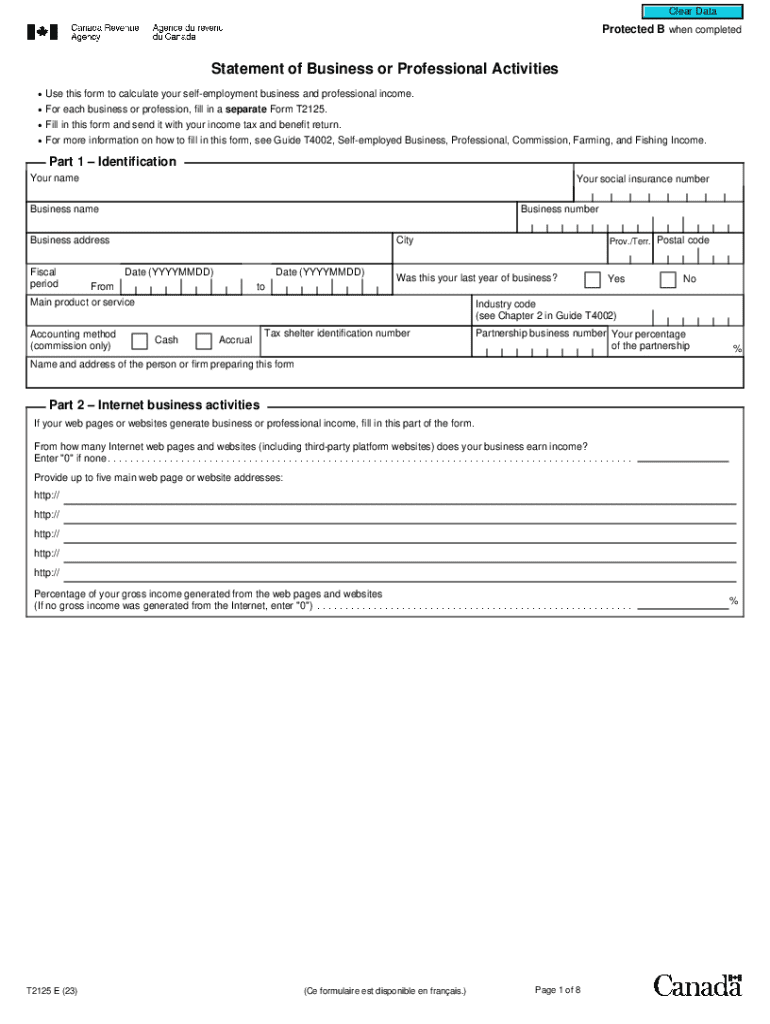

The Statement of Business or Professional Activities T2125 is a crucial form used by self-employed individuals in Canada to report their business income and expenses. This form is essential for calculating the net income from business activities, which is then reported on the individual’s income tax return. The T2125 is particularly relevant for sole proprietors, freelancers, and professionals who operate their own businesses. It provides a structured way to disclose various sources of income, as well as eligible expenses that can be deducted to reduce taxable income.

Key Elements of the Statement of Business or Professional Activities T2125

The T2125 form includes several key sections that require detailed information. These sections typically cover:

- Business Information: This includes the business name, address, and the nature of the business activities.

- Income: Here, taxpayers must report all sources of income generated from their business activities.

- Expenses: This section allows for the deduction of various business-related expenses, such as cost of goods sold (COGS), operating expenses, and other eligible deductions.

- Net Income Calculation: The form culminates in a calculation of net income, which is essential for tax reporting purposes.

Steps to Complete the Statement of Business or Professional Activities T2125

Completing the T2125 form involves several steps to ensure accurate reporting of income and expenses. The following steps can guide individuals through the process:

- Gather Financial Records: Collect all relevant financial documents, including invoices, receipts, and bank statements.

- Fill Out Business Information: Provide accurate details about the business, including its name and type of activities.

- Report Income: Document all income earned from business activities during the tax year.

- List Expenses: Carefully itemize all business expenses, ensuring to include only those that are eligible for deduction.

- Calculate Net Income: Subtract total expenses from total income to determine the net income.

- Review and Submit: Double-check all entries for accuracy before submitting the form with the income tax return.

How to Obtain the Statement of Business or Professional Activities T2125

The T2125 form can be obtained through various channels. Individuals can access it online through the Canada Revenue Agency (CRA) website, where it is available for download in PDF format. Additionally, tax preparation software often includes the T2125 form as part of their offerings, allowing users to fill it out digitally. For those who prefer paper forms, they can also be requested directly from the CRA or obtained at local tax offices.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the T2125 form to avoid penalties. Generally, the deadline for filing personal income tax returns, including the T2125, is April 30 of each year for most individuals. However, if you are self-employed, the deadline extends to June 15, but any taxes owed must still be paid by April 30 to avoid interest charges. Keeping track of these dates is crucial for compliance with tax regulations.

Legal Use of the Statement of Business or Professional Activities T2125

The T2125 form is legally required for self-employed individuals to accurately report their business income and expenses to the CRA. Failing to file this form or providing inaccurate information can lead to penalties, including fines and interest on unpaid taxes. It is important for taxpayers to understand their obligations and ensure that they complete the T2125 accurately to maintain compliance with Canadian tax laws.

Quick guide on how to complete statement of business or professional activities t2125 and

Complete Statement Of Business Or Professional Activities T2125 And effortlessly on any device

Managing online documents has gained traction among businesses and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Statement Of Business Or Professional Activities T2125 And on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Statement Of Business Or Professional Activities T2125 And with ease

- Find Statement Of Business Or Professional Activities T2125 And and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), joining link, or download it to your computer.

Eliminate the worry of lost or misplaced files, monotonous form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any preferred device. Edit and eSign Statement Of Business Or Professional Activities T2125 And and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the statement of business or professional activities t2125 and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is t2125e and how does it relate to airSlate SignNow?

The t2125e form is a tax document used in Canada for self-employed individuals to report their business income. airSlate SignNow simplifies the process of signing and sending the t2125e form electronically, ensuring that you can manage your tax documents efficiently and securely.

-

How much does airSlate SignNow cost for managing t2125e forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while ensuring you have the necessary features to manage your t2125e forms effectively.

-

What features does airSlate SignNow provide for t2125e document management?

With airSlate SignNow, you can easily create, send, and eSign t2125e forms. The platform also offers templates, automated workflows, and secure storage, making it a comprehensive solution for managing your tax documents.

-

Can I integrate airSlate SignNow with other software for t2125e processing?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow for t2125e processing. This integration capability enhances productivity by connecting your existing tools with our eSigning solution.

-

What are the benefits of using airSlate SignNow for t2125e forms?

Using airSlate SignNow for your t2125e forms offers numerous benefits, including time savings, enhanced security, and improved accuracy. The platform ensures that your documents are signed quickly and stored securely, reducing the risk of errors.

-

Is airSlate SignNow user-friendly for completing t2125e forms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete and eSign t2125e forms. The intuitive interface allows users to navigate the platform effortlessly, regardless of their technical skills.

-

How does airSlate SignNow ensure the security of my t2125e documents?

airSlate SignNow prioritizes the security of your t2125e documents by employing advanced encryption and secure cloud storage. This ensures that your sensitive information remains protected throughout the signing process.

Get more for Statement Of Business Or Professional Activities T2125 And

- Wilmington trust directed trustee form

- Inmate personal property inventory form

- Proposal ref no sales person print nameaddressd form

- Lactation consultant referral nbph nbph org form

- Hsbc full partial redemption form hsbc singapore

- Alabama security regulatory board personal license application form

- Building permit application 791412836 form

- Form 512 e oklahoma return of organization exempt from income tax 794951353

Find out other Statement Of Business Or Professional Activities T2125 And

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online