Form 1040NR Siue

What is the Form 1040NR Siue

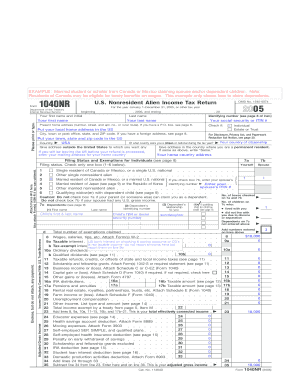

The Form 1040NR Siue is a tax form used by non-resident aliens in the United States to report their income and calculate their tax liability. This form is specifically designed for individuals who do not meet the criteria for resident alien status but have earned income from U.S. sources. It is essential for non-resident aliens to accurately complete this form to comply with U.S. tax regulations and avoid potential penalties.

How to obtain the Form 1040NR Siue

To obtain the Form 1040NR Siue, individuals can visit the official IRS website, where the form is available for download in PDF format. Alternatively, the form can be requested by mail from the IRS. It is advisable to ensure that the most current version of the form is used, as tax regulations may change annually.

Steps to complete the Form 1040NR Siue

Completing the Form 1040NR Siue involves several key steps:

- Gather all necessary documents, including income statements, tax identification numbers, and any relevant deductions.

- Fill out personal information, including name, address, and filing status.

- Report all income earned from U.S. sources, ensuring to include any applicable deductions and credits.

- Calculate the total tax liability based on the reported income.

- Sign and date the form before submission.

Key elements of the Form 1040NR Siue

The Form 1040NR Siue includes several key elements that are crucial for accurate reporting:

- Personal Information: This section requires basic details about the taxpayer.

- Income Reporting: All income from U.S. sources must be reported, including wages, dividends, and rental income.

- Deductions and Credits: Eligible deductions and credits can help reduce the overall tax liability.

- Tax Calculation: This section calculates the total tax owed based on the reported income.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040NR Siue are typically aligned with the U.S. tax calendar. Non-resident aliens must file their tax returns by April fifteenth of the following year. If additional time is needed, an extension can be requested, but it is important to ensure that any taxes owed are paid by the original deadline to avoid penalties.

Required Documents

When completing the Form 1040NR Siue, certain documents are necessary to support the information reported. These may include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Tax identification numbers, such as a Social Security Number or Individual Taxpayer Identification Number.

- Documentation of any deductions or credits claimed.

Quick guide on how to complete form 1040nr siue

Complete [SKS] effortlessly on any device

Web-based document management has become prevalent among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the needed form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] without effort

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at each stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1040NR Siue

Create this form in 5 minutes!

How to create an eSignature for the form 1040nr siue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040NR Siue and who needs it?

Form 1040NR Siue is a tax form specifically designed for non-resident aliens who need to report their income to the IRS. If you are a non-resident alien earning income in the United States, you are required to file this form to ensure compliance with tax regulations.

-

How can airSlate SignNow help with Form 1040NR Siue?

airSlate SignNow streamlines the process of completing and eSigning Form 1040NR Siue. With its user-friendly interface, you can easily fill out the form, gather necessary signatures, and send it securely, making tax filing more efficient.

-

What are the pricing options for using airSlate SignNow for Form 1040NR Siue?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose from monthly or annual subscriptions, ensuring you have access to all features necessary for managing Form 1040NR Siue at a cost-effective rate.

-

Are there any integrations available for Form 1040NR Siue with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage Form 1040NR Siue alongside your existing tools. This integration enhances productivity by enabling you to access documents and data from multiple platforms in one place.

-

What features does airSlate SignNow offer for managing Form 1040NR Siue?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for Form 1040NR Siue. These features ensure that your tax documents are completed accurately and submitted on time.

-

Is airSlate SignNow secure for handling Form 1040NR Siue?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your Form 1040NR Siue and other sensitive documents. You can trust that your information is safe while using our platform.

-

Can I access Form 1040NR Siue on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage Form 1040NR Siue on the go. This flexibility ensures that you can complete your tax documents anytime, anywhere.

Get more for Form 1040NR Siue

- Fl llc form

- Florida estate form

- Notice of dishonored check civil keywords bad check bounced check florida form

- Check bad form

- Mutual wills containing last will and testaments for unmarried persons living together with no children florida form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children florida form

- Will not married form

- Florida cohabitation form

Find out other Form 1040NR Siue

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now