41 CFR105 57 008 Amounts Withheld CFRUS LawLII Form

What is the 41 CFR105 57 008 Amounts Withheld CFRUS LawLII

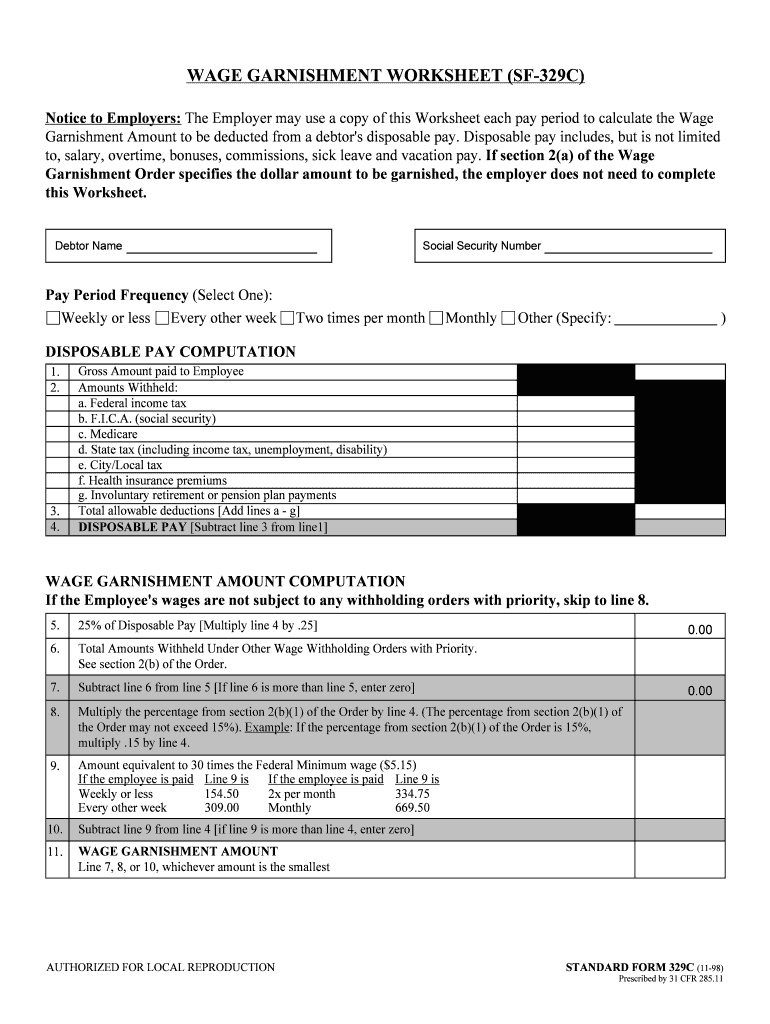

The 41 CFR105 57 008 Amounts Withheld CFRUS LawLII form is a crucial document used in the United States for reporting specific amounts withheld from payments. This form is essential for compliance with federal regulations, ensuring that the correct amounts are reported to the appropriate authorities. It serves as a record of withheld taxes and other deductions, which are necessary for accurate financial reporting and tax obligations.

Steps to Complete the 41 CFR105 57 008 Amounts Withheld CFRUS LawLII

Completing the 41 CFR105 57 008 Amounts Withheld CFRUS LawLII form involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including payment details and withholding amounts.

- Fill out the form with accurate data, ensuring all required fields are completed.

- Review the information for any errors or omissions.

- Submit the form electronically or via mail, following the submission guidelines provided.

Legal Use of the 41 CFR105 57 008 Amounts Withheld CFRUS LawLII

The legal use of the 41 CFR105 57 008 Amounts Withheld CFRUS LawLII form is governed by federal regulations that mandate accurate reporting of withheld amounts. This form must be filled out in accordance with the guidelines set forth by the Internal Revenue Service (IRS) and other regulatory bodies. Proper use ensures that businesses comply with tax laws and avoid potential penalties for misreporting.

How to Obtain the 41 CFR105 57 008 Amounts Withheld CFRUS LawLII

The 41 CFR105 57 008 Amounts Withheld CFRUS LawLII form can be obtained through various channels. It is typically available on government websites, including the IRS and other federal agencies. Additionally, businesses can access it through accounting software that integrates federal forms, making it easier to complete and submit electronically.

Examples of Using the 41 CFR105 57 008 Amounts Withheld CFRUS LawLII

Examples of using the 41 CFR105 57 008 Amounts Withheld CFRUS LawLII form include:

- Employers reporting withheld income taxes from employee wages.

- Businesses documenting amounts withheld from payments to contractors.

- Organizations ensuring compliance with federal withholding requirements for various payments.

Filing Deadlines / Important Dates

Filing deadlines for the 41 CFR105 57 008 Amounts Withheld CFRUS LawLII form are crucial for compliance. Typically, these forms must be submitted by specific dates set by the IRS, often coinciding with quarterly tax deadlines. It is important to stay informed about these dates to avoid penalties and ensure timely reporting.

Quick guide on how to complete cfrus

Effortlessly Prepare cfrus on Any Device

Managing documents online has gained popularity among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage cfrus on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and Electronically Sign cfrus with Ease

- Locate cfrus and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that function.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device. Edit and electronically sign cfrus and ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to cfrus

Create this form in 5 minutes!

How to create an eSignature for the cfrus

How to make an electronic signature for your 41 Cfr105 57008 Amounts Withheldcfrus Lawlii in the online mode

How to create an eSignature for your 41 Cfr105 57008 Amounts Withheldcfrus Lawlii in Chrome

How to create an eSignature for signing the 41 Cfr105 57008 Amounts Withheldcfrus Lawlii in Gmail

How to make an eSignature for the 41 Cfr105 57008 Amounts Withheldcfrus Lawlii right from your mobile device

How to generate an eSignature for the 41 Cfr105 57008 Amounts Withheldcfrus Lawlii on iOS devices

How to make an electronic signature for the 41 Cfr105 57008 Amounts Withheldcfrus Lawlii on Android OS

People also ask cfrus

-

What is cfrus and how does it relate to airSlate SignNow?

Cfrus is a vital consideration for businesses looking to streamline their document signing processes. airSlate SignNow incorporates cfrus principles to ensure that your eSigning experiences are not only effective but also compliant with regulatory standards. This makes it easier for organizations to manage documents securely.

-

How does airSlate SignNow’s pricing compare when focusing on cfrus compliance?

When considering cfrus compliance, airSlate SignNow offers competitive pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, affordable options are available to ensure that you can achieve cfrus compliance without straining your budget. You get flexibility and value for your investment.

-

What features of airSlate SignNow help with cfrus compliance?

airSlate SignNow includes features specifically designed to maintain cfrus compliance. These features include secure document storage, detailed audit trails, and strong authentication options, ensuring that all eSigned documents meet regulatory requirements. This makes managing compliance straightforward for businesses of all sizes.

-

Can airSlate SignNow integrate with other tools to support cfrus?

Yes, airSlate SignNow offers seamless integration with a variety of third-party applications that can support cfrus compliance. Whether you use CRM software or accounting tools, integrating these with airSlate SignNow can help you manage eSigning workflows while ensuring compliance with cfrus requirements. This enhances efficiency across your operations.

-

What are the benefits of using airSlate SignNow for cfrus-related processes?

Using airSlate SignNow for cfrus-related processes provides businesses with an efficient and cost-effective solution for eSigning documents. It reduces turnaround time and minimizes paper usage, making your organization more environmentally friendly. Additionally, by ensuring compliance, you protect your business from potential legal issues.

-

Is airSlate SignNow user-friendly for teams managing cfrus documentation?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, making it perfect for teams managing cfrus documentation. The intuitive interface allows users to easily navigate through the eSigning process, reducing the learning curve and increasing productivity across your team. This ensures that everyone can contribute to achieving compliance effortlessly.

-

How does airSlate SignNow ensure the security of cfrus transactions?

AirSlate SignNow prioritizes security in all transactions, playing a crucial role in cfrus compliance. With advanced encryption, secure servers, and authentication protocols, your document security is guaranteed. This ensures that sensitive information remains protected while meeting cfrus guidelines effectively.

Get more for cfrus

- Fanniemae request for verification of employment form

- Cenored otjiwarongo form

- Mi 1040 michigan income tax return form mi 1040 michigan income tax return michigan

- State of california electrical power distribution cecnrcielc01e created 0116 california energy commission certificate of form

- Student behavior contract bishop hartley high school bishop hartley form

- Confidential form c character certificate i to whom it may kicsit edu

- Vancouver one card low income form

- Cp0090 form

Find out other cfrus

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form