MI 1040, Michigan Income Tax Return Form MI 1040, Michigan Income Tax Return Michigan

What is the MI 1040, Michigan Income Tax Return Form MI 1040, Michigan Income Tax Return Michigan

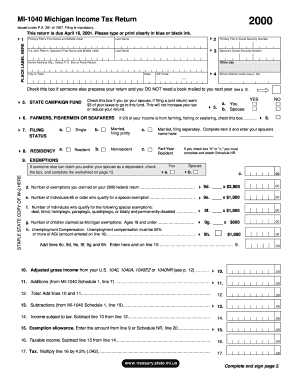

The MI 1040 is the official Michigan Income Tax Return form that residents use to report their income and calculate their state tax liability. This form is essential for individuals who earn income in Michigan, whether through employment, self-employment, or other sources. It captures various types of income, deductions, and credits that taxpayers may be eligible for, ensuring compliance with state tax laws.

Steps to complete the MI 1040, Michigan Income Tax Return Form MI 1040, Michigan Income Tax Return Michigan

Completing the MI 1040 involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and other sources.

- Claim any deductions or credits you qualify for, such as the standard deduction or Michigan-specific credits.

- Calculate your tax liability based on the provided tax tables.

- Sign and date the form to validate your submission.

How to obtain the MI 1040, Michigan Income Tax Return Form MI 1040, Michigan Income Tax Return Michigan

The MI 1040 can be obtained through multiple channels. Taxpayers can download the form directly from the Michigan Department of Treasury's website or request a physical copy by contacting their local tax office. Additionally, many tax preparation software programs include the MI 1040, allowing for easy completion and electronic filing.

Legal use of the MI 1040, Michigan Income Tax Return Form MI 1040, Michigan Income Tax Return Michigan

The MI 1040 is legally binding when completed accurately and submitted on time. It must adhere to the regulations set forth by the Michigan Department of Treasury. Electronic submissions are accepted and must comply with the eSignature laws to ensure their validity. Properly filing this form is crucial to avoid penalties and ensure compliance with state tax obligations.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines related to the MI 1040. Typically, the filing deadline for the MI 1040 aligns with the federal tax deadline, which is usually April fifteenth. However, extensions may be available, allowing additional time for filing. It is essential to stay informed about any changes to these dates to avoid late filing penalties.

Required Documents

To complete the MI 1040 accurately, taxpayers need to gather several documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as interest or dividends

- Documentation for any deductions or credits claimed

Form Submission Methods (Online / Mail / In-Person)

The MI 1040 can be submitted through various methods. Taxpayers can file online using approved tax software, which often simplifies the process and allows for electronic signatures. Alternatively, forms can be mailed to the Michigan Department of Treasury or submitted in person at designated tax offices. Each method has its own processing times and requirements, so choosing the best option for your situation is important.

Quick guide on how to complete mi 1040 michigan income tax return form mi 1040 michigan income tax return michigan

Effortlessly prepare MI 1040, Michigan Income Tax Return Form MI 1040, Michigan Income Tax Return Michigan on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle MI 1040, Michigan Income Tax Return Form MI 1040, Michigan Income Tax Return Michigan on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and electronically sign MI 1040, Michigan Income Tax Return Form MI 1040, Michigan Income Tax Return Michigan with ease

- Find MI 1040, Michigan Income Tax Return Form MI 1040, Michigan Income Tax Return Michigan and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to store your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign MI 1040, Michigan Income Tax Return Form MI 1040, Michigan Income Tax Return Michigan to ensure exemplary communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi 1040 michigan income tax return form mi 1040 michigan income tax return michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MI 1040, Michigan Income Tax Return Form MI 1040?

The MI 1040, Michigan Income Tax Return Form MI 1040, is the official document that residents of Michigan use to report their personal income to the state. This form allows individuals to calculate their tax obligations and claim any applicable deductions or credits. Completing this form accurately is essential for compliance with Michigan tax laws.

-

How can I file my MI 1040, Michigan Income Tax Return Form MI 1040 using airSlate SignNow?

You can file your MI 1040, Michigan Income Tax Return Form MI 1040 through airSlate SignNow by utilizing our user-friendly eSignature features. Simply upload your completed form, add necessary signatures, and send it securely. Our platform streamlines the filing process, making it both efficient and compliant with Michigan regulations.

-

What are the pricing options for using airSlate SignNow to complete my MI 1040, Michigan Income Tax Return Form MI 1040?

airSlate SignNow offers several pricing tiers that cater to different needs, allowing you to choose a plan that best fits your budget for eSigning your MI 1040, Michigan Income Tax Return Form MI 1040. With our cost-effective solutions, you can efficiently manage your tax documents without breaking the bank. Visit our website for detailed pricing information.

-

What features does airSlate SignNow provide for managing the MI 1040, Michigan Income Tax Return Form MI 1040?

airSlate SignNow provides a range of features to enhance your experience with the MI 1040, Michigan Income Tax Return Form MI 1040, including customizable templates, bulk sending options, and secure cloud storage. These features simplify the process of preparing and filing your tax return, while ensuring all documents are signed and stored safely.

-

What benefits can I expect from using airSlate SignNow for my MI 1040, Michigan Income Tax Return Form MI 1040?

Using airSlate SignNow for your MI 1040, Michigan Income Tax Return Form MI 1040 can save you time and effort, as our platform streamlines the eSigning process. You'll benefit from increased accuracy and reduced paper waste, along with peace of mind knowing your tax documents are compliant with Michigan laws. Plus, our customer support is always available to assist you.

-

Does airSlate SignNow integrate with accounting software for filing the MI 1040, Michigan Income Tax Return Form MI 1040?

Yes, airSlate SignNow seamlessly integrates with various accounting software programs, making it easier for you to file your MI 1040, Michigan Income Tax Return Form MI 1040. These integrations allow for smooth data transfer and enhanced workflow, ensuring that your financial information is captured accurately and efficiently.

-

Is it safe to use airSlate SignNow for submitting my MI 1040, Michigan Income Tax Return Form MI 1040?

Absolutely! airSlate SignNow prioritizes security and provides a safe platform for submitting your MI 1040, Michigan Income Tax Return Form MI 1040. We use top-notch encryption and comply with strict data privacy regulations to ensure that your sensitive information is well-protected throughout the signing process.

Get more for MI 1040, Michigan Income Tax Return Form MI 1040, Michigan Income Tax Return Michigan

- If something should happen pdf form

- Hccp certification practice test form

- Black water barrels form

- Prior authorization form

- Health alaska govdphvitalstatsalaska marriage certificate request form

- Marriage license application health analytics vi form

- Mental capacity assessment form 788517409

- Design and access statement template form

Find out other MI 1040, Michigan Income Tax Return Form MI 1040, Michigan Income Tax Return Michigan

- Help Me With Sign Colorado Affidavit of Title

- How Do I Sign Massachusetts Affidavit of Title

- How Do I Sign Oklahoma Affidavit of Title

- Help Me With Sign Pennsylvania Affidavit of Title

- Can I Sign Pennsylvania Affidavit of Title

- How Do I Sign Alabama Cease and Desist Letter

- Sign Arkansas Cease and Desist Letter Free

- Sign Hawaii Cease and Desist Letter Simple

- Sign Illinois Cease and Desist Letter Fast

- Can I Sign Illinois Cease and Desist Letter

- Sign Iowa Cease and Desist Letter Online

- Sign Maryland Cease and Desist Letter Myself

- Sign Maryland Cease and Desist Letter Free

- Sign Mississippi Cease and Desist Letter Free

- Sign Nevada Cease and Desist Letter Simple

- Sign New Jersey Cease and Desist Letter Free

- How Can I Sign North Carolina Cease and Desist Letter

- Sign Oklahoma Cease and Desist Letter Safe

- Sign Indiana End User License Agreement (EULA) Myself

- Sign Colorado Hold Harmless (Indemnity) Agreement Now