GIFT RECEIPT FORM Stevens

What is the GIFT RECEIPT FORM Stevens

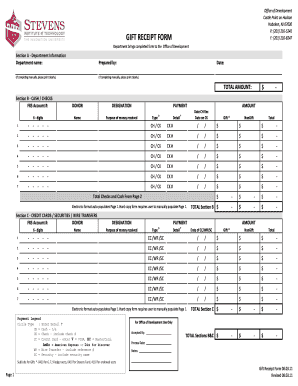

The GIFT RECEIPT FORM Stevens is a document used to acknowledge the receipt of a gift. This form serves as proof for both the giver and the recipient, detailing the nature and value of the gift. It is particularly useful for tax purposes, as it helps in documenting non-cash gifts that may need to be reported to the IRS. This form is essential for maintaining transparency in financial transactions and ensuring compliance with applicable tax regulations.

How to use the GIFT RECEIPT FORM Stevens

Using the GIFT RECEIPT FORM Stevens involves several straightforward steps. First, the giver must fill out the form, providing their name, address, and details about the gift, including its value and description. The recipient should also provide their information to confirm the acceptance of the gift. Once completed, both parties should retain a copy of the form for their records, as it may be necessary for future reference, especially during tax season.

Steps to complete the GIFT RECEIPT FORM Stevens

Completing the GIFT RECEIPT FORM Stevens requires careful attention to detail. Follow these steps:

- Begin by entering the giver's full name and contact information.

- Provide a detailed description of the gift, including its condition and any relevant serial numbers.

- Indicate the fair market value of the gift at the time of transfer.

- Include the recipient's name and contact information.

- Both parties should sign and date the form to validate the transaction.

Legal use of the GIFT RECEIPT FORM Stevens

The GIFT RECEIPT FORM Stevens has legal significance, particularly in the context of tax reporting. It is essential for documenting gifts that exceed certain monetary thresholds, which may require the giver to file a gift tax return. By maintaining accurate records through this form, both the giver and recipient can safeguard against potential disputes regarding the value or existence of the gift. This documentation is also crucial for estate planning and ensuring compliance with IRS regulations.

IRS Guidelines

The IRS has specific guidelines regarding the reporting of gifts, which the GIFT RECEIPT FORM Stevens helps to address. Gifts exceeding the annual exclusion amount must be reported, and the form serves as documentation for both the giver and recipient. It is advisable to consult IRS publications or a tax professional to understand the implications of gifting and the necessary reporting requirements. This ensures that both parties remain compliant with federal tax laws and avoid penalties.

Examples of using the GIFT RECEIPT FORM Stevens

There are various scenarios in which the GIFT RECEIPT FORM Stevens can be utilized. For instance, if an individual gifts a piece of jewelry valued at one thousand dollars to a friend, they should complete the form to document the transaction. Similarly, a parent gifting a vehicle to their child would also benefit from using this form to outline the details of the gift. These examples illustrate the importance of maintaining clear records for both personal and tax-related purposes.

Quick guide on how to complete gift receipt form stevens

Prepare [SKS] effortlessly on any device

The management of online documents has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly alternative to conventional printed and signed materials, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which only takes seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that require you to print new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to GIFT RECEIPT FORM Stevens

Create this form in 5 minutes!

How to create an eSignature for the gift receipt form stevens

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a GIFT RECEIPT FORM Stevens?

A GIFT RECEIPT FORM Stevens is a specialized document that allows businesses to provide customers with a receipt for gifts. This form is essential for returns and exchanges, ensuring that recipients can easily verify the purchase. Using airSlate SignNow, you can create and manage GIFT RECEIPT FORMs efficiently.

-

How can I create a GIFT RECEIPT FORM Stevens using airSlate SignNow?

Creating a GIFT RECEIPT FORM Stevens with airSlate SignNow is straightforward. Simply log in to your account, select the template for gift receipts, and customize it to fit your needs. Our platform allows you to add fields, logos, and other branding elements to make your form unique.

-

Is there a cost associated with using the GIFT RECEIPT FORM Stevens?

Yes, there is a cost associated with using airSlate SignNow for creating GIFT RECEIPT FORMs Stevens. However, our pricing plans are designed to be cost-effective, providing great value for businesses of all sizes. You can choose a plan that best fits your needs and budget.

-

What features does the GIFT RECEIPT FORM Stevens offer?

The GIFT RECEIPT FORM Stevens offers several features, including customizable templates, electronic signatures, and secure storage. With airSlate SignNow, you can easily track the status of your forms and ensure that they are signed and returned promptly. This streamlines the process for both you and your customers.

-

How does the GIFT RECEIPT FORM Stevens benefit my business?

Using the GIFT RECEIPT FORM Stevens can enhance customer satisfaction by simplifying the return and exchange process. It provides clarity and transparency for gift recipients, which can lead to increased trust in your brand. Additionally, it helps you maintain organized records of transactions.

-

Can I integrate the GIFT RECEIPT FORM Stevens with other software?

Absolutely! airSlate SignNow allows for seamless integration with various software applications, including CRM and eCommerce platforms. This means you can easily incorporate the GIFT RECEIPT FORM Stevens into your existing workflows, enhancing efficiency and productivity.

-

Is the GIFT RECEIPT FORM Stevens legally binding?

Yes, the GIFT RECEIPT FORM Stevens created through airSlate SignNow is legally binding when signed electronically. Our platform complies with e-signature laws, ensuring that your documents hold up in court if necessary. This adds an extra layer of security and trust for your transactions.

Get more for GIFT RECEIPT FORM Stevens

- Maine llc company form

- Maine notice owner form

- Maine warranty deed 497310751 form

- Notice to owner corporation or llc maine form

- Discharge of lien by individual maine form

- Maine lien form

- Conditional waiver and release upon progress payment individual maine form

- Conditional waiver and release upon progress payment corporation or llc maine form

Find out other GIFT RECEIPT FORM Stevens

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple