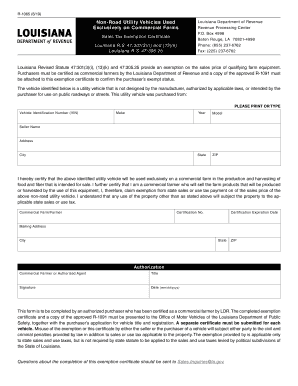

R 1065 619 Form

What is the R 1065 619

The R 1065 619 is a specific form used in the United States for reporting income, deductions, and credits for partnerships. This form is essential for partnerships to accurately report their financial activities to the Internal Revenue Service (IRS). It provides a comprehensive overview of the partnership's financial status and helps ensure compliance with federal tax regulations.

How to use the R 1065 619

Using the R 1065 619 involves several steps to ensure accurate reporting. First, gather all necessary financial information, including income, expenses, and any applicable deductions. Next, complete the form by entering the partnership's details, such as the name, address, and tax identification number. Be sure to report all income and expenses accurately to avoid penalties. Once completed, the form must be filed with the IRS by the designated deadline.

Steps to complete the R 1065 619

Completing the R 1065 619 requires careful attention to detail. Follow these steps:

- Collect financial records, including income statements and receipts for expenses.

- Fill in the partnership information, including the name and address.

- Report all sources of income, ensuring to categorize them correctly.

- List all deductions and credits applicable to the partnership.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the R 1065 619 are crucial for compliance. Typically, the form must be submitted by March 15 of the year following the tax year being reported. If the deadline falls on a weekend or holiday, it is extended to the next business day. Partnerships may also request an extension, but it is important to file for an extension before the original deadline.

Legal use of the R 1065 619

The R 1065 619 is legally required for partnerships operating in the United States. It serves as a formal declaration of the partnership's financial activities and is used by the IRS to assess tax liabilities. Failure to file this form can result in penalties and interest on unpaid taxes. Therefore, it is essential for partnerships to understand their legal obligations regarding this form.

Required Documents

Before completing the R 1065 619, certain documents are necessary to ensure accurate reporting. These documents typically include:

- Financial statements, including profit and loss statements.

- Receipts for all business-related expenses.

- Records of any income received by the partnership.

- Details of any deductions or credits the partnership intends to claim.

Who Issues the Form

The R 1065 619 is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax collection and enforcement of tax laws in the United States. The form is specifically designed for partnerships to report their income and expenses, ensuring compliance with federal tax regulations.

Quick guide on how to complete r 1065 619

Complete R 1065 619 seamlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without interruptions. Handle R 1065 619 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign R 1065 619 effortlessly

- Locate R 1065 619 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign R 1065 619 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 1065 619

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is R 1065 619 and how does it relate to airSlate SignNow?

R 1065 619 is a specific form used for tax purposes, and airSlate SignNow provides a seamless way to eSign and send this document. With our platform, you can easily manage your R 1065 619 forms, ensuring compliance and efficiency in your business operations.

-

How much does airSlate SignNow cost for handling R 1065 619 documents?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our pricing is designed to be cost-effective, allowing you to manage your R 1065 619 documents without breaking the bank, with various subscription options available.

-

What features does airSlate SignNow offer for R 1065 619 document management?

Our platform includes features such as customizable templates, secure eSigning, and document tracking specifically for R 1065 619 forms. These tools enhance your workflow, making it easier to manage and sign important documents efficiently.

-

Can I integrate airSlate SignNow with other software for R 1065 619 processing?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to streamline your R 1065 619 processing. This means you can connect with your existing tools for a more cohesive workflow, enhancing productivity.

-

What are the benefits of using airSlate SignNow for R 1065 619 forms?

Using airSlate SignNow for your R 1065 619 forms provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are handled securely while simplifying the signing process.

-

Is airSlate SignNow user-friendly for managing R 1065 619 documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage R 1065 619 documents. Our intuitive interface allows users to navigate the platform effortlessly, regardless of their technical expertise.

-

How does airSlate SignNow ensure the security of R 1065 619 documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your R 1065 619 documents, ensuring that your sensitive information remains confidential and safe from unauthorized access.

Get more for R 1065 619

- Annex 1b form

- Independent student petition parent affidavit asu students site students asu form

- Lexington excess flood app form

- Affidavit of indigency harris county form

- Petition for a court order of protection adult missouri courts form

- For your protection and privacy press the clear t 576589444 form

- Ab 540 form mt san antonio college mtsac

- Accounting firm partnership agreement template form

Find out other R 1065 619

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free