AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 DOC Form

What is the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc

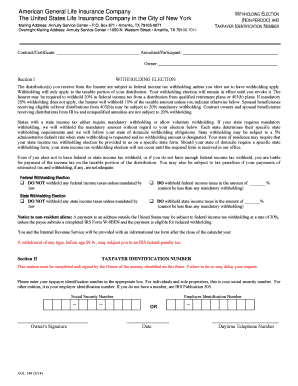

The AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 document is a specific form used for tax purposes in the United States. It allows taxpayers to make withholding elections related to non-periodic payments, ensuring proper tax withholding in accordance with IRS regulations. This form is essential for individuals or entities receiving certain types of income, as it helps determine the correct amount of tax to withhold from payments made to them.

How to use the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc

To use the AGL 149 form, taxpayers must complete it accurately, providing necessary information such as their Taxpayer Identification Number (TIN) and details regarding the type of income they expect to receive. Once filled out, the form should be submitted to the appropriate payer or withholding agent, who will use the information to calculate withholding amounts. It is important to keep a copy of the completed form for personal records and future reference.

Steps to complete the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc

Completing the AGL 149 form involves several straightforward steps:

- Gather necessary personal information, including your Taxpayer Identification Number (TIN).

- Identify the type of non-periodic payment you will receive.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate withholding agent or payer.

Key elements of the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc

Key elements of the AGL 149 form include:

- Taxpayer Identification Number (TIN): Essential for identifying the taxpayer.

- Type of Payment: Specifies the nature of the non-periodic payment.

- Withholding Election: Allows the taxpayer to indicate their withholding preferences.

- Signature: Required to validate the information provided on the form.

Legal use of the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc

The AGL 149 form is legally recognized by the IRS and must be used in compliance with federal tax regulations. It is important for taxpayers to understand that failing to submit this form or providing inaccurate information can lead to incorrect withholding, potentially resulting in tax liabilities or penalties. Proper use of the form ensures that withholding is aligned with the taxpayer's financial situation, promoting compliance with tax laws.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of filing deadlines associated with the AGL 149 form. Generally, the form should be submitted before the first payment is made to ensure correct withholding from the outset. Specific deadlines may vary based on the type of payment and the payer's requirements, so it is advisable to check for any updates or changes in regulations that may affect timing.

Quick guide on how to complete agl 149 withholding election non periodic ampamp taxpayer identification number 3 14 doc

Effortlessly Prepare AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to swiftly create, modify, and eSign your documents without any holdups. Manage AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

The Simplest Way to Modify and eSign AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc with Ease

- Find AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize relevant sections of the documents or black out sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and the need to print new copies due to errors. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the agl 149 withholding election non periodic ampamp taxpayer identification number 3 14 doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc?

The AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc is a crucial document for taxpayers to manage their withholding elections effectively. It helps ensure compliance with tax regulations and simplifies the process of reporting income. Understanding this document is essential for accurate tax filing.

-

How can airSlate SignNow assist with the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc?

airSlate SignNow provides a user-friendly platform to create, send, and eSign the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc. Our solution streamlines the document management process, making it easier for businesses to handle their tax-related paperwork efficiently.

-

What are the pricing options for using airSlate SignNow for the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while providing access to essential features for managing the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc.

-

What features does airSlate SignNow offer for managing the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking for the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc. These features enhance efficiency and ensure that your documents are processed quickly and securely.

-

Are there any integrations available for the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc?

Using airSlate SignNow for the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the signing process, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling the AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc is protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the signing process.

Get more for AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc

Find out other AGL 149 Withholding Election Non Periodic & Taxpayer Identification Number 3 14 doc

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form