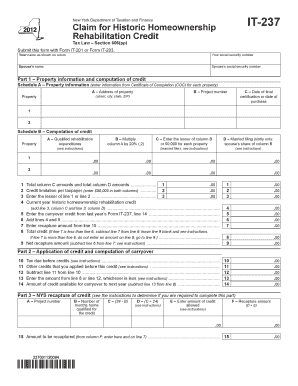

It 237 Instructions Form

What is the IT 237 Instructions?

The IT 237 instructions form is a crucial document used in the United States for various tax-related purposes. It provides detailed guidelines on how to report specific income, deductions, and credits to ensure compliance with federal tax regulations. This form is particularly important for individuals and businesses seeking clarity on their tax obligations, as it outlines the necessary steps to accurately complete their tax filings.

How to Use the IT 237 Instructions

Using the IT 237 instructions involves carefully following the guidelines provided to ensure accurate completion of the form. Start by reviewing the instructions thoroughly, paying close attention to the sections that pertain to your specific situation. It is essential to gather all required documentation and information before beginning the form. This preparation will help streamline the process and reduce the likelihood of errors.

Steps to Complete the IT 237 Instructions

Completing the IT 237 instructions requires a systematic approach. Here are the key steps:

- Review the eligibility criteria outlined in the instructions.

- Gather all necessary documents, such as income statements and previous tax returns.

- Fill out the form accurately, ensuring all information is complete and correct.

- Double-check your entries against the guidelines to avoid mistakes.

- Submit the completed form by the specified deadline, either electronically or by mail.

Legal Use of the IT 237 Instructions

The IT 237 instructions are legally binding when completed correctly and submitted in accordance with IRS regulations. To ensure legal compliance, it is vital to follow the guidelines precisely, as any inaccuracies can lead to penalties or audits. The form must be signed and dated, affirming that the information provided is true and accurate to the best of the signer's knowledge.

Filing Deadlines / Important Dates

Filing deadlines for the IT 237 instructions vary depending on the type of taxpayer and the specific tax year. Generally, the deadline for individual tax returns is April 15, while businesses may have different deadlines based on their fiscal year. It is crucial to stay informed about these dates to avoid late fees and penalties. Marking your calendar with these important dates can help ensure timely submissions.

Required Documents

To complete the IT 237 instructions, certain documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother completion process and help ensure all necessary information is included.

Quick guide on how to complete it 237 instructions

Effortlessly Prepare It 237 Instructions on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any delays. Manage It 237 Instructions on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and eSign It 237 Instructions with Ease

- Locate It 237 Instructions and click Get Form to commence.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or disorganized documents, tiresome form searching, or mistakes that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign It 237 Instructions and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 237 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 237 feature in airSlate SignNow?

The IT 237 feature in airSlate SignNow refers to an advanced electronic signature solution designed to streamline document signing processes. It allows users to easily send, sign, and manage documents digitally while ensuring compliance with legal standards.

-

How much does the IT 237 plan cost?

Pricing for the IT 237 plan in airSlate SignNow varies based on the number of users and features required. Typically, the plan starts at an affordable monthly rate, making it a cost-effective solution for businesses of all sizes.

-

What are the key benefits of using IT 237?

The IT 237 offers numerous benefits including increased efficiency in document workflows, enhanced security features, and reduced turnaround times for signing documents. It empowers businesses to operate seamlessly while saving time and resources.

-

Is IT 237 suitable for all business sizes?

Yes, the IT 237 feature is designed to cater to businesses of all sizes, from startups to large enterprises. Its flexible pricing and customizable features make it an ideal choice for any organization looking to enhance their document management processes.

-

What integrations does IT 237 support?

airSlate SignNow's IT 237 supports a wide range of integrations with popular applications such as Google Drive, Salesforce, and Microsoft Office Suite. This allows users to incorporate electronic signing into their existing workflows seamlessly.

-

How secure is the IT 237 signing process?

The IT 237 signing process is highly secure, utilizing encryption and secure storage to protect sensitive information. With compliance to legal standards, users can trust that their document transactions are safe.

-

Can I customize documents with IT 237?

Absolutely! The IT 237 feature in airSlate SignNow allows users to customize documents according to their specific needs. This includes adding fields, checkboxes, or notes to streamline the signing process.

Get more for It 237 Instructions

- U s customs declaration form

- Ps form 5436 2010 2019

- California residential purchase agreement rpa title advantage form

- Short form prime contract between owner amp contractor agc agc ca 100338454

- Relations settlement form

- Series determination a b c and small quantity c form 1093a dtsc ca

- Write sheet spelling words blank form

- Switch2tmobilecom form

Find out other It 237 Instructions

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free