Form R 1303 "Application for Exemption for Nonprofit

What is the Form R-1303 "Application For Exemption For Nonprofit"

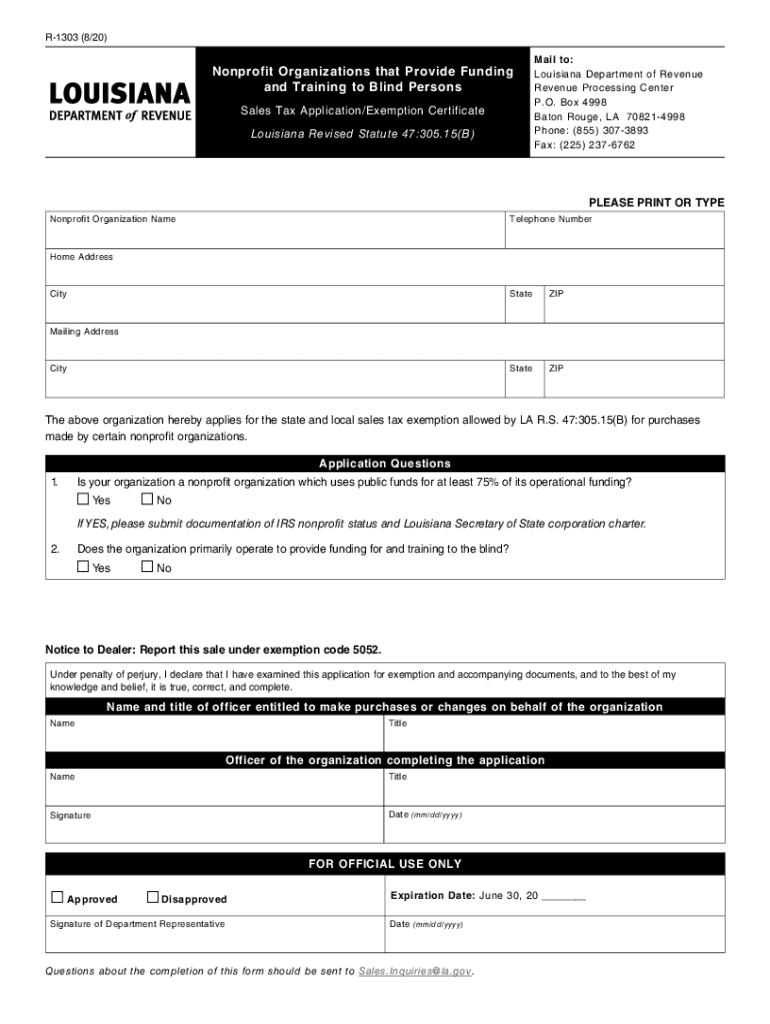

The Form R-1303, officially titled "Application For Exemption For Nonprofit," is a crucial document for nonprofit organizations seeking tax-exempt status in the United States. This form allows qualifying nonprofits to apply for exemptions from certain state taxes, thereby enabling them to allocate more resources towards their charitable missions. Understanding the specific requirements and implications of this form is essential for organizations aiming to operate efficiently while adhering to legal standards.

Steps to Complete the Form R-1303 "Application For Exemption For Nonprofit"

Completing the Form R-1303 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your nonprofit organization, including its mission, structure, and financial details. Next, fill out the form carefully, providing detailed answers to each section. It is important to include supporting documentation, such as proof of nonprofit status and financial statements, to substantiate your application. Finally, review the completed form for any errors before submission to avoid delays in processing.

Eligibility Criteria

To qualify for the Form R-1303 exemption, organizations must meet specific eligibility criteria. Generally, the organization must be established for charitable, educational, religious, or scientific purposes. It should operate primarily for the benefit of the public and not for profit. Additionally, the organization must comply with any state-specific regulations regarding nonprofit operations. Ensuring that your organization meets these criteria is vital for a successful application.

Required Documents

When submitting the Form R-1303, certain documents are required to support your application. These typically include:

- Proof of nonprofit status, such as articles of incorporation or bylaws.

- Financial statements from the past two years, detailing income and expenses.

- A detailed description of the organization's mission and activities.

- Any additional documentation required by state regulations.

Having these documents ready will streamline the application process and enhance the chances of approval.

Form Submission Methods

The Form R-1303 can typically be submitted through various methods, including online, by mail, or in person, depending on state regulations. For online submissions, organizations may need to create an account on the relevant state tax authority's website. Mail submissions should be sent to the designated address provided in the form instructions. If submitting in person, it is advisable to check the office hours and any specific requirements beforehand to ensure a smooth process.

IRS Guidelines

While the Form R-1303 is a state-level application, it is essential to be aware of the IRS guidelines that govern nonprofit organizations. The IRS outlines the necessary criteria for tax-exempt status under section 501(c)(3) of the Internal Revenue Code. Organizations must ensure compliance with these federal requirements, as state exemptions often rely on adherence to IRS standards. Familiarizing yourself with these guidelines can help prevent potential issues during the application process.

Quick guide on how to complete form r 1303 ampquotapplication for exemption for nonprofit

Prepare Form R 1303 "Application For Exemption For Nonprofit effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents rapidly without any delays. Handle Form R 1303 "Application For Exemption For Nonprofit on any platform using airSlate SignNow's Android or iOS applications and streamline your document processes today.

The simplest way to modify and electronically sign Form R 1303 "Application For Exemption For Nonprofit with ease

- Locate Form R 1303 "Application For Exemption For Nonprofit and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form R 1303 "Application For Exemption For Nonprofit and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form r 1303 ampquotapplication for exemption for nonprofit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form R 1303 "Application For Exemption For Nonprofit?"

Form R 1303 "Application For Exemption For Nonprofit" is a document that nonprofits use to apply for tax-exempt status. This form helps organizations demonstrate their eligibility for exemption under specific tax codes. Understanding this form is crucial for nonprofits looking to maximize their financial resources.

-

How can airSlate SignNow assist with Form R 1303 "Application For Exemption For Nonprofit?"

airSlate SignNow provides a streamlined platform for nonprofits to prepare, send, and eSign Form R 1303 "Application For Exemption For Nonprofit." Our user-friendly interface simplifies the document management process, ensuring that your application is completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for Form R 1303 "Application For Exemption For Nonprofit?"

airSlate SignNow offers flexible pricing plans tailored to the needs of nonprofits. Our cost-effective solutions ensure that you can manage Form R 1303 "Application For Exemption For Nonprofit" without breaking your budget. Visit our pricing page for detailed information on plans and features.

-

What features does airSlate SignNow offer for managing Form R 1303 "Application For Exemption For Nonprofit?"

With airSlate SignNow, you gain access to features like customizable templates, secure eSigning, and real-time tracking for Form R 1303 "Application For Exemption For Nonprofit." These tools enhance your workflow, making it easier to manage your nonprofit's documentation needs.

-

Are there any benefits to using airSlate SignNow for Form R 1303 "Application For Exemption For Nonprofit?"

Using airSlate SignNow for Form R 1303 "Application For Exemption For Nonprofit" offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform helps nonprofits save time and resources, allowing them to focus on their mission.

-

Can airSlate SignNow integrate with other tools for Form R 1303 "Application For Exemption For Nonprofit?"

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow for Form R 1303 "Application For Exemption For Nonprofit." This includes popular tools like Google Drive, Dropbox, and CRM systems, ensuring that your documents are easily accessible.

-

Is airSlate SignNow secure for handling Form R 1303 "Application For Exemption For Nonprofit?"

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data while handling Form R 1303 "Application For Exemption For Nonprofit." You can trust us to keep your sensitive information safe.

Get more for Form R 1303 "Application For Exemption For Nonprofit

- Vsa01 form

- Cigna prior authorization form

- Sos hear form

- Waste disposal agreement format in india

- Victim rights request form

- Misissippi state tax commission title division form 79 008 co warren ms

- A non resident disposing of taxable canadian property form

- Prince william juvenile amp domestic relations district court form

Find out other Form R 1303 "Application For Exemption For Nonprofit

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form